Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

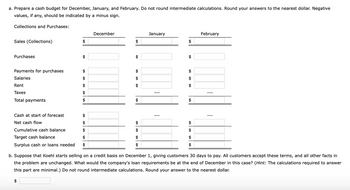

Transcribed Image Text:a. Prepare a cash budget for December, January, and February. Do not round intermediate calculations. Round your answers to the nearest dollar. Negative

values, if any, should be indicated by a minus sign.

Collections and Purchases:

Sales (Collections)

Purchases

Payments for purchases

Salaries

Rent

Taxes

Total payments

December

$

$

$

Cash at start of forecast

$

Net cash flow

$

Cumulative cash balance

$

Target cash balance

$

Surplus cash or loans needed

$

January

February

b. Suppose that Koehl starts selling on a credit basis on December 1, giving customers 30 days to pay. All customers accept these terms, and all other facts in

the problem are unchanged. What would the company's loan requirements be at the end of December in this case? (Hint: The calculations required to answer

this part are minimal.) Do not round intermediate calculations. Round your answer to the nearest dollar.

$

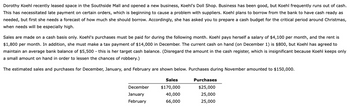

Transcribed Image Text:Dorothy Koehl recently leased space in the Southside Mall and opened a new business, Koehl's Doll Shop. Business has been good, but Koehl frequently runs out of cash.

This has necessitated late payment on certain orders, which is beginning to cause a problem with suppliers. Koehl plans to borrow from the bank to have cash ready as

needed, but first she needs a forecast of how much she should borrow. Accordingly, she has asked you to prepare a cash budget for the critical period around Christmas,

when needs will be especially high.

Sales are made on a cash basis only. Koehl's purchases must be paid for during the following month. Koehl pays herself a salary of $4,100 per month, and the rent is

$1,800 per month. In addition, she must make a tax payment of $14,000 in December. The current cash on hand (on December 1) is $800, but Koehl has agreed to

maintain an average bank balance of $5,500 - this is her target cash balance. (Disregard the amount in the cash register, which is insignificant because Koehl keeps only

a small amount on hand in order to lessen the chances of robbery.)

The estimated sales and purchases for December, January, and February are shown below. Purchases during November amounted to $150,000.

December

Sales

$170,000

Purchases

$25,000

January

40,000

25,000

February

66,000

25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Dorothy Koehl recently leased space in the Southside Mall and opened a new business, Koehl’s Doll Shop. Business has been good, but Koehl frequently runs out of cash. This has necessitated late payment on certain orders, which is beginning to cause a problem with suppliers. Koehl plans to borrow from the bank to have cash ready as needed, but first she needs a forecast of how much she should borrow. Accordingly, she has asked you to prepare a cash budget for the critical period around Christmas, when needs will be especially high. Sales are made on a cash basis only. Koehl’s purchases must be paid for during the following month. Koehl pays herself a salary of $4,800 per month, and the rent is $2,000 per month. In addition, she must make a tax payment of $12,000 in December. The current cash on hand (on December 1) is $400, but Koehl has agreed to maintain an average bank balance of $6,000—this is her target cash balance. (Disregard the amount in the cash register, which is insignificant because Koehl keeps only a small amount on hand in order to lessen the chances of robbery.) The estimated sales and purchases for December, January, and February are shown in the following table. Purchases during November amounted to $140,000. Prepare a cash budget for December, January, and February. Suppose that Koehl starts selling on a credit basis on December 1, giving customers 30 days to pay. All customers accept these terms, and all other facts in the problem are unchanged. What would the company’s loan requirements be at the end of December in this case? (Hint: The calculations required to answer this part are minimal.)arrow_forwardDorothy Koehl recently leased space in the Southside Mall and opened a new business, Koehl's Doll Shop. Business has been good, but Koehl frequently runs out of cash. This has necessitated late payment on certain orders, which is beginning to cause a problem with suppliers. Koehl plans to borrow from the bank to have cash ready as needed, but first she needs a forecast of how much she should borrow. Accordingly, she has asked you to prepare a cash budget for the critical period around Christmas, when needs will be especially high. Sales are made on a cash basis only. Koehl's purchases must be paid for during the following month. Koehl pays herself a salary of $4,500 per month, and the rent is $2,600 per month. In addition, she must make a tax payment of $10,000 in December. The current cash on hand (on December 1) is $400, but Koehl has agreed to maintain an average bank balance of $4,500 - this is her target cash balance. (Disregard the amount in the cash register, which is…arrow_forwardDorothy Koehl recently leased space in the Southside Mall and opened a new business, Koehl's Doll Shop. Business has been good, but Koehl frequently runs out of cash. This has necessitated late payment on certain orders, which is beginning to cause a problem with suppliers. Koehl plans to borrow from the bank to have cash ready as needed, but first she needs a forecast of how much she should borrow. Accordingly, she has asked you to prepare a cash budget for the critical period around Christmas, when needs will be especially high. Sales are made on a cash basis only. Koehl's purchases must be paid for during the following month. Koehl pays herself a salary of $4,000 per month, and the rent is $2,900 per month. In addition, she must make a tax payment of $14,000 in December. The current cash on hand (on December 1) is $350, but Koehl has agreed to maintain an average bank balance of $6,500 - this is her target cash balance. (Disregard the amount in the cash register, which is…arrow_forward

