Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN: 9781337395250

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

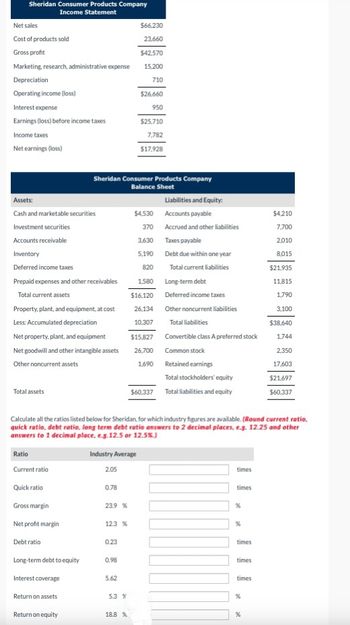

Transcribed Image Text:Sheridan Consumer Products Company

Income Statement

Net sales

$66,230

Cost of products sold

23,660

Gross profit

$42,570

Marketing, research, administrative expense

15,200

Depreciation

710

Operating income (loss)

$26,660

Interest expense

950

Earnings (loss) before income taxes

$25,710

Income taxes

7,782

Net earnings (loss)

$17,928

Sheridan Consumer Products Company

Balance Sheet

Assets:

Liabilities and Equity:

Cash and marketable securities

$4,530

Accounts payable

$4,210

Investment securities

370

Accrued and other liabilities

7,700

Accounts receivable

3,630

Taxes payable

2,010

Inventory

5,190 Debt due within one year

8,015

Deferred income taxes

820

Total current liabilities

$21,935

Prepaid expenses and other receivables

1,580

Long-term debt

11,815

Total current assets

$16,120

Deferred income taxes

1,790

Property, plant, and equipment, at cost

26,134

Other noncurrent liabilities

3,100

Less: Accumulated depreciation

10,307

Total liabilities

$38,640

Net property, plant, and equipment

$15,827

Convertible class A preferred stock

1,744

Net goodwill and other intangible assets

26,700

Common stock

2,350

Other noncurrent assets

1,690

Retained earnings

17,603

Total stockholders' equity

$21,697

Total assets

$60,337 Total liabilities and equity

$60,337

Calculate all the ratios listed below for Sheridan, for which industry figures are available. (Round current ratio.

quick ratio, debt ratio, long term debt ratio answers to 2 decimal places, e.g. 12.25 and other

answers to 1 decimal place, e.g.12.5 or 12.5%)

Ratio

Current ratio

Industry Average

2.05

times

Quick ratio

0.78

times

Gross margin

23.9 %

%

Net profit margin

12.3 %

%

Debt ratio

0.23

times

Long-term debt to equity

0.98

times

Interest coverage

5.62

times

Return on assets

5.3 %

%

Return on equity

18.8 %

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Income statement net sales $51,407.00 cost of products sold $25,076.00 gross profit $26,331.00 marketing, research, administrative exp $15,746.00 Depreciation $758.00 operating income(loss) $9,827.00 Interest expense $477.00 Earnings (loss)before income taxes $9,350.00 Income taxes $2,869.00 Net earnings(loss) $6,481.00 Balance Sheet Assets: Liablilites and Equity: cash and marketable securities $5,469.00 accounts payable $3,617.00 investment securities $423.00 accrued and other liablilties $7,689.00 accounts receivable $4,062.00 taxes payable $2,554.00 inventory $4,400.00 debt due within one year $8,287.00 deffered income taxes $958.00 total current liabilite $22,147.00 prepaid expense and other receivables $1,803.00 long term debt $12,554.00 total current assets $17,115.00 deferrred income taxes…arrow_forwardIncome statement net sales $51,407.00 cost of products sold $25,076.00 gross profit $26,331.00 marketing, research, administrative exp $15,746.00 Depreciation $758.00 operating income(loss) $9,827.00 Interest expense $477.00 Earnings (loss)before income taxes $9,350.00 Income taxes $2,869.00 Net earnings(loss) $6,481.00 Balance Sheet Assets: Liablilites and Equity: cash and marketable securities $5,469.00 accounts payable $3,617.00 investment securities $423.00 accrued and other liablilties $7,689.00 accounts receivable $4,062.00 taxes payable $2,554.00 inventory $4,400.00 debt due within one year $8,287.00 deffered income taxes $958.00 total current liabilite $22,147.00 prepaid expense and other receivables $1,803.00 long term debt $12,554.00 total current assets $17,115.00 deferrred income taxes…arrow_forwardTB MC Qu. 16-106 (Algo) Jester Corporation's most recent income statement... Jester Corporation's most recent income statement appears below: Income Statement Sales (all on account) Cost of goods sold Gross margin Selling and administrative expense Net operating income Interest expense Net income before taxes Income taxes (30%) Net income $ 230,000 105,000 125,000 37,000 88,000 19,000 69,000 20,700 $ 48,300 The beginning balance of total assets was $230,000 and the ending balance was $223,000. The return on total assets is closest Multiple Choice 30.5% O 27.2% O 38.9% 21.3%arrow_forward

