FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Solve for C please

Transcribed Image Text:(d)

Your answer is partially correct.

In 2025, Blue determined that a competitor's product would make the New Age Piano obsolete and the patent worthless by

December 31, 2026. Prepare all journal entries required in 2025 and 2026. (Credit account titles are automatically indented when

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List

debit entry before credit entry.)

Date

Account Titles and Explanation

2025

Amortization Expense

Patents

2026

V

Amortization Expense

Patents

Debit

Credit

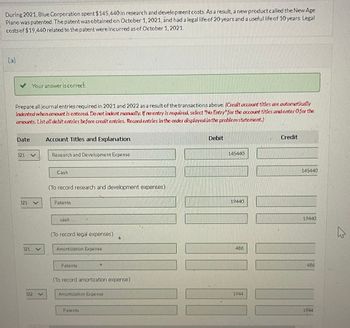

Transcribed Image Text:During 2021, Blue Corporation spent $145,440 in research and development costs. As a result, a new product called the New Age

Piano was patented. The patent was obtained on October 1, 2021, and had a legal life of 20 years and a useful life of 10 years. Legal

costs of $19,440 related to the patent were incurred as of October 1, 2021.

(a)

Your answer is correct.

Prepare all journal entries required in 2021 and 2022 as a result of the transactions above. (Credit account titles are automatically

indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts. List all debit entries before credit entries. Record entries in the order displayed in the problem statement.)

Date

Account Titles and Explanation

121

Research and Development Expense

021

021

V

122 V

Cash

(To record research and development expenses)

Patents

cash

(To record legal expenses)

Amortization Expense

Patents

(To record amortization expense)

Amortization Expense

Patents

Debit

145440

19440

486

1944

Credit

145440

19440

486

1944

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During 2021, Grouper Corporation spent $152,640 in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on October 1, 2021, and had a legal life of 20 years and a useful life of 10 years. Legal costs of $28,080 related to the patent were incurred as of October 1, 2021. (a) Your answer is partially correct. Prepare all journal entries required in 2021 and 2022 as a result of the transactions above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record entries in the order displayed in the problem statement.) Date 2021 2021 2021 Account Titles and Explanation Research and Development Expense Cash (To record research and development expenses) Legal Fees Expense Cash (To record legal expenses) Amortization Expense Debit 152640 28080…arrow_forwardSheridan Company from time to time embarks on a research program when a special project seems to offer possibilities. In 2019, the company expends $323,000 on a research project, but by the end of 2019 it is impossible to determine whether any benefit will be derived from it. (b) The project is completed in 2020, and a successful patent is obtained. The R&D costs to complete the project are $113,000. The administrative and legal expenses incurred in obtaining patent number 472-1001-84 in 2020 total $16,000. The patent has an expected useful life of 5 years. Record these costs in journal entry form. Also, record patent amortization (full year) in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)arrow_forwardDuring 2021, Concord Corporation spent $168,480 in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on October 1, 2021, and had a legal life of 20 years and a useful life of 10 years. Legal costs of $41,040 related to the patent were incurred as of October 1, 2021.arrow_forward

- During 2021, Culver Corporation spent $169,920 in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on October 1, 2021, and had a legal life of 20 years and a useful life of 10 years. Legal costs of $45,360 related to the patent were incurred as of October 1, 2021.arrow_forwardPlease help me. Thankyou.arrow_forwardPLEASEEE HELParrow_forward

- During 2021, Bramble Corporation spent $178,560 in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on October 1, 2021, and had a legal life of 20 years and a useful life of 10 years. Legal costs of $30,000 related to the patent were incurred as of October 1, 2021.arrow_forwardCullumber Company from time to time embarks on a research program when a special project seems to offer possibilities. In 2019, the company expends $321,000 on a research project, but by the end of 2019 it is impossible to determine whether any benefit will be derived from it. The project is completed in 2020, and a successful patent is obtained. The R&D costs to complete the project are $111,000. The administrative and legal expenses incurred in obtaining patent number 472-1001-84 in 2020 total $16,250. The patent has an expected useful life of 5 years. Record these costs in journal entry form. Also, record patent amortization (full year) in 2020. Account Titles and Explanation Debit Credit (To record research and development costs) (To record legal and administrative costs) (To record one year’s amortization expense) In 2021, the company successfully defends the patent in extended litigation at a…arrow_forwardThe Western Company, a company that follows IFRS, provided you with the following information about a number of transactions that took place in 2020: On January 1, 2020 Western acquired a patent for $45,000 cash. The patent expires on January 1, 2028, but the company determined that it will generate future benefits for 6 years from the date of acquisition. During 2022, the total useful life of the patent was revised to 4 years. During March 2020, The Wester Company invested $120,000 in research costs about a new product that it aims to develop in 2021. The amount was paid in cash. The Western Company estimates that its internal goodwill is worth $980,000 in July 2020. Required- Prepare the journal entries related to the patent from January 1, 2020 to December 31, 2022. Prepare the journal entries for 2 and 3. If no journal entry is required, justify why.arrow_forward

- Please explain the steps clearly.arrow_forwardOn April 1, 2020, the Tech Corp. acquired a patent for $162,000. This patent has an estimated useful life of 12 years with an estimated residual value of $18,000. Required: a. In determining the 12-year useful life of this patent, what two lives of the patent did Tech consider? b. Which of these two lives did Tech use as the patent's useful life or is that determinable? c. Make the December 31, 2020, entry for Tech to record the 2020 amortization of this patent in the manner that Tech would have to use in this class. d. What will be the book value of this patent on the December 31, 2023, balance sheet? 14 010 120m 20 1arrow_forwardPLEASE HELP!!!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education