CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Hello tutor please need answer this accounting question

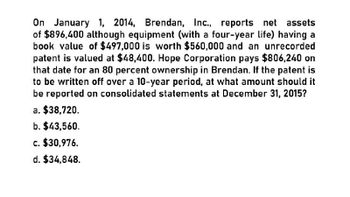

Transcribed Image Text:On January 1, 2014, Brendan, Inc., reports net assets

of $896,400 although equipment (with a four-year life) having a

book value of $497,000 is worth $560,000 and an unrecorded

patent is valued at $48,400. Hope Corporation pays $806,240 on

that date for an 80 percent ownership in Brendan. If the patent is

to be written off over a 10-year period, at what amount should it

be reported on consolidated statements at December 31, 2015?

a. $38,720.

b. $43,560.

c. $30,976.

d. $34,848.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.arrow_forwardOn January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.arrow_forwardOn May 1, 2015, Zoe Inc. purchased Branta Corp. for $15,000,000 in cash. They only received $12,000,000 in net assets. In 2016, the market value of the goodwill obtained from Branta Corp. was valued at $4,000,000, but in 2017 it dropped to $2,000,000. Prepare the journal entry for the creation of goodwill and the entry to record any impairments to it in subsequent years.arrow_forward

- For each of the following unrelated situations, calculate the annual amortization expense and prepare a journal entry to record the expense: A. A patent with a seventeen-year remaining legal life was purchased for $850,000. The patent will be usable for another six years. B. A patent was acquired on a new tablet. The cost of the patent itself was only $12,000, but the market value of the patent is $150,000. The company expects to be able to use this patent for all twenty years of its life.arrow_forwardOn January 1, 2020, Grand Haven, Inc., reports net assets of $843,200 although equipment (with a four-year remaining life) having a book value of $463,000 is worth $525,000 and an unrecorded patent is valued at $46,800. Van Buren Corporation pays $761,600 on that date to acquire an 80 percent equity ownership in Grand Haven. If the patent has a remaining life of nine years, at what amount should the patent be reported on Van Buren's consolidated balance sheet at December 31, 2021? Multiple Choice $36,400. $29,120. $41,600. $32,760.arrow_forwardOn January 1, 2023, Bertrand Incorporated paid $70,800 for a 40% interest in Chestnut Corporation's common stock. This investee had assets with a book value of $235,000 and liabilities of $95000. A patent held by Chestnut having a book value of $8900 was actually worth $25,400. This patent had a six year remaining life. Any further excess cost associated with this acquisition was attributed to an indefinite-lived asset. During 2023, Chestnut earned income of $45,700 and declared and paid dividends of $20,000. During 2024, the fair value of Bertrand's investment in Chestnut had risen from $84,080 to $88,960. Assuming Bertrand uses the quity method, what balnace should appear in the investment in Chestnut account as of December 31, 2024? Assuming Bertrand uses fair-value accounting, what income from the investment in Chestnut should be reported for 2024?arrow_forward

- On January 1, 2007, Taft Co. purchased a patent for 714,000. The patent is being amortized over its remaining legal life of fifteenyears expiring on January 1, 2022. During 2010, Taft determined that the economic benefits of the patent would not last longer than ten years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2010?a.428,400b.489,600c.504,000d.523,600arrow_forwardOn January 2, 2018,Judd Co. bought a trademark from Krug Co. for P500,000. Judd retained an independent consultant, who estimated the trademark’s remaining life to be fifty years. Its unamortized cost on Krug’s accounting records was P380,000. In Judd’s December 31, 2018 balance sheet, what amount should be reported as accumulated amortization? a P7,600 b P9,500 c P10,000 d P12,500arrow_forwardMali Inc. acquires 80% of Dog Company on January 1, 2020 for $692,000. At that date Dog reports net assets of $760,000 although equipment (with a remaining life of four years) with a book value of $440,000 is valued at $500,000 and a patent valued at $45,000 is unrecorded. If the patent has a remaining life of nine years, at what amount should the patent be reported on Mali's consolidated balance sheet at December 31, 2021?arrow_forward

- On January 1, 2023, Bertrand, Incorporated, paid $81,200 for a 40 percent interest in Chestnut Corporation’s common stock. This investee had assets with a book value of $219,000 and liabilities of $80,500. A patent held by Chestnut having a $7,400 book value was actually worth $55,400. This patent had a six-year remaining life. Any further excess cost associated with this acquisition was attributed to an indefinite-lived asset. During 2023, Chestnut earned income of $54,200 and declared and paid dividends of $18,000. In 2024, it had income of $66,700 and dividends of $23,000. During 2024, the fair value of Bertrand’s investment in Chestnut had risen from $95,480 to $98,960. Assuming Bertrand uses the equity method, what balance should appear in the Investment in Chestnut account as of December 31, 2024? Assuming Bertrand uses fair-value accounting, what income from the investment in Chestnut should be reported for 2024?arrow_forwardOn January 1, 2020. Alison, Inc., paid $69,500 for a 40 percent interest in Holister Corporation's common stock. This investee had assets with a book value of $219,500 and liabilities of $95,500. A patent held by Holister having a $12,000 book value was actually worth $31,500. This patent had a six-year remaining life. Any further excess cost associated with this acquisition was attributed to goodwill. During 2020, Holister earned income of $32,500 and declared and paid dividends of $11,000. In 2021, it had income of $71,500 and dividends of $16,000. During 2021, the fair value of Allison's investment in Holister had risen from $79,200 to $89,900. a. Assuming Alison uses the equity method, what balance should appear in the Investment in Holister account as of December 31, 2021? b. Assuming Alison uses fair-value accounting, what income from the investment in Holister should be reported for 2021? a. Investment in Holister b. Investment incomearrow_forwardOn January 1, 2020, Alison, Inc., paid $83,800 for a 40 percent interest in Holister Corporation’s common stock. This investee had assets with a book value of $290,500 and liabilities of $117,000. A patent held by Holister having a $13,600 book value was actually worth $31,600. This patent had a six-year remaining life. Any further excess cost associated with this acquisition was attributed to goodwill. During 2020, Holister earned income of $40,700 and declared and paid dividends of $14,000. In 2021, it had income of $70,000 and dividends of $19,000. During 2021, the fair value of Allison’s investment in Holister had risen from $95,380 to $106,180. Assuming Alison uses the equity method, what balance should appear in the Investment in Holister account as of December 31, 2021? Assuming Alison uses fair-value accounting, what income from the investment in Holister should be reported for 2021?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning