Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

General Accounting

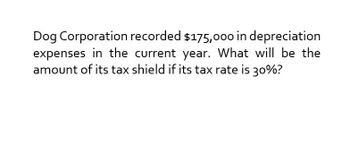

Transcribed Image Text:Dog Corporation recorded $175,000 in depreciation

expenses in the current year. What will be the

amount of its tax shield if its tax rate is 30%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?arrow_forwardFinancial Accountingarrow_forwardA corporation’s marginal tax rate is 28%. An outlay of $35,000 is being considered for a new asset. Estimated annual receipts are $20,000 and annual disbursements $10,000. The useful life of the asset is 5 years, and it has no salvage value. a. What is the prospective rate of return before income tax? b. What is the prospective rate of return after taxes, assuming straightline depreciation?arrow_forward

- A firm invests $10.70 million in a new stamping machine. It depreciates straight-line for tax purposes over 5 years. The tax rate is 21%, inflation is 2% a year, and the discount rate is 8%. What is the PV of the depreciation tax shield?arrow_forwardYou have a depreciation expense of $478,000 and a tax rate of 35%. What is your depreciation tax shield? The depreciation tax shield will be $ (Round to the nearest dollar.)arrow_forward-Suppose a 5-year piece of equipment purchased for 500,000 is sold at the end of year 4 after taking four years of straight- line depreciation. Assume that the equipment is sold for 200,000 and the tax rate is 35%. What is the book value? Is there tax savings on the sale? Is there tax effect?arrow_forward

- Consider a profitable company with an asset that cost $3 million that is depreciated straight line to zero over. It’s 11 year depreciable tax life. The asset is to be used in a three year project at the end of the project. The asset can be sold for 362,000. If the relevant tax rate is 18%, what is the after tax cash flow from the sale of this asset (after tax salvage)?arrow_forwardThe XYZ Company is considering a new project that will have an annual depreciation expense of $3.7 million. If XYZ's corporate tax rate is 13 %, then what is the value of the depreciation tax shield on their new project?arrow_forwardK You have a depreciation expense of $546,000 and a tax rate of 22%. What is your depreciation tax shield? The depreciation tax shield will be $ (Round to the nearest dollar.)arrow_forward

- attachedarrow_forwardA corporation expects to receive $32,000 each year for 15 years from the sale of a product. There will be an initial investment of $150,000. Manufacturing and sales expenses will be $8067 per year. Assume straight line depreciation, a 15-year useful life and no salvage value. Use a 46% income tax rate. What is the before and after-tax rate of return?arrow_forwardAdidas bought a $36.4 million piece of equipment. It will be depreciated by $6.07 million per year over 6 years, starting this year (i.e., the same year they purchased it). Suppose Adidas' tax rate is 35%. a. What impact will the cost of the purchase have on earnings for each of the next 6 years? b. What impact will the cost of the purchase have on the firm's cash flow for the next 6 years? Question content area bottom Part 1 a. The impact on earnings will be $enter your response here million each year for 6 years. (Round to two decimal places. Use a negative sign for a decrease in value.) b1. The impact on the firm's cash flow in Year 1 is $enter your response here million. (Round to two decimal places. Use a negative sign for a decrease in value.) b2. The impact on the firm's cash flow in years 2 through 6 is $enter your response here million. (Round to two decimal places. Use a negative sign for a decrease in value.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning