FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

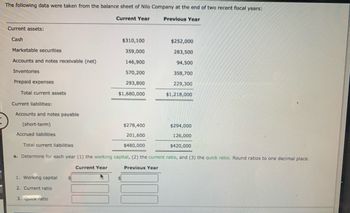

Transcribed Image Text:The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years:

Current Year

Previous Year

Current assets:

Cash

Marketable securities

Accounts and notes receivable (net)

Inventories

Prepaid expenses

Total current assets

Current liabilities:

Accounts and notes payable

(short-term)

Accrued liabilities

Total current liabilities

1. Working capital

2. Current ratio

$310,100

359,000

146,900

570,200

293,800

$1,680,000

3. Quick ratio

$278,400

201,600

$480,000

a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place.

Current Year

Previous Year

$

$252,000

283,500

94,500

358,700

229,300

$1,218,000

$294,000

126,000

$420,000

Expert Solution

arrow_forward

Step 1 Introduction

Working Capital :— It is the difference between current assets and current liabilities.

Current Ratio :— It is the ratio between current assets and current liabilities.

Quick Ratio :— It is the ratio between quick assets and current liabilities.

Quick Ratio

= (Current Assets — Inventory — Prepaid expenses)/Current Liabilities

Or

= (Cash + Accounts Receivable + Marketable securities)/Current Liabilities

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information applies to the questions displayed below.] Simon Company's yearend balance sheets follow. Current 2 31 Assets Cash Accounts receivable , Merchandise inventory Prepaid expenses ? assets , Total assets Liabilities and Equity Bccounts payable Long-term payable secured by mortgages on plast assets Common stock, $ 10 par value earnings Total Isabilities and equity $ 31,224 89,900 115,000 10,055 277, 807 $523.985 $ 37,266 62,200 50,400 84,000 57,000 4,141 259,433 223,893 $ 451,712 372, 701 $ 131,777$ 77,103 $ 99,494 162,500 130.215 $523.986 104, 5 83,190 162,500 162,500 107.176 77.322 $ , 712 372, 70arrow_forwardUSE THE DATA IN THE TABLE BELOW TO ANSWER THE FOLLOWING 3 QUESTIONS LukaDonc, Incorporated Balance Sheets for the Years Ending December 31, (All amounts are in dollars) Cash Accounts receivable Inventory Total current assets Net fixed assets* Land Total assets Notes payable Accounts payable Accruals Current portion of LT Debt Total current liabilities Long-term debt Common stock Capital surplus Retained earnings Total liabilities and equity Year 1 184,600 3,322,800 1,476,800 4,984,200 11,999,000 1,476,800 18,460,000 923,000 2,215,200 553,800 2,399,800 6,091,800 5,722,600 553,800 2,215,200 3,876,600 18,460,000 Year 2 201,700 3,227,200 2,017,000 5,445,900 13,110,500 1,613,600 20,170,000 806,800 2,017,000 806,800 2,823,800 6,454,400 6,252,700 806,800 2,622,100 4,034,000 20,170,000 Additional Data from Company Income Statement(s); Sales in Year 2 Net income in Year 2 Depreciation expense in Year 1 Depreciation expense in Year 2 *No long-term assets were sold in either Year 1 or Year 2…arrow_forwardSimon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable. Common stock, $10 par value Retained earnings Total liabilities and equity Current Year 1 Year Ago 2 Years Ago $ 38,057 $ 37,692 $ 32,880 91,559 67,918 51,292 120,991 86,264 55,178 9,891 4,274 10,381 290,549 268,870 $ 546,360 $ 471,000 $ 136,044 100,661 162,500 147,155 $ 78,803 107,247 162,500 122,450 $ 546,360 $ 471,000 Current Year The company's income statements for the current year and one year ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share. $ 433,263 220,183 12,075 9,233 $ 710,268 244,064 $ 392,500 674,754 $ 35,514 $ 2.19 $ 52,846 88,477 162,500 88,677 $ 392,500 1 Year Ago $364,319 141,804 12,891 8,407 $ 560,490…arrow_forward

- Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year $31,800 89,500 112,500 10,700 278,500 $523,000 $129,900 98,500 163,500 131,100 $523,000 1 Year Ago $35,625 62,500 82,500 9,375 255,000 $445,000 $75,250 101,500 2 Years Ago $37,800 50,200 54,000 5,000 230,500 $377,500 $51,250 83,500 163,500 163,500 104,750 79,250 $445,000 $377,500 Required: 1. Express the balance sheets in common-size percents. (Use cells A4 to D17 from the given information to complete this question.)arrow_forwardBased on the financial statements below, what is the current ratio and quick ratio?arrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities a. Determine for each year (1) the working Current Year 1. Working capital 2. Current ratio 3. Quick ratio b. The liquidity of Nilo has current assets relative to current liabilities. $690,500 799,500 327,000 1,042,800 537,200. $3,397,000 $458,200 $579,600 652,100 217,300 673,400 430,600 $2,553,000 $483,000 331,800 207,000 $790,000 $690,000 capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Previous Year from the preceding year to the current year. The working capital, current ratio, and quick ratio have all . Most of these changes are the result of an inarrow_forward

- Formulating Financial Statements from Raw Data and Calculating Ratios Following is selected financial information from JM Smucker Co. for the year ended April 30, 2018 ($ millions). Current assets, end of year Cash, end of year $1,710.5 Long-term liabilities, end of year 211.9 Stockholders' equity, end of year (305.4) Cash from operating activities 4,973.1 Total assets, beginning of year 8,151.1 Revenue (1,006.1) Total expenses, other than cost of product sold Dividends paid 385.3 * Cash from financing activities includes the effects of foreign exchange rate fluctuations. Cash from investing activities Cost of products sold Total liabilities, end of year Cash from financing activities* Stockholders' equity, beginning of year 7,535.2 a. Prepare the income statement for the year ended April 30, 2018. Note: Do not use negative signs with any of your answers. JM Smucker Co Income Statement ($ millions) For the year ended April 30, 2018 Revenues $ Cost of product sold Gross profit Expenses…arrow_forwardhelp mearrow_forwardCurrent position analysis the following data were taken from the balance sheet of Nilo company at the end of the two recent Fisher years; Current assets: Cash Marketable securities Account and note receivable (net) Inventories Prepaid expenses Total Current assets Current liabilities Account and notes payable ( short-term) Accrued liabilities Total Current liabilities Current year $417,000 cash 483,100 Marketable securities 197,700 acct not receivable ( net) 845,500 inventory 435,500 prepaid 2,379,000 Total Current assets Previous year $339,200 cash 381,600 Marketable securities 127,200 access note receivable ( net) 614,300 inventory 392,700 prepaid expenses 1,855,000 Total Current assets Current year Current liabilities Short term $353,800 Accrued liabilities 256,200 Total Current liabilities $610,000 Previous year Short term $371,000 Accrued liabilities 159,000 Total Current liabilities $530,000 A. Determine for each year 1 capital, 2 the current ratio,…arrow_forward

- How do I solve this?arrow_forwardThe following items are reported on a company's balance sheet: Cash $112,300 Marketable securities 131,400 Accounts receivable (net) 45,200 Inventory 170,000 Accounts payable 270,000. Determine the current ratio ?arrow_forwardGiven the data in the following table, the current ratio in 2023 was… % (table is attached) 1) 2.89 2 ) 2.61 3) 1.97 4) 2.08 52.14arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education