- You are working as a summer intern at a rapidly growing organic food distributor. Part of your responsibility is to assist in the accounts payable department. You notice that most bills from suppliers are not paid within the discount period. The manager of accounts payable says the bills are organized by vendor, like the accounts payable ledger, and she is too busy to keep track of the discount periods. Besides, the owner has told her that the 1% and 2% discounts available are not worth worrying about.arrow_forwardYou are working as a summer intern at a rapidly growing orgainc food distribution. Part of your responsibility is to assist in the accounts payable department. You notice that most of the bills are not paid with in discount period. The manager of the accounts payable sees the bills are organized by vendor, like the accounts payable ledger, and she is too busy to keep track of the discounts period. Besides, the owner has told her that The 1% and 2% discount available or not worth worrying about. 1. Explain to the owner why it is expensive not to take it advantage to cash discounts on credit purchases. suggest a way to file (organize) suppliers invoices so that they are paid with in the discount period.arrow_forwardNatalie decides that she cannot afford to hire John to do her accounting. One way that she can ensure that her cash account does not have any errors and is accurate and up-to-date is to prepare a bank reconciliation at the end of each month. Natalie would like you to help her. She asks you to prepare a bank reconciliation for June 2020 using the information below.Please refer to the image attached Additionally, take the following information into account. On June 30th, there were two outstanding checks: #595 for $238 and #604 for $297. Premier Bank made a posting error to the bank statement: Check #603 was issued for $425, not $452. The deposit made on June 20 was for $125, which Natalie received for teaching a class. Natalie made an error in recording this transaction. The electronic funds transfer (EFT) was for Natalie’s cell phone use. Remember that she uses this phone only for business. The NSF check was from Ron Black. Natalie received this check for teaching a class to Ron’s…arrow_forward

- Catherine Romanov was a loan officer who needed one last loan to make her quota for the month. Yvonne Gunner, who was only a freshman in college, walked in one day for a loan for a new software business she was starting. She had never dealt with banks before and did not understand the nuances of loans but asked very good questions. Ms. Romanov, however, was ruthless and intentionally did not answer the questions accurately. Had Ms. Gunner received accurate answers to her questions, she would not have taken the loan. After six months, Ms. Gunner defaulted on the loan, and the bank pursued her for payment. 1. Does Ms. Gunner have any remedies?arrow_forwardNatalie decides that she cannot afford to hire John to do her accounting. One way thatshe can ensure that her cash account does not have any errors and is accurate and upto-date is to prepare a bank reconciliation at the end of each month.Natalie would like you to help her. She asks you to prepare a bank reconciliation forJune 2020 using the following information.arrow_forwardSal Shirey is an owner of a small business. His company has recently borrowed a large amount of funds to finance the construction of a large building addition, as well as, the purchase of equipment and machinery. Shirey's banker requires him to submit quarterly financial statements so that he can monitor the financial health of his business. The bank has warned that if profit margins decline, the interest rate on the loan may need to be increased in order to reflect additional risk. Shirey knows that profit may decline this year. As he is preparing the year-end adjusting entries, Sal decides, for depreciation purposes, to treat all long-term asset purchases as though they occurr on the first day of the month following the month of purchase. 1. Is there an ethical issue with the implementation of this rule? If so, what is it?2. When should depreciation first be recorded?3. What impact will Shirey's approach to recording depreciation have on the financial statements?arrow_forward

- Your friend, Wendy Geiger, owns a small retail store that sells candies and nuts. Geiger acquires her goods from a few select vendors. She generally makes purchase orders by phone and on credit. Sales are primarily for cash. Geiger keeps her own manual accounting system using a general journal and a general ledger. At the end of each business day, she records one summary entry for cash sales. Geiger recently began offering items in creative gift packages. This has increased sales substantially, and she is now receiving orders from corporate and other clients who order large quantities and prefer to buy on credit. As a result of increased credit transactions in both purchases and sales, keeping the accounting records has become extremely time- consuming. Geiger wants to continue to maintain her own manual system and calls you for advice. Write a memo to her advising how she might modify her current manual accounting system to accommodate the expanded business activities. Geiger is…arrow_forward(Receivables Management) As the manager of the accounts receivable department for Beavis Leather Goods, Ltd., you recently noticed that Kelly Collins, your accounts receivable clerk who is paid $1,200 per month, has been wearing unusually tasteful and expensive clothing. (This is Beavis’s first year in business.) This morning, Collins drove up to work in abrand new Lexus.Naturally suspicious by nature, you decide to test the accuracy of the accounts receivable balance of $192,000 as shown in the ledger. The following information is available for your first year (precisely 9 months ended September 30, 2017) in business.(1) Collections from customers $188,000(2) Merchandise purchased 360,000(3) Ending merchandise inventory 90,000(4) Goods are marked to sell at 40% above cost.InstructionsAssuming all sales were made on account, compute the ending accounts receivable balance that should appear in the ledger, noting any apparent shortage. Then, draft a memo dated October 3, 2017, to Mark…arrow_forward33. subject:- Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning