Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please provide answer the accounting question Don't use

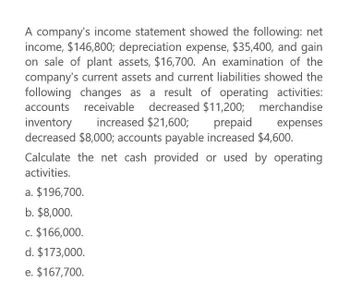

Transcribed Image Text:A company's income statement showed the following: net

income, $146,800; depreciation expense, $35,400, and gain

on sale of plant assets, $16,700. An examination of the

company's current assets and current liabilities showed the

following changes as a result of operating activities:

accounts receivable decreased $11,200; merchandise

inventory increased $21,600; prepaid expenses

decreased $8,000; accounts payable increased $4,600.

Calculate the net cash provided or used by operating

activities.

a. $196,700.

b. $8,000.

c. $166,000.

d. $173,000.

e. $167,700.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company's income statement showed the following: net income, $125,000; depreciation expense, $35,500; and gain on sale of plant assets, $9,500. An examination of the company's current assets and current liabilities showed the following changes as a result of operating activities: accounts receivable decreased $10,500; merchandise inventory increased $23,500; prepaid expenses decreased $7,300; accounts payable increased $4,500. Calculate the net cash provided or used by operating activities. A. $135,000. B. $147,800. C. $149,800. D. $175,800 E. $154,600.arrow_forwardFitz Company reports the following information. Selected Annual Income Statement Data Selected Year-End Balance Sheet Data Net income $ 391,000 Accounts receivable decrease $ 27,200 Depreciation expense 44,200 Inventory decrease 46,000 Amortization expense 8,000 Prepaid expenses increase 6,400 Gain on sale of plant assets 7,100 Accounts payable decrease 8,200 Salaries payable increase 1,900 Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. Note: Amounts to be deducted should be indicated with a minus sign.arrow_forwardI need answer of this question general financearrow_forward

- Please provide answer the following requirementsarrow_forwardAdditionally, the company informed the following: Net income = $156,042 Sales = $4,063,589 Determine the following values for the company: Total asset turnover ratio _____________ Fixed asset turnover ratio _____________arrow_forwardA company's income statement showed the following: net income, $134,000; depreciation expense, $30,000; and gain on sale of plant assets, $4,000. An examination of the company's current assets and current liabilities showed the following changes: accounts receivable decreased $9,400; merchandise inventory increased $18,0003; prepaid expenses increased $6,200; accounts payable increased $3,400. Calculate the net cash provided or used by operating activities. A) $156,600. B) $141,000. C) $96,600. D) $148,600. E) $88,600. OD O A OB O Earrow_forward

- In its income statement for the year ended December 31, 2025, Crane Inc. reported the following condensed data. Operating expenses Cost of goods sold Interest expense Income tax expense $711,000 1,247,000 61,000 38,000 Interest revenue Loss on disposal of plant assets Sales revenue Sales discounts $ 24,000 8,000 2,333,000 164,000 Prepare a multiple-step income statement. (List Other revenue and gains before Other expenses and losses.) CRANE INC. Income Statement For the Year Ended December 31, 2025arrow_forwardThe income statement disclosed the following items for the year: Line Item Description Amount Depreciation expense $43,900 Gain on disposal of equipment 25,610 Net income 292,200 The changes in the current asset and liability accounts for the year are as follows: Line Item Description Increase (Decrease) Accounts receivable $6,840 Inventory (3,890) Prepaid insurance (1,460) Accounts payable (4,640) Income taxes payable 1,460 Dividends payable 1,020 Question Content Area a. Prepare the "Cash flows from (used for) operating activities" section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. blankStatement of Cash Flows (partial) Line Item Description Amount Amount Cash flows from (used for) operatingactivities: $Net income Adjustments to reconcile net incometo net cash flows from (used for) operating…arrow_forwardIn its income statement for the year ended December 31, 2022, Metlock, Inc. reported the following condensed data. Operating expenses Cost of goods sold Interest expense (a) $709,000 1,250,000 73,000 Interest revenue Loss on disposal of plant assets Net sales Other comprehensive income $32,000 19,000 2,187,000 8,500 Prepare a multiple-step income statement. (List other revenues before other expenses) Metlock, Inc. Income Statementarrow_forward

- solve my general accounting questionarrow_forwardIn its income statement for the year ended December 31, 2022, Crane Company reported the following condensed data. Salaries and wages expenses $381,300 Loss on disposal of plant assets $ 68,470 Cost of goods sold 809,340 Sales revenue 1,812,200 Interest expense 58,220 Income tax expense 20,500 Interest revenue 53,300 Sales discounts 131,200 Depreciation expense 254,200 Utilities expense 90,200 Prepare a multiple-step income statement. (List other revenues before other expenses.)arrow_forwardAn analysis of the transactions of Rutherford Company for the year ended December 31, yieldsthe following information: sales revenue, $65,000; insurance expense, $4,300; interest income,$3,900; cost of goods sold, $28,800; and loss on disposal of property, plant, and equipment,$1,200.Required:Prepare a single-step income statement.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College