Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

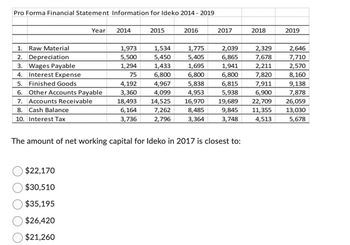

Transcribed Image Text:Pro Forma Financial Statement Information for Ideko 2014 - 2019

Year

1. Raw Material

2. Depreciation

3. Wages Payable

4. Interest Expense

5. Finished Goods

6. Other Accounts Payable

7. Accounts Receivable

8. Cash Balance

10. Interest Tax

$22,170

$30,510

$35,195

$26,420

$21,260

2014

1,973

5,500

1,294

75

4,192

3,360

18,493

6,164

3,736

2015

1,534

5,450

1,433

6,800

4,967

4,099

14,525

7,262

2,796

2016

1,775

5,405

1,695

6,800

5,838

4,953

16,970

8,485

3,364

2017

2,039

6,865

1,941

6,800

6,815

5,938

19,689

9,845

3,748

The amount of net working capital for Ideko in 2017 is closest to:

2018

2,329

7,678

2,211

7,820

7,911

6,900

22,709

11,355

4,513

2019

2,646

7,710

2,570

8,160

9,138

7,878

26,059

13,030

5,678

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The following information relates to SE10-5 through SE10-7: (in millions) Net sales... Cost of goods sold SE10-7. Gross profit. Selling and administrative expenses Income from operations Interest expense.. EVANS & SONS, INC. Income Statement For Years Ended December 31, 2019 and 2018 Income before income taxes Income tax expense. Net income (in millions) Assets Current assets Cash and cash equivalents Accounts receivable Inventory.. Other current assets. Total current assets Property, plant, & equipment (net) Other assets. Total Assets Liabilities and Stockholders' Equity Current liabilities. Long-term liabilities. Total liabilities.. EVANS & SONS, INC. Balance Sheet December 31, 2019 and 2018 Stockholders' equity - common. Total Liabilities and Stockholders' Equity.. 2019 9,800 (5,500) 4,300 (2,800) 1,500 (300) $ 1,200 2019 100 900 500 400 2018 1,900 2,600 5,700 $10,200 9,300 (5,200) 4,100 (2,700) (220) (200) $980 $950 1,400 $ (250) 1,150 2018 300 800 650 250 2,000 2,500 5,900 $10,400…arrow_forwardPhilly Corporation Philly Corporation Income Statement Comparative Account Information Relating to Operations For the Year Ended December 31, 2020 For the Year Ended December 31, 2020 2020 2019 Sales Revenue 680,000 Accounts receivable -net 78,000 65,000 Cost of goods sold 355,000 Prepaid insurance 5,000 6,000 Salaries expense 50,000 Equipment 111,100 122,400 Depreciation expense equipment 6,800 Accumulated Depreciation 13,800 14,600 Interest expense 8,000 Land 56,000 36,000 Bad debt expense 2,400 Accounts Payable 59,000 47,000 Loss on sale of equipment 4,800 Interest payable 600 1,500 Miscellaneous…arrow_forwardOperating and Nonoperating Items in Boston Scientific's Income Statement EXHIBIT 3.6 For Year Ended December 31, S mllllons 2018 2017 2016 Net sale . Cost of products sold $9,823 $9,048 2,593 $8,386 2,424 2,813 Gross profit. Operating expenses Selllng, general and admlnIstratlve expenses. Research and development expenses Royalty expense Amortlzatlon expense Intanglble asset Impalrment charges ContIngent conslderatlon expense (beneflt) . RestructurIng charges. LItigatlon-related charges 7,010 6,455 5,962 3,569 1,113 3,294 3,099 997 920 70 68 79 599 565 545 35 4 11 (21) (80) 29 36 37 28 103 285 804 Operating expenses - 5,504 5,170 5,515 Operating income . Other expense (income) Interest expense 1,506 1,285 447 241 229 233 Other expense (income), net. (156) 124 37 Income before income taxes 1,422 932 177 Income tax expense (benefit) . (249) 828 (170) Net income. $1,671 $ 104 $ 347 Calculate the operating expense margin ratio for 2016arrow_forward