- Sales Costs Other expenses Earnings before interest and taxes Interest paid Taxable income Taxes (21%) Net income Dividends Addition to retained earnings Current assets Cash CROSBY, INCORPORATED 2023 Income Statement Accounts receivable Inventory Total Total assets Assets Fixed assets Net plant and equipment EFN $ 21,340 44,280 98,960 $ 164,580 $ 430,000 $ 28,203 65,807 $ 594,580 $ 754,000 589,000 25,000 $ 140,000 21,000 CROSBY, INCORPORATED Balance Sheet as of December 31, 2023 $ 119,000 24,990 $ 94,010 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Total Total liabilities and owners' equity $ 55,500 14,700 $ 70,200 $ 137,000 $ 118,000 269,380 $ 387,380 $ 594,580 If the firm is operating at full capacity and no new debt or equity is issued, what is the external financing needed to support the 25 percent growth rate in sales? Note: Do not round…arrow_forwardSales Sales Revenue Less Net Sales Cost of Goods Sold Gross Profit Operating Expenses Salaries and Wages Expense Sales Discounts Depreciation Expense Utilities Expense Total Operating Expenses Income From Operations Other Revenues and Gains Interest Revenue Other Expenses and Losses Interest Expense Loss on Disposal of Plant Assets Income Before Income Taxes Income Tax Expense Net Income /(Loss) A V V V CULLUMBER COMPANY Income Statement For the Year Ended December 31, 2025 $ 1,856,400 -134,400 i 390,600 i 260,400 i 92,400 i -59,640 -54,600 i $ 1,722,000 -792,120 929,880 -743,400 i 186,480 54,600 -114,240 126,840 -25,200 i 101,640arrow_forwardSUNLAND COMPANYIncome StatementsFor the Years Ended December 31 2022 2021 Net sales $2,178,400 $2,030,000 Cost of goods sold 1,207,000 1,187,080 Gross profit 971,400 842,920 Selling and administrative expenses 590,000 565,220 Income from operations 381,400 277,700 Other expenses and losses Interest expense 25,960 23,600 Income before income taxes 355,440 254,100 Income tax expense 106,632 76,230 Net income $ 248,808 $ 177,870 SUNLAND COMPANYBalance SheetsDecember 31 Assets 2022 2021 Current assets Cash $ 70,918 $ 75,756 Debt investments (short-term) 87,320 59,000 Accounts receivable 139,004 121,304 Inventory 148,680 136,290 Total current assets 445,922 392,350 Plant assets (net) 765,820 613,954 Total assets $1,211,742…arrow_forward

- View Policies Current Attempt in Progress For Cullumber Company, the following information is available: Cost of goods sold $385000 Dividend revenue 14800 Income tax expense 36500 Operating expenses 140000 Sales revenue 594000 In Cullumber's multīple-step income statement, gross profit O should be reported at $209000. O should be reported at $ 47300. O should not be reported. O should be reported at $223800. Save for Laterarrow_forwardCABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 448,600 297,150 151,450 98,600 5,000 47,850 19,276 $ 28,574 Cost of goods sold Gross profit Operating expenses Interest expense Profit before taxes Income tax expense Net profit Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Property, plant and equipment, net Total assets Req 1 and 2 Req 3 Req 4 CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity Req 5 8,000 Accounts payable 8,800 Accrued wages payable 32,400 Income taxes payable 2,750 Share capital 150,300 Retained earnings $ 238,400 Total liabilities and equity Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio. 36,150 Long-term note payable, secured by mortgage on property, plant and equipment Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days'…arrow_forwardIncome Statement Balance Sheet Current Current Sales $9,300 $ 4,050 $ 2,625 assets liabilities Long-term debt Costs 6,550 Fixed assets 9,300 4,190 Taxable $2,750 Equity 6,535 income Taxes (22%) 605 Total $13,350 Total $13,350 Net income $ 2,145 Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant 44 percent dividend payout ratio. As with every other firm in its industry, next year's sales are projected to increase by exactly 17 percent. What is the external financing needed? External financing neededarrow_forward

- gross profit ratioarrow_forwardNet sales from Following inform sttementarrow_forwardProblem: Remesh Corporation prepared the following income statement and statement of retained earnings for the year ended December 31, 2021. Remesh Corporation December 31, 2021 Expense and Profit Statement Dollars in thousands Sales (net) $206,000 Less: Selling Expenses (20,600) Net Sales $185,400 Add: Interest Revenue 2,400 Add: Gain on sale of equipment 3,600 Gross Sales Revenue $191,400 Less: Cost of operations: Cost of Goods Sold $126,100 Correction of overstatement in last years income because of error $5,500 (net of tax credit) $3850 Dividend cost ($0.50 per share for 8k common shares) $4000 Unusual loss due to a hurricane, $6,400 (net of tax credit) $1,920 ($135,870) Taxable Revenues $55,530 Less: Income tax on income from continuing operations $16,659 Net income $38871 Miscellaneous Deductions Loss from operations of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning