FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

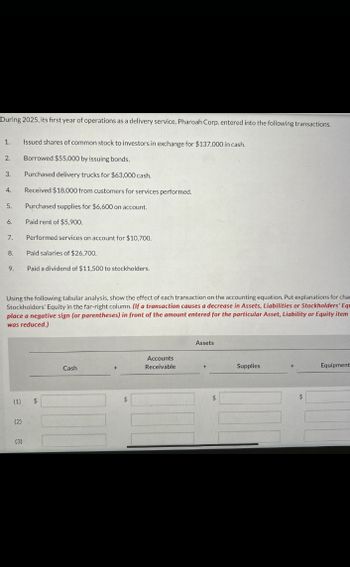

Transcribed Image Text:During 2025, its first year of operations as a delivery service, Pharoah Corp. entered into the following transactions.

1.

Issued shares of common stock to investors in exchange for $137,000 in cash.

2.

Borrowed $55,000 by issuing bonds.

3.

Purchased delivery trucks for $63,000 cash.

4.

Received $18,000 from customers for services performed.

5. Purchased supplies for $6,600 on account.

6.

Paid rent of $5,900.

7.

Performed services on account for $10,700.

8.

Paid salaries of $26,700.

9.

Paid a dividend of $11,500 to stockholders.

Using the following tabular analysis, show the effect of each transaction on the accounting equation. Put explanations for cha

Stockholders' Equity in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equ

place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item

was reduced.)

(2)

(3)

རྒྱ་སེ་གྱི

(1)

Assets

Accounts

Cash

Receivable

Supplies

Equipment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Described below are certain transactions of Pharoah Company for 2021: On May 10, the company purchased goods from Fox Company for $74,900, terms 2/10, n/30. Purchases and accounts payable are recorded at net amounts. The invoice was paid on May 18. 1. On June 1, the company purchased equipment for $96,000 from Rao Company, paying $31,200 in cash and giving a one- year, 9% note for the balance. 2. On September 30, the company discounted at 11% its $220,000, one-year zero-interest-bearing note at Virginia State Bank, receiving $198,000. 3.arrow_forwardCasio adheres to ASPE. Casio Corp.'s transactions for the year ended December 31, 2020 included the following: 1. Purchased land for $275,000 cash. 2. Borrowed $275,000 from the bank on a long-term note. 3. Sold long-term investments for $250,000. 4. Accounts receivable decreased by $50,000. 5. Paid cash dividends of $300,000. 6. Issued 1,000 common shares for $125,000. 7. Purchased machinery and equipment for $62,500 cash. 8. Accounts payable increased by $100,000. The cash used in investing activities for 2020 was $(337,500). $(25,000). O $(187,500). O s(87,500).arrow_forwardCypress Corp. went into business on October 1, 2020. Cypress had the following transactions during 2020: Oct. 1 - Issued a total of 20 shares of stock to two stockholders for a total of $6,00O. • Oct. 1 - Borrowed $20,000 from the bank. No payments will be made on this loan until October 1, 2022, when $24,000 will be due. Oct. 12 - Purchased land for $8,000 in cash. • Nov. 1 - Purchased equipment for $12,000 in cash. The equipment is expected to last for four years with no salvage value. • Nov. 15 - Purchased $5,000 inventory, half in cash and half on account. • Dec. 1 - Purchased six months of insurance for $1,200. Dec. 10 - Sold $2,000 of inventory for $4,500 in cash. • Dec. 12 - Sold one-half of land for $5,000 in cash. Dec. 13 - Paid balance owed on accounts payable. Dec. 18 - Sold $1,500 of inventory for $2,500 on account. • Dec. 31 - Paid $1,000 in dividends. What were the net operating cash flows for Cypress during 2020? O $3,300 $800 O ($600) O ($1,700) None of the abovearrow_forward

- The following transactions apply to Hooper Co. for 2018, its first year of operations: Issued $60,000 of common stock for cash. Provided $90,000 of services on account. Collected $78,000 cash from accounts receivable. Loaned $20,000 to Mosby Co. on November 30, 2018. The note had a one-year term to maturity and a 6 percent interest rate. Paid $26,000 of salaries expense for the year. Paid a $2,000 dividend to the stockholders. Recorded the accrued interest on December 31, 2018 (see item 4). Estimated that 1 percent of service revenue will be uncollectible Prepare the income statement, balance sheet, and statement of cash flows for 2018.arrow_forwardDuring the fiscal year ended December 31, Duckworth Corporation engaged in the following transactions involving notes payable: Sept. 16. Purchased office equipment from Earthtime Equipment. The invoice amount was $24,000, and Earthtime agreed to accept, as full payment, on 12%, three-month note for the invoice amount. Nov. 1. Borrowed $100,000 from Sandra Duckworth, a major corporate stockholder. The corporation issued Duckworth a $100,000, 15%, 120-day note payable. Dec. 1. Purchased merchandise inventory in the amount of $5,000 from Teller Corporation. Teller accepted a 90-day, 14% note as a full settlement of the purchase. Duckworth Corporation uses a perpetual inventory system. Dec. 16. The $24,000 note payable to Earthtime Equipment matured today. Duckworth paid the accrued interest on this note and issued a new 30-day, 16% note payable in the amount of $24,000 to replace the note that matured.arrow_forwardGalubhaiarrow_forward

- Please help mearrow_forwardASSETS Current assets: Cash MANGO INC.. CONSOLIDATED BALANCE SHEET September 30, 2017 (dollars in millions) Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued expenses Unearned revenue. Short-term notes payable Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities. Stockholders' equity: Common stock ($0.00001 per value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity Assume that the following transactions fin $ 14,024 11,377 17,681 2,134 24,141 69,357 131,732 20,873 12,676 $234,638 $ 30,563 18,679 8,599 6,385 64,226 29,344 28,196 121,766 1 25,212 87,659 112,872 $234,638arrow_forwardAssume that the following transactions (in millions) occurred during the next fiscal year (ending on September 26, 2020): Borrowed $18,279 from banks due in two years. Purchased additional investments for $22,200 cash; one-fifth were long term and the rest were short term. Purchased property, plant, and equipment; paid $9,584 in cash and signed a short-term note for $1,422. Issued additional shares of common stock for $1,481 in cash; total par value was $1 and the rest was in excess of par value. Sold short-term investments costing $19,021 for $19,021 cash. Declared $11,138 in dividends to be paid at the beginning of the next fiscal year. Prepare a classified balance sheet for Orange at September 26, 2020, based on these transactions. please complete this with working and show how did you get the number with other work answer in text thanksarrow_forward

- On November 1, Lee Corporation borrowed 10,000 by signing a six-month 5% bank loan payable. On this date, hiw should the corporation have recorded this transaction in its accounting records?arrow_forwardThe following selected transactions relate to liabilities of United Insulation Corporation. United’s fiscal year ends on December 31. 2024 January 13 Negotiated a revolving credit agreement with Parish Bank that can be renewed annually upon bank approval. The amount available under the line of credit is $27.5 million at the bank’s prime rate. February 1 Arranged a three-month bank loan of $5.2 million with Parish Bank under the line of credit agreement. Interest at the prime rate of 7% was payable at maturity. May 1 Paid the 7% note at maturity. December 1 Supported by the credit line, issued $17.3 million of commercial paper on a nine-month note. Interest was discounted at issuance at a 6% discount rate. December 31 Recorded any necessary adjusting entry(s). 2025 September 1 Paid the commercial paper at maturity. Required: Prepare the appropriate journal entries through the maturity of each liability. Note: Do not round intermediate calculations. If no entry is…arrow_forwardAssume that the following transactions (in millions) occurred during the next fiscal year (ending on September 29, 2018): Borrowed $21,304 from banks due in two years. Purchased additional investments for $21,500 cash; one-fifth were long term and the rest were short term. Purchased property, plant, and equipment; paid $9,610 in cash and signed a short-term note for $1,448. Issued additional shares of common stock for $1,507 in cash; total par value was $1 and the rest was in excess of par value. Sold short-term investments costing $19,045 for $19,045 cash. Declared $11,163 in dividends to be paid at the beginning of the next fiscal year. Use the drop-downs below to select the accounts that should be properly included on the balance sheet. MANGO, INC. Balance Sheet At September 29, 2018 (in millions) Assets Current assets: Total current assets 0 Total assets $0 Liabilities…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education