- he following information is related to the Doll Pty Ltd. Description 2018 2020 Total revenues (Sales) $2,580 $5,880 Total assets: Beginning of year 1,200 2,290 End of year 1120 2,381 The ratio of sales to assets for 2018 and 2020 will be: Select one: a. 2.22 And 2.52 b. 2.30 And 2.47 c. 1.11 And 1.26 d. 2.15 And 2.56arrow_forwardQuestion 13 The extract disclosed below relates to JohNicho Limited for the year ended December 31, 2021 JohNicho Limited Statement of Comprehensive Income for the year ended 31st December: Net Sales Cost of goods sold SG&A Other costs Operating Income (EBIT) Interest Extraordinary income EBT Taxes Net Income Non-current assets Property, Plant & Equipment Motor vehicles Furniture Total non-current assets Current assets Trade Receivables Other Current Assets Inventories Total Current Assets Total assets Current liabilities Accounts payable Other current liabilities Total Current Liabilities JohLex Limited Statement of Financial Position as at 31st December: 2020 GHC Long-term Debt Debenture Total non-current liabilities 10 Shareholders' equity Total Liabilities and Equity GHC 6,386 18,472 6,759 8,461 25,265 19,811 20,753 Required to calculate: (a) Inventory turnover period (in days) (b) Receivable collection period (in days) (c) Payable collection period (in days) (d) Working capital…arrow_forwardPart C. Cullumber Appliances Corporation has reported its financial results for the year ended December 31, 2017. Cullumber Appliances Corporation Income Statement for the Fiscal Year Ended December 31, 2017 Net sales $ 5,899,512,000 Cost of goods sold 3,224,958,940 Gross profit $ 2,674,553,060 Selling, general, and administrative expenses 1,101,893,423 Depreciation 334,776,116 Operating income $ 1,237,883,521 Interest expense 32,014,500 EBT $ 1,205,869,021 Income taxes 320,866,566 Net earnings $ 885,002,455 Cullumber Appliances Corporation Balance Sheet as of December 31, 2017 Assets: Liabilities Equity: Cash and cash equivalents $ 642,840,000 Short-term borrowings $…arrow_forward

- MOSS COMPANY Selected Balance Sheet Information 2020 At December 31 Current assets Cash Accounts receivable. Inventory Current liabilities. Accounts payable Income taxes payable $ 84,650 25,000 60,000 Sales Cost of goods sold Gross profit 30,400 2,050 2019 $26,800 32,000 54,100 MOSS COMPANY Income Statement For Year Ended December 31, 2020 25,700 2,200 Operating expenses (excluding depreciation) Depreciation expense Income before taxes Income taxes expense Net income $ 515,000 331,600 183,400 121,500 36,000 25,900 7,700 $ 18,200 Use the information above to calculate cash flows from operating activities using the indirect method. Note: Amounts to be deducted should be indicated by a minus sign. Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by operating activitiesarrow_forwardFind Percentages and show workarrow_forwardUse the appropriate information from the data provided below to calculate operating income for the year ended December 31, 2020. Cost of goods sold General and administrative expenses Net cash provided by financing activities Dividends paid Income tax expense Other selling expenses Net sales Advertising expense Accounts payable $ 234,000 96,000 138,000 32,000 22,000 52,000 556,000 78,000 66,000arrow_forward

- HIC GROUP OF Companies COMPARATIVE INCOME STATEMENT For years ended 3rd December 2019 2020 Revenue and gains Sales revenue 495,500 496,738.75 Interest revenue 278,500 279,196.25 Investment Income 71,700 71,879.25 Other revenue 101,500 101,753.75 Total revenue and gains 947,200 949,968 Expenses and losses Cost of good sold 450,000 447,750 Selling&administrative 185,000 184,075 Computer (operating) 42,500 42,288…arrow_forwardCurrent Assets Cash A/R Inventory Total Net Plant & Equip Total Assets Tomson Corporation 2013 and 2014 Statement of Financial Position Assets 2013 $ 8,436 21,530 38.760 $ 68,726 $ 226.706 $295,432 2014 $ 10,157 23,406 42.650 $ 76,213 Current Liabilities A/P Notes Payable Total 1. The current ratio for each year 2. The quick ratio for each year Long-term Debt Owner's Equity Common Stock & Paid-in Surplus Retained Earnings $248,306 Total Total Liabilities & $324,519 Owners Equity Liabilities 3. The cash ratio for each year 4. The NWC to total assets ratio for each year 2013 5. The debt-equity ratio and the equity multiplier for each year 6. The total debt ratio and the long-term debt ratio for each year Round all answers to 2 decimal places. $ 43,050 18.384 $61.434 $ 25.000 $ 40,000 168.998 $ 208,998 $ 295,432 2014 1. Prepare: The 2014 combined common-size, common-base year statement of financial position for Tomson. Round your intermediate calculations to 2 decimal places…arrow_forwardOperating and Nonoperating Items in Boston Scientific's Income Statement EXHIBIT 3.6 For Year Ended December 31, S mllllons 2018 2017 2016 $9,823 2,813 $9,048 2,593 $8,386 2,424 Net sales Cost of products sold Gross profit. Operating expenses Selllng, general and admlnlstratlve expenses. Research and development expenses Royalty expense Amortlzatlon expense Intanglble asset Impalrment charges. ContIngent conslderatlon expense (beneflt) Restructurlng charges. Litigatlon-related charges 7,010 6,455 5,962 3,569 3,294 3,099 1,113 997 920 70 68 79 599 565 545 35 11 (21) (80) 29 36 37 28 103 285 804 Operating expenses 5,504 5,170 5,515 Operating income Other expense (income) Interest expense 1,506 1,285 447 241 229 233 Other expense (income), net. (156) 124 37 1,422 (249) Income before income taxes 932 177 Income tax expense (benefit) . 828 (170) Net income $1,671 24 104 2$ 347 Calculate the profit margin ratio for 2016arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education