Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

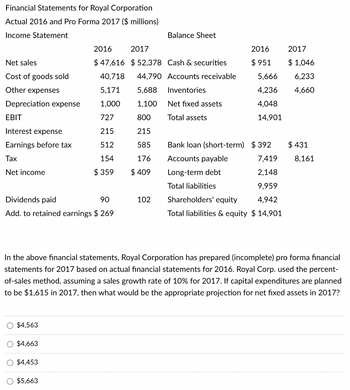

Transcribed Image Text:Financial Statements for Royal Corporation

Actual 2016 and Pro Forma 2017 ($ millions)

Income Statement

Net sales

Cost of goods sold

Other expenses

Depreciation expense

EBIT

Interest expense

Earnings before tax

Tax

Net income

Dividends paid

90

Add. to retained earnings $ 269

O $4,563

O $4,663

$4.453

2016

2017

$ 47,616 $52,378 Cash & securities

40,718

44,790 Accounts receivable

5,171

5,688 Inventories

1,000

1,100

727

800

215

215

512

585

154

176

$ 359

$ 409

$5,663

Balance Sheet

102

Net fixed assets

Total assets

Bank loan (short-term)

Accounts payable

Long-term debt

Total liabilities

2016

$951

2017

$1,046

5,666

6,233

4,236 4,660

4,048

14,901

$392

In the above financial statements, Royal Corporation has prepared (incomplete) pro forma financial

statements for 2017 based on actual financial statements for 2016. Royal Corp. used the percent-

of-sales method, assuming a sales growth rate of 10% for 2017. If capital expenditures are planned

to be $1,615 in 2017, then what would be the appropriate projection for net fixed assets in 2017?

7,419

2,148

9,959

Shareholders' equity

4,942

Total liabilities & equity $ 14,901

$431

8,161

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the following statement of financial position and statement of comprehensive income Blue Bird, Inc. 2018 Statement of comprehensive income Net Sales Less: Cost of Goods Sold Less: Depreciation Earnings Before Interest and Taxes Less: Interest Paid Taxable Income Less: Taxes Net Income Blue Bird, Inc. Statement of financial position Years ended 2017 and 2018 $12,630 8,240 1,010 3,380 750 $2,630 920 $1,710 Cash Accounts rec. Inventory Total 2017 2018 $640 $590 1,200 1,390 2,300 2,470 $4,140 $4,450 Net fixed assets 4,640 5,200 Total assets $8,780 $9,650 Total liabilities & equity Accounts payable Long-term debt Common stock Retained earnings 2017 2018 2,500 2,800 4,000 4,500 1,040 1,690 $8,780 $9,650 Blue Bird, Inc. has 1,500 shares of stock outstanding. The price-earnings ratio for 2018 is 21. What is the market price per share of stock?arrow_forwardDividends per ShareThe following financial data is from Hi-Tech Instruments' financial statements (thousands of dollars, except earnings per share.) 2016 Sales revenue $210,000 Cost of goods sold 125,000 Net income 8,800 Dividends 3,100 Earnings per share 4.40 Hi-Tech Instruments, Inc.Balance Sheet (Thousands of Dollars) Dec. 31, 2016 Dec. 31, 2015 Assets Cash $18,300 $18,000 Accounts receivable (net) 46,000 41,000 Inventory 39,500 43,700 Total current assets 103,800 102,700 Plant assets (net) 52,600 50,500 Other assets 15,600 13,800 Total assets $172,000 $167,000 Liabilities and Stockholders' Equity Notes payable-banks $6,000 $6,000 Accounts payable 22,500 18,700 Accrued liabilities 16,500 21,000 Total current liabilities 45,000 45,700 9% Bonds payable 40,000 40,000 Total liabilities 85,000 85,700 Common stock, $25 par value (2,000,000 shares) 50,000 50,000 Retained earnings 37,000 31,300 Total…arrow_forwardSelected balance sheet and income statement information for Home Depot follows. $ millions Operating assets Jan. 31, 2016 Feb. 01, 2015 $40,333 $38,223 Nonoperating assets 2,216 1,723 Total assets 42,549 39,946 Operating liabilities 14,918 13,427 Nonoperating liabilities 21,315 17,197 Total liabilities 36,233 30,624 Total stockholders' equity 6.316 9.322 Sales 88,519 Net operating profit before tax (NOPBT) 11,774 Non-operating expense before tax 753 Tax expense 4,012 Net income 7,009 Compute the return on equity for the year ended January 31, 2016. You want your all-equity (no debt) firm to provide a return on equity of 13.5%. If total assets are $375,000, how much must be generated in net income to make this target? a. $41,234 b. $43,405 c. $45,689 d. $48,094 e. $50,625 For the FY 2016, Alpha Company had net sales of $950,000 and a net income of $65,000, paid income taxes of $30,000, and had before-tax interest expense of $15,000. Use this information to determine the: 1. Times…arrow_forward

- How much net income did Wolf Enterprises earn during 2021? Net income for 2021 was Cost of services sold Accumulated depreciation Selling, general, and administrative expenses Retained earnings, December 31, 2020 $ 14,500 Service revenue 40,800 Depreciation expense Other revenue 6,100 Dividends declared Income tax expense 2,700 Income tax payable 32,400 4,200 700 700 500 1,100arrow_forwardDebt to Equity Total Debt Ratio Times Interest Earnedarrow_forward($n millions) Net soles Cost of goods sold Depreciation Earnings before interest and taxes Interest paidl Taxable incone 7,010 470 $1,320 165 $1,214 425 Taxes Net. incone $789 windswept, Inc. 2016 and 2017 Balance sheets, ($ in nillions) 2016 2017 2016 2017 Cash Accounts re. Inventory Total Net fixed 33sets Accounts payable Long-tera debt, Conmon stock Retained earnings $240 S 270 $1,410 $1,410 1,110 1,318 1,820 920 1,848 1,710 3,368 3,280 658 3,430 4,008 Total assets $6,530 S6,9 Total 11ab. & equity $6,530$6.988arrow_forward

- Pro Forma Financial Statement Information for Ideko 2014 - 2019 Year 1. Raw Material 2. Depreciation 3. Wages Payable 4. Interest Expense 5. Finished Goods 6. Other Accounts Payable 7. Accounts Receivable 8. Cash Balance 10. Interest Tax $22,170 $30,510 $35,195 $26,420 $21,260 2014 1,973 5,500 1,294 75 4,192 3,360 18,493 6,164 3,736 2015 1,534 5,450 1,433 6,800 4,967 4,099 14,525 7,262 2,796 2016 1,775 5,405 1,695 6,800 5,838 4,953 16,970 8,485 3,364 2017 2,039 6,865 1,941 6,800 6,815 5,938 19,689 9,845 3,748 The amount of net working capital for Ideko in 2017 is closest to: 2018 2,329 7,678 2,211 7,820 7,911 6,900 22,709 11,355 4,513 2019 2,646 7,710 2,570 8,160 9,138 7,878 26,059 13,030 5,678arrow_forwardForecast the Balance Sheet Following is the balance sheet for Medtronic PLC for the year ended April 29, 2016. Medtronic plc Consolidated Balance Sheets ($ millions) Apr. 29, 2016 Apr. 24, 2015 Current assets Cash and cash equivalents $2,876 $4,843 Investments 9,758 14,637 Accounts receivable 5,562 5,112 Inventories 3,473 3,463 Tax assets 697 1,335 Prepaid expenses and other current assets 1,234 1,454 Total current assets 23,600 30,844 Property, plant, and equipment, net 4,841 4,699 Goodwill 41,500 40,530 Other intangible assets, net 26,899 28,101 Long-term tax assets 1,383 774 Other assets 1,559 1,737 Total assets $99,782 $106,685 Current liabilities Short-term borrowings $993 $2,434 Accounts payable 1,709 1,610 Accrued compensation 1,712 1,611 Accrued income taxes 566 935 Deferred tax liabilities - 119…arrow_forwardCurrent Assets Cash A/R Inventory Total Net Plant & Equip Total Assets Tomson Corporation 2013 and 2014 Statement of Financial Position Assets 2013 $ 8,436 21,530 38.760 $ 68,726 $ 226.706 $295,432 2014 $ 10,157 23,406 42.650 $ 76,213 Current Liabilities A/P Notes Payable Total 1. The current ratio for each year 2. The quick ratio for each year Long-term Debt Owner's Equity Common Stock & Paid-in Surplus Retained Earnings $248,306 Total Total Liabilities & $324,519 Owners Equity Liabilities 3. The cash ratio for each year 4. The NWC to total assets ratio for each year 2013 5. The debt-equity ratio and the equity multiplier for each year 6. The total debt ratio and the long-term debt ratio for each year Round all answers to 2 decimal places. $ 43,050 18.384 $61.434 $ 25.000 $ 40,000 168.998 $ 208,998 $ 295,432 2014 1. Prepare: The 2014 combined common-size, common-base year statement of financial position for Tomson. Round your intermediate calculations to 2 decimal places…arrow_forward

- You have gathered this information on JJ Enterprises: 2014 2015 Sales $6.318 $7,202 COGS 3,945 4.460 Interest 303 277 Depreciation 1,204 1,196 Cash 672 418 Accounts receivables 601 578 Current liabilities 414 463 Inventory 1,215 1.598 Long-term debt 4,780 4.103 Net fixed assets 7.700 7,330 Shareholder's equity 4.994 5.358 Taxes 217 317 What is the operating cash flow for 2015? Al $1,823 B) $1.229 C) $1,367 D) $2,425 E) $1,766arrow_forwardSales Costs Other expenses Earnings before interest and taxes Interest paid Taxable income Taxes (21%) Net income Dividends Addition to retained earnings Current assets Cash CROSBY, INCORPORATED 2023 Income Statement Accounts receivable Inventory Total Total assets Assets Fixed assets Net plant and equipment EFN $ 21,340 44,280 98,960 $ 164,580 $ 430,000 $ 28,203 65,807 $ 594,580 $ 754,000 589,000 25,000 $ 140,000 21,000 CROSBY, INCORPORATED Balance Sheet as of December 31, 2023 $ 119,000 24,990 $ 94,010 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Total Total liabilities and owners' equity $ 55,500 14,700 $ 70,200 $ 137,000 $ 118,000 269,380 $ 387,380 $ 594,580 If the firm is operating at full capacity and no new debt or equity is issued, what is the external financing needed to support the 25 percent growth rate in sales? Note: Do not round…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education