FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

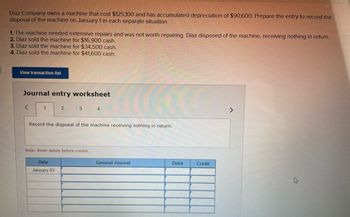

Transcribed Image Text:Diaz Company owns a machine that cost $125,100 and has accumulated depreciation of $90,600. Prepare the entry to record the

disposal of the machine on January 1 in each separate situation.

1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return.

2. Diaz sold the machine for $16,900 cash.

3. Diaz sold the machine for $34,500 cash.

4. Diaz sold the machine for $41,600 cash.

View transaction list

Journal entry worksheet

<

1

2

3

4

Record the disposal of the machine receiving nothing in return.

Note: Enter debits before credits.

General Journal

Debit

Date

January 01

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following are the transactions of Morrell Corporation: Morrell Corporation disposed of two computers at the end of their useful lives. The computers had cost $4,640 and their Accumulated Depreciation was $4,640. No residual value was received. Assume the same information as (a), except that Accumulated Depreciation, updated to the date of disposal, was $3,280. Prepare journal entries to record above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardDiaz Company owns a machine that cost $125,700 and has accumulated depreciation of $93,300. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $15,600 cash. 3. Diaz sold the machine for $32,400 cash. 4. Diaz sold the machine for $40,900 cash. View transaction list 1 Record the disposal of the machine receiving nothing in return. 2 Record the sale of the machine for $15,600 cash. 3 Record the sale of the machine for $32,400 cash. 4 Record the sale of the machine for $40,900 cash. Note : = = journal entry has been entered Record entry Clear entry X Credit View general journal >arrow_forwardHenry Oldham purchased the office building in which his CPA firm was housed in 1983 . Henny purchased the building for $225,000. Henry replaced the windows in the building and restructured the lay-out of the offices in the builing. His costs were $32,000 for the improvement. Henry is retiring and has just sold the buulding lor $495,000. Heny has claimed $55,000 in depreciation. Henry will have selling costs of $5,000. What is Henn's gain on the slie?arrow_forward

- Memanarrow_forward3arrow_forwardDiaz Company owns machine that cost $126,300 and has accumulated depreciation of $93,000. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $16,600 cash. 3. Diaz sold the machine for $33,300 cash. 4. Diaz sold the machine for $40,400 cash. View transaction list Journal entry worksheet 1 2 Record the disposal of the machine receiving nothing in return. Date January 01 3 4 Note: Enter debits before credits. Record entry General Journal Clear entry Debit Credit View general Journal >arrow_forward

- Please don't give image formatarrow_forwardLowes Corporation sold its storage building for $86,000 cash. Lowes originally purchased the building for $200,000, and depreciation through the date of sale totaled $120,000. Required:Prepare the journal entry to record the sale of this building. (A separate calculation of any gain or loss is recommended.)arrow_forwardSalem Amusement Park paid $400,000 for a concession stand. Salem started out depreciating the building using the straight-line method over 20 years with a residual value of zero. After using the concession stand for four years, Salem determines that the building will remain useful for only four more years. Record Salem's depreciation on the concession stand for year five using the straight-line method. (Record debits first, then credits. Exclude explanations from any journal entries.) Date Journal Entry Accounts Debit Creditarrow_forward

- Robertson Company exchanged a machine for some land. The machine had cost $17,000, was 70% depreciated, and could be sold for $4,500. Robertson paid $950 in addition to giving up the machine. compute the amount at which the land should be recorded.arrow_forwardJake parchased a $235,000 crane for his constraction business. He sold the crane for $175,000 after taking $115,000 of depreciation. Assume take is What is the amount of gain or loss on the sale?arrow_forwardCottrell incurred the following costs related to its office building. You can assume all costs were paid in cash. (You do not need to record any depreciation related to the office building.) Installed a second air conditioner because it was determined that one air conditioning unit could not sufficiently cool the building, $7,000. Repaired and painted wall damage, $800. Replaced the building roof which was estimated to have a remaining life of less than 5 years, $37,000. The new metal roof should last a minimum of 25 years. Paid property taxes, $9,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education