SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Problem 1-34 (LO 1-3) (Algo)

Chuck, a single taxpayer, earns $76,600 in taxable income and $11,700 in interest from an investment in City of Heflin bonds. (Use the

U.S tax rate schedule.)

Required:

a. How much federal tax will he owe?

b. What is his average tax rate?

c. What is his effective tax rate?

d. What is his current marginal tax rate?

Complete this question by entering your answers in the tabs below.

Req A

Req B

Req C

Req D

What is his current marginal tax rate?

Marginal tax rate

%

< Req C

Reg D D

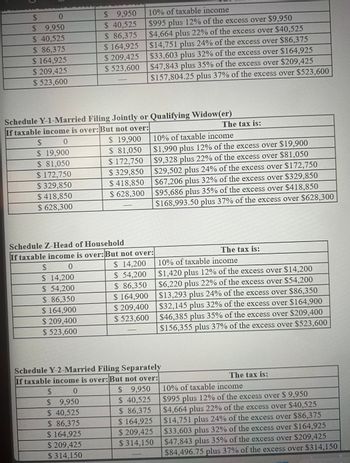

Transcribed Image Text:$ 40,525

$ 86,375

$ 164,925

$

0

$ 9,950

$ 9,950

$ 40,525

$ 86,375

$ 164,925

$ 209,425

$ 523,600

$ 209,425

$ 523,600

10% of taxable income

$995 plus 12% of the excess over $9,950

$4,664 plus 22% of the excess over $40,525

$14,751 plus 24% of the excess over $86,375

$33,603 plus 32% of the excess over $164,925

$47,843 plus 35% of the excess over $209,425

$157,804.25 plus 37% of the excess over $523,600

Schedule Y-1-Married Filing Jointly or Qualifying Widow(er)

If taxable income is over: But not over:

$

0

$ 19,900

$ 19,900

$ 81,050

$ 81,050

$ 172,750

$ 172,750

$ 329,850

$ 418,850

$ 329,850

$418,850

$ 628,300

$ 628,300

The tax is:

10% of taxable income

$1,990 plus 12% of the excess over $19,900

$9,328 plus 22% of the excess over $81,050

$29,502 plus 24% of the excess over $172,750

$67,206 plus 32% of the excess over $329,850

$95,686 plus 35% of the excess over $418,850

$168,993.50 plus 37% of the excess over $628,300

Schedule Z-Head of Household

If taxable income is over: But not over:

$

0

$ 14,200

$ 14,200

$ 54,200

$ 86,350

$ 54,200

$ 86,350

$164,900

$ 164,900

$ 209,400

$ 209,400

$ 523,600

$ 523,600

The tax is:

10% of taxable income

$1,420 plus 12% of the excess over $14,200

$6,220 plus 22% of the excess over $54,200

$13,293 plus 24% of the excess over $86,350

$32,145 plus 32% of the excess over $164,900

$46,385 plus 35% of the excess over $209,400

$156,355 plus 37% of the excess over $523,600

Schedule Y-2-Married Filing Separately

If taxable income is over: But not over:

$

0

$ 9,950

$ 9,950

$ 40,525

$ 40,525

$ 86,375

$ 86,375

$ 164,925

$ 164,925

$ 209,425

$ 314,150

$ 209,425

$ 314,150

The tax is:

10% of taxable income

$995 plus 12% of the excess over $ 9,950

$4,664 plus 22% of the excess over $40,525

$14,751 plus 24% of the excess over $86,375

$33,603 plus 32% of the excess over $164,925

$47,843 plus 35% of the excess over $209,425

$84,496.75 plus 37% of the excess over $314,150

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- $ O- Taxable Income 50,000 50,001- 75,001- Y 100,001- 75,000 100,000 335,000 335,001- 10,000,000 Tax Rate 15% 25 34 39 34 Bait and Tackle has taxable income of $411,562. How much do a. $128,603.33 b. $134,611.27 c. $138,542.79 d. $139,931.08 e. $141,35674.82 tinarrow_forward(Corporate income tax) Sales for J. P. Hulett Inc. during the past year amounted to $4.0 million. Gross profits totaled $1.00 million, and operating and depreciation expenses were $500,000 and $350,000, respectively. Dividend income for the year was $12,000, which was paid by a firm in Comcute the corporation's tax which Hulett owns 85 percent of the shares. Use the corporate tax rates shown in the popup window, liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is $ (Round to the nearest dollar.)arrow_forwardTaxable Income $0-$50,000 Marginal Tax Rate 15% $50,001 - $75,000 25% $75,001 - $100,000 34% $100,001 - $335,000 39% $335,001-$10,000,000 34% $10,000,001 - $15,000,000 35% $15,000,001 - $18,333,333 38% Over $18,333,333 35% (Click on the icon in order to copy its contents into a spreadsheet.)arrow_forward

- Calculating Taxable Income Taxable income Rate $0 — $9,525 10.0% $9,526 — $38,700 12.0% $38,701 — $82,500 22.0% $82,501 — $157,500 24.0% $157,501 — $200,000 32.0% $200,001 — $500,000 35.0% $500,001 or more 37% Using the previous tax table, compute the tax liability for the individual in the scenario presented, rounding the liability to the nearest dollar. In addition, use the dropdown lists to identify the marginal tax rate and average tax rate for the individual in the scenario. Shen’s Tax Scenario Shen is a young professional with taxable income of $116,500 as an advertising account executive. What is Shen’s total tax liability? (Note: Round your answer to the nearest cent, if necessary.) What is Shen’s top marginal tax rate? What is Shen's average tax rate?arrow_forward2023 TAXABLE INCOME FIRST $53,359 OVER $53,359 TO $106,717 OVER $106,717 TO $165,430 OVER $ $165,430 TO $237,675 OVER $235,675 ernment Budget Fiscal Policy FILL IN THE BLANK UNIT TAX RATE 15.00% 20.50% 26.00% 29.32% 33.00% D) The average tax rate for someone making $120,000. type your text here Based on the Canadian Federal Income Tax Brackets for 2023 shown above, calculate and input the numeric answers to the questions below. Round off your answers to the nearest dollar. Do not use $, decimals or comma. For example, instead of $23,486.52, write 23487. For answers requiring a tax rate, enter only the numeric value with two decimal places, with "%" symbol. For example, 20.50%).arrow_forwardOver But not over Tax is: Of amount over: $0 $50,000 15% $0 $50,000 $75,000 $7,500 + 25% $50,000 $75,000 $100,000 $13,750 + 34% $75,000 $100,000 $335,000 $22,250 + 39% $100,000 $335,000 $10,000,000 $113,900 + 34% $335,000 $10,000,000 $15,000,000 $3,400,000 + 35% $10,000,000 $15,000,000 $18,333,333 $5,150,000 + 38% $15,000,000 $18,333,333 _______ 35% $0 Refer to the table above: A firm has $12,000,000 in taxable income. What is the firm’s average tax rate?arrow_forward

- Over But not over Tax is: Of amount over: $0 $50,000 15% $0 $50,000 $75,000 $7,500 + 25% $50,000 $75,000 $100,000 $13,750 + 34% $75,000 $100,000 $335,000 $22,250 + 39% $100,000 $335,000 $10,000,000 $113,900 + 34% $335,000 $10,000,000 $15,000,000 $3,400,000 + 35% $10,000,000 $15,000,000 $18,333,333 $5,150,000 + 38% $15,000,000 $18,333,333 _______ 35% $0 Refer to the table above: A firm has $12,000,000 in taxable income. What is the firm’s tax bill?arrow_forwardCalculating Taxable Income Taxable income $0-$9,525 $9,526 $38,700 $38,701 $82,500 $82,501 $157,500 24.0% $157,501 $200,000 32.0% $200,001 $500,000 35.0% $500,001 or more 37% - Rate 10.0% 12.0% 22.0% Lucia's Tax Scenario Using the previous tax table, compute the tax liability for the individual in the scenario presented, rounding the liability to the nearest dollar. In addition, use the dropdown lists to identify the marginal tax rate and average tax rate for the individual in the scenario. Lucia is a professional with taxable income of $74,200. What is Lucia's total tax liability? S What is Lucia's top marginal tax rate? STEP: 2 of 2 What is Lucia's average tax rate? (Note: Round your answer to the nearest cent, if necessary.)arrow_forwardver But not over Tax is: Of amount over: $0 $50,000 15% $0 $50,000 $75,000 $7,500 + 25% $50,000 $75,000 $ 100,000 $13,750 + 34% $75,000 $100,000 $335,000 $22,250 + 39% $100,000 $335,000 $10,000,000 $ 113,900+ 34% $335,000 $10,000,000 $15,000,000 $3,400,000 + 35% $10,000,000 $15,000,000 $18, 333, 333 $ 5,150,000 + 38% $15,000,000 $18,333,333 35% $0 Refer to the table above: A firm has $12, 000, 000 in taxable income. What is the firm's average tax rate?arrow_forward

- 2023 TAXABLE INCOME FIRST $53,359 OVER $53,359 TO $106,717 OVER $106,717 TO $165,430 OVER $ $165,430 TO $237,675 OVER $235,675 Budget & Fiscal Policy FILL IN THE BLANK TAX RATE 15.00% 20.50% 26.00% 29.32% 33.00% A) The marginal rate of tax for someone making a salary of $52,000. type your text here Based on the Canadian Federal Income Tax Brackets for 2023 shown above, calculate and input the numeric answers to the questions below. Round off your answers to the nearest dollar. Do not use $, decimals or comma. For example, instead of $23,486.52, write 23487. For answers requiring a tax rate, enter only the numeric value with two decimal places, with "%" symbol. For example, 20.50%).arrow_forwardCalculating Taxable Income Taxable income $0-$9,525 $9,526- $38,700 $38,701 - $82,500 $82,501 $157,500 $157,501 $200,000 $200,001 $500,000 $500,001 or more - - - - Rate 10.0% Deborah's Tax Scenario 12.0% 22.0% 24.0% 32.0% 35.0% 37% Using the previous tax table, compute the tax liability for the individual in the scenario presented, rounding the liability to the nearest dollar. In addition, use the dropdown lists to identify the marginal tax rate and average tax rate for the individual in the scenario. Deborah is a young professional with taxable income of $195,500 as an advertising account executive.arrow_forwardvv. Subject:- Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you