FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

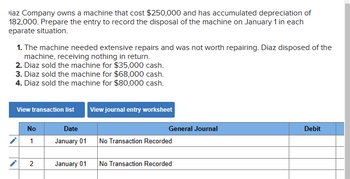

Transcribed Image Text:iaz Company owns a machine that cost $250,000 and has accumulated depreciation of

182,000. Prepare the entry to record the disposal of the machine on January 1 in each

eparate situation.

1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the

machine, receiving nothing in return.

2. Diaz sold the machine for $35,000 cash.

3. Diaz sold the machine for $68,000 cash.

4. Diaz sold the machine for $80,000 cash.

View transaction list View journal entry worksheet

No

1

2

Date

January 01

January 01

General Journal

No Transaction Recorded

No Transaction Recorded

Debit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Diaz Company owns a machine that cost $125,700 and has accumulated depreciation of $93,300. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $15,600 cash. 3. Diaz sold the machine for $32,400 cash. 4. Diaz sold the machine for $40,900 cash. View transaction list 1 Record the disposal of the machine receiving nothing in return. 2 Record the sale of the machine for $15,600 cash. 3 Record the sale of the machine for $32,400 cash. 4 Record the sale of the machine for $40,900 cash. Note : = = journal entry has been entered Record entry Clear entry X Credit View general journal >arrow_forwardPLEASE DO ALL REQUIREMENTS WITH WORKING More info 1. On February 1, Braun sold the vehicles to Direct Produce, Inc. for$20,000. 2. On March 31, all of Braun's equipment and machinery was destroyed by a fire in one of its facilities. 3. On May 1, the equipment was replaced at a cost of$570,000and the machinery cost the company$318,400to replace. The estimated useful lives and residual values remained the same as specified for the original machinery and equipment. The company paid cash for the new assets.arrow_forwardHenry Oldham purchased the office building in which his CPA firm was housed in 1983 . Henny purchased the building for $225,000. Henry replaced the windows in the building and restructured the lay-out of the offices in the builing. His costs were $32,000 for the improvement. Henry is retiring and has just sold the buulding lor $495,000. Heny has claimed $55,000 in depreciation. Henry will have selling costs of $5,000. What is Henn's gain on the slie?arrow_forward

- Memanarrow_forward3arrow_forwardDiaz Company owns machine that cost $126,300 and has accumulated depreciation of $93,000. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $16,600 cash. 3. Diaz sold the machine for $33,300 cash. 4. Diaz sold the machine for $40,400 cash. View transaction list Journal entry worksheet 1 2 Record the disposal of the machine receiving nothing in return. Date January 01 3 4 Note: Enter debits before credits. Record entry General Journal Clear entry Debit Credit View general Journal >arrow_forward

- The following cases are independent. Case A Starling Ltd. bought a building for $1,330,000. Before using the building, the following expenditures were made: Repair and renovation of building Construction of new paved driveway Upgraded landscaping Wiring Deposits with utilities for connections Sign for front and back of building, attached to roof Installation of fence around property Case B Lark Company purchased a $33,400 tract of land for a new manufacturing facility. Lark demolished an old building on the property and sold the materials it salvaged from the demolition. Lark incurred additional costs and realized salvage proceeds as follows: Demolition of old building Routine maintenance (mowing) done on purchase Proceeds from sale of salvaged materials Legal fees Title guarantee insurance $129,000 35,800 4,750 16,700 2,775 17,450 14,750 $ 33,150 2,775 13,450 10,950 6,425arrow_forwardSalem Amusement Park paid $400,000 for a concession stand. Salem started out depreciating the building using the straight-line method over 20 years with a residual value of zero. After using the concession stand for four years, Salem determines that the building will remain useful for only four more years. Record Salem's depreciation on the concession stand for year five using the straight-line method. (Record debits first, then credits. Exclude explanations from any journal entries.) Date Journal Entry Accounts Debit Creditarrow_forwardRobertson Company exchanged a machine for some land. The machine had cost $17,000, was 70% depreciated, and could be sold for $4,500. Robertson paid $950 in addition to giving up the machine. compute the amount at which the land should be recorded.arrow_forward

- Jake parchased a $235,000 crane for his constraction business. He sold the crane for $175,000 after taking $115,000 of depreciation. Assume take is What is the amount of gain or loss on the sale?arrow_forwardOn May 1, 2017 Merron Inc. sold a machine that it no longer had any use for. Merron sold the machine for $2,000 cash. The original cost of the machine was $32,000 and at December 31, 2016 the accumulated depreciation on the machine was $26,000. The machine had an original useful life of 10 years with zero estimated residual value. Merron uses the straight-line method to depreciate all of their machines. Required: Prepare the journal entries required for this transaction.arrow_forwardCompany management decided to discard a machine. The machine cost $ 125,000, had accumulated depreciation of $ 125,000, and was scrapped as junk. The machine was depreciated on a straight-line basis, with a useful life of 5 years, and a $10,000 salvage value. What journal entry is required to record the disposal of this machine?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education