Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

write full answer in all question

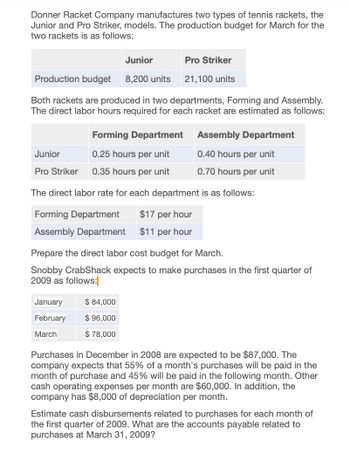

Transcribed Image Text:Donner Racket Company manufactures two types of tennis rackets, the

Junior and Pro Striker, models. The production budget for March for the

two rackets is as follows:

Junior

Pro Striker

Production budget 8,200 units

21,100 units

Both rackets are produced in two departments, Forming and Assembly.

The direct labor hours required for each racket are estimated as follows:

Forming Department

Assembly Department

Junior

0.25 hours per unit

0.40 hours per unit

Pro Striker

0.35 hours per unit

0.70 hours per unit

The direct labor rate for each department is as follows:

Forming Department

$17 per hour

Assembly Department $11 per hour

Prepare the direct labor cost budget for March.

Snobby CrabShack expects to make purchases in the first quarter of

2009 as follows:

January

$ 84,000

February

$ 96,000

March

$ 78,000

Purchases in December in 2008 are expected to be $87,000. The

company expects that 55% of a month's purchases will be paid in the

month of purchase and 45% will be paid in the following month. Other

cash operating expenses per month are $60,000. In addition, the

company has $8,000 of depreciation per month.

Estimate cash disbursements related to purchases for each month of

the first quarter of 2009. What are the accounts payable related to

purchases at March 31, 2009?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Krouse Company produces two products, forged putter heads and laminated putter heads, which are sold through specialty golf shops. The company is in the process of developing itsoperating budget for the coming year. Selected data regarding the companys two products areas follows: Manufacturing overhead is applied to units using direct labor hours. Variable manufacturing overhead Ls projected to be 25,000, and fixed manufacturing overhead is expected to be15,000. The estimated cost to produce one unit of the laminated putter head is: a. 42. b. 46. c. 52. d. 62.arrow_forwardUse the following information for Exercises 9-63 and 9-64: Palladium Inc. produces a variety of household cleaning products. Palladiums controller has developed standard costs for the following four overhead items: Next year, Palladium expects production to require 90,000 direct labor hours. Exercise 9-63 Flexible Budget for Various Levels of Activity Refer to the information for Palladium Inc. above. Required: 1. Prepare an overhead budget for the expected level of direct labor hours for the coming year. 2. Prepare an overhead budget that reflects production that is 15% higher than expected and for production that is 15% lower than expected.arrow_forwardCloud Shoes manufactures recovery sandals and is planning on producing 12.000 units in March and 11,500 in April. Each sandal requires 1.2 yards if material, which costs $3.00 per yard. The companys policy is to have enough material on hand to equal 15% of next months production needs and to maintain a finished goods inventory equal to 20% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forward

- Adam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forwardMultiple production department factory overhead rates The total factory overhead for Bardot Marine Company is budgeted for the year at 600,000 divided into two departments: Fabrication, 420,000, and Assembly, 180,000. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboats require 8 direct labor hours in Fabrication and 4 direct labor hours in Assembly. The bass boats require 4 direct labor hours in Fabrication and 8 direct labor hours in Assembly. Each product is budgeted for 250 units of production for the year. Determine (A) the total number of budgeted direct labor hours for the year in each department, (B) the departmental factory overhead rates for both departments, and (C) the factory overhead allocated per unit for each product using the department factory overhead allocation rates.arrow_forwardDouglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forward

- Sunrise Poles manufactures hiking poles and is planning on producing 4,000 units in March and 3,700 in April. Each pole requires a half pound of material, which costs $1.20 per pound. The companys policy is to have enough material on hand to equal 10% of the next months production needs and to maintain a finished goods inventory equal to 25% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forwardTIB makes custom guitars and prepared the following sales budget for the second quarter It also has this additional information related to its expenses: Direct material per unit $55, Direct labor per hour 20, Variable manufacturing overhead per hour 3.50, Fixed manufacturing overhead per month 3,000, Sales commissions per unit 20, Sales salaries per month 5,000, Delivery expense per unit 0.50, Utilities per month 4,000. Administrative salaries per month 20,000, Marketing expenses per month 8,000, Insurance expense per month 11,000, Depreciation expense per month 9,000. Prepare a sales and administrative expense budget for each month in the quarter ended June 30. 2018.arrow_forwardFirenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Previously, Sanjay Bhatt, Firenza Companys controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours. Sanjay has been asked to prepare bids for two jobs with the following information: The typical bid price includes a 40 percent markup over full manufacturing cost. Required: 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate? 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates? 3. Which bids are more accurate? Why?arrow_forward

- Jacson Company produces two brands of a popular pain medication: regular strength and extra strength. Regular strength is produced in tablet form, and extra strength is produced in capsule form. All direct materials needed for each batch are requisitioned at the start. The work orders for two batches of the products are shown below, along with some associated cost information: In the Mixing Department, conversion costs are applied on the basis of direct labor hours. Budgeted conversion costs for the department for the year were 60,000 for direct labor and 190,000 for overhead. Budgeted direct labor hours were 5,000. It takes one minute of labor time to mix the ingredients needed for a 100-unit bottle (for either product). In the Bottling Department, conversion costs are applied on the basis of machine hours. Budgeted conversion costs for the department for the year were 400,000. Budgeted machine hours were 20,000. It takes one-half minute of machine time to fill a bottle of 100 units. Required: 1. What are the conversion costs applied in the Mixing Department for each batch? The Bottling Department? 2. Calculate the cost per bottle for the regular and extra strength pain medications. 3. Prepare the journal entries that record the costs of the 12,000 regular strength batch as it moves through the various operations. 4. Suppose that the direct materials are requisitioned by each department as needed for a batch. For the 12,000 regular strength batch, direct materials are requisitioned for the Mixing and Bottling departments. Assume that the amount of cost is split evenly between the two departments. How will this change the journal entries made in Requirement 3?arrow_forwardActivity-based costing: factory overhead costs The total factory overhead for Bardot Marine Company is budgeted for the year at 600,000, divided into four activities: fabrication, 204,000; assembly, 105,000; setup, 156,000; and inspection, 135,000. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Each product is budgeted for 250 units of production for the year. Determine (A) the activity rates for each activity and (B) the activity-based factory overhead per unit for each product.arrow_forwardLens & Shades sells sunglasses for $37 each and is estimating sales of 21,000 units in January and 19,000 in February. Each lens consist of 2.00 mm of plastic costing $2.50 per mm, 1.7 oz of dye costing $2.80 per ounce. and 0.50 hours direct labor at a labor rate of $18 per unit. Desired inventory levels are: Prepare a sales budget, production budget, direct materials budget for silicon and solution, and a direct labor budget.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning