FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Sheridan Company from time to time embarks on a research program when a special project seems to offer possibilities. In 2019, the

company expends $323,000 on a research project, but by the end of 2019 it is impossible to determine whether any benefit will be

derived from it.

(b)

The project is completed in 2020, and a successful patent is obtained. The R&D costs to complete the project are $113,000. The

administrative and legal expenses incurred in obtaining patent number 472-1001-84 in 2020 total $16,000. The patent has an

expected useful life of 5 years. Record these costs in journal entry form. Also, record patent amortization (full year) in 2020.

(Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry"

for the account titles and enter O for the amounts.)

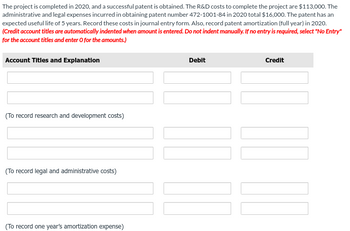

Transcribed Image Text:The project is completed in 2020, and a successful patent is obtained. The R&D costs to complete the project are $113,000. The

administrative and legal expenses incurred in obtaining patent number 472-1001-84 in 2020 total $16,000. The patent has an

expected useful life of 5 years. Record these costs in journal entry form. Also, record patent amortization (full year) in 2020.

(Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry"

for the account titles and enter O for the amounts.)

Account Titles and Explanation

(To record research and development costs)

(To record legal and administrative costs)

(To record one year's amortization expense)

Debit

Credit

10.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 2022, Harper Corporation spent $500,000 developing a new product, $75,000 in legal fees to obtain a patent on the product, and $100,000 to market the product that was patented. Describe how each of these costs should be accounted for in 2022? Do NOT prepare any journal entries! Use complete sentences and correct grammar.arrow_forwardsarrow_forwardDuring 2024, Nash constructed a small manufacturing facility specifically to manufacture one particular accessory. Nash paid the construction contractor $5,279,000 cash (which was the total contract price) and placed the facility into service on January 1, 2025. Because of technological change, Nash anticipates that the manufacturing facility will be useful for no more than 10 years. The local government where the facility is located required that, at the end of the 10-year period, Nash remediate the facility so that it can be used as a community center. Nash estimates the cost of remediation will be $632,900. Nash uses straight-line depreciation with $0 salvage value for its plant asset and a 12% discount rate for asset retirement obligations. (a) Your answer is correct. Prepare the journal entries to record the January 1, 2025, transactions. Use the Plant Assets account for the tanker depot. (Credit account titles are automatically indented when the amount is entered. Do not indent…arrow_forward

- Cayman Corp. incurred $ 140,000 of basic research and $ 35,000 of development costs to develop a product for which a patent was granted on January 2, 2015. Legal fees and other costs associated with registration of the patent totalled $ 50,000. On March 31, 2020, Cayman paid $ 75,000 for legal fees in a successful defence of the patent. The total amount capitalized for the patent through March 31, 2020 should be $ 265,000. $ 160,000.arrow_forwardOn January 3, 2020, Gagne Inc. paid $320,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $2,500, $6,400 sales tax, and $21,100 for special installation. Management estimates that the computer will remain in service for five years and have a residual value of $20,000. The computer will process 50,000 documents the first year, decreasing annually by 5,000 during each of the next four years (that is 45,000 documents in 2021, 40,000 documents is 2022, and so on). In trying to decide which depreciation method to use, the company president has requested a depreciation schedule for each of three depreciation methods (straight-line, units-of-production, and double-diminishing-balance). Before completing the straight-line depreciation schedule, calculate the straight-line depreciation rate. First, select the labels for the formula and then compute the rate. (Round the rate to two decimal places.) Date January 3, 2020 December 31, 2020 December…arrow_forwardKingbird Construction Company began work on a $418,500 construction contract in 2020. During 2020, Kingbird incurred costs of $285,500, billed its customer for $233,000, and collected $172,000. At December 31, 2020, the estimated additional costs to complete the project total $155,765.Prepare Kingbird’s journal entry to record profit or loss, if any, using (a) the percentage-of-completion method and (b) the completed-contract method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275.) No. Account Titles and Explanation Debit Credit (a) enter an account title to record the transaction using the percentage-of-completion method enter a debit amount enter a credit amount enter an account title to record the transaction using the percentage-of-completion method enter a debit…arrow_forward

- Roland Company uses special strapping equipment in its packaging business. The equipment was purchased in January 2019 for $10,000,000 and had an estimated useful life of 8 years with no salvage value. At December 31, 2020, new technology was introduced that would accelerate the obsolescence of Roland’s equipment. Roland’s controller estimates that expected future net cash flows on the equipment will be $6,300,000 and that the fair value of the equipment is $5,600,000. Roland intends to continue using the equipment, but it is estimated that the remaining useful life is 4 years. Roland uses straight-line depreciation. Instructions a. Prepare the journal entry (if any) to record the impairment at December 31, 2020. b. Prepare any journal entries for the equipment at December 31, 2021. The fair value of the equipment at December 31, 2021, is estimated to be $5,900,000. c. Repeat the requirements for (a) and (b), assuming that Roland intends to dispose of the equipment and that it…arrow_forwardDuring 2021, Grouper Corporation spent $152,640 in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on October 1, 2021, and had a legal life of 20 years and a useful life of 10 years. Legal costs of $28,080 related to the patent were incurred as of October 1, 2021. (a) Your answer is partially correct. Prepare all journal entries required in 2021 and 2022 as a result of the transactions above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record entries in the order displayed in the problem statement.) Date 2021 2021 2021 Account Titles and Explanation Research and Development Expense Cash (To record research and development expenses) Legal Fees Expense Cash (To record legal expenses) Amortization Expense Debit 152640 28080…arrow_forwardXYZ Co. completed construction of a new silver mine in 2020. The cost of direct materials for the construction was $2,500,000 and direct labour was $2,300,000. In addition, the company allocated $280,000 of general overhead costs to the project. To finance the project, the company obtained a loan of $2,700,000 from its bank. The loan funds were drawn on February 24, 2020 and the mine was completed on November 24, 2020. The interest rate on the loan was 9% p.a. During construction, excess funds from the loan were invested and earned interest income of $24,000. The remainder of the funds needed for construction was drawn from internal cash reserves in the company. The company has also publicly made a commitment to clean up the site of the mine when the extraction operation is complete. It is estimated that the mining of this particular seam will be completed in 13 years, at which time restoration costs of $150,000 will be incurred. The appropriate discount rate for this type of…arrow_forward

- Irwin, Inc. constructed a machine at a total cost of $39 million. Construction was completed at the end of 2017 and the machine was placed in service at the beginning of 2018. The machine was being depreciated over a 10-year life using the straight-line method. The residual value is expected to be $3 million. At the beginning of 2021, Irwin decided to change to the sum-of-the-years’-digits method. Ignoring income taxes, prepare the journal entry relating to the machine for 2021.arrow_forwardBlue Incorotation has a patent that will expire at the end of 2025. They spent $100,000 to successfully prosecute an infringement suit on July 1, 2018. The carrying value of this patent before the litigation is $300,000. Write journal entries to record for these activities.arrow_forwardDuring 2021, Culver Corporation spent $169,920 in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on October 1, 2021, and had a legal life of 20 years and a useful life of 10 years. Legal costs of $45,360 related to the patent were incurred as of October 1, 2021.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education