FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

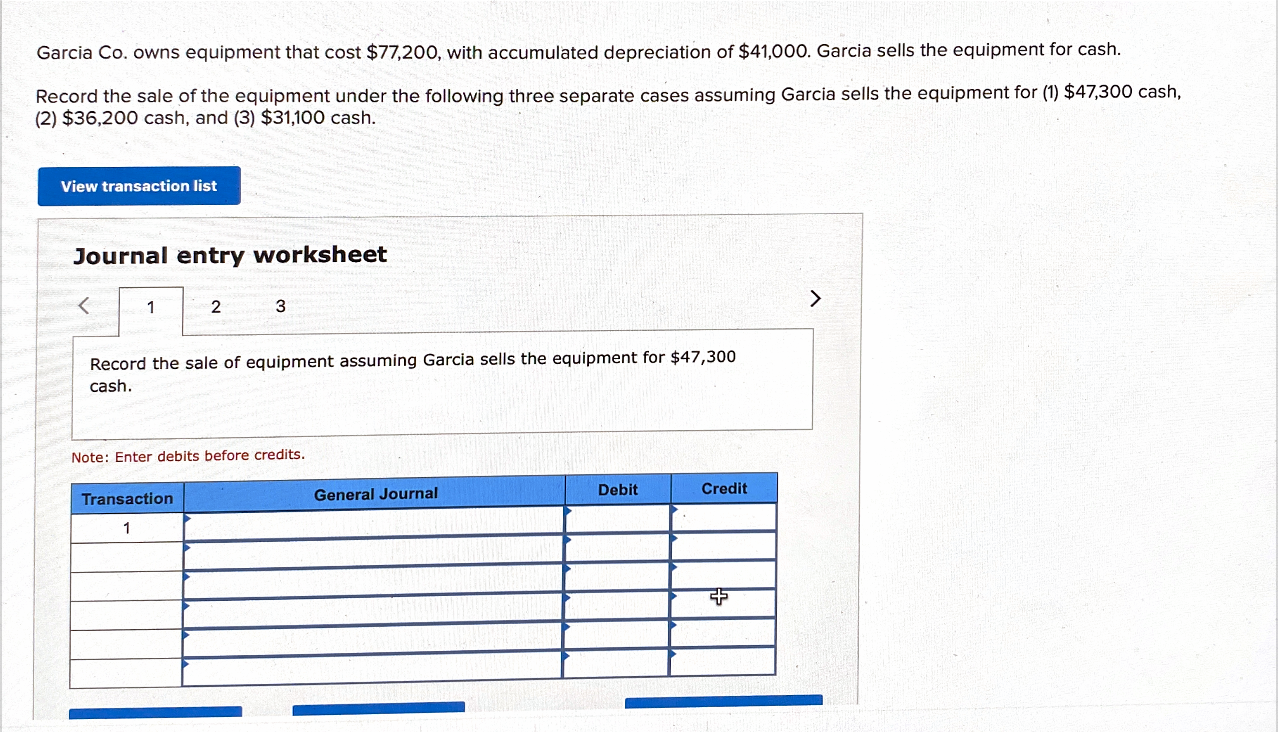

Transcribed Image Text:Garcia Co. owns equipment that cost $77,200, with accumulated depreciation of $41,000. Garcia sells the equipment for cash.

Record the sale of the equipment under the following three separate cases assuming Garcia sells the equipment for (1) $47,300 cash,

(2) $36,200 cash, and (3) $31,100 cash.

View transaction list

Journal entry worksheet

<>

3

Record the sale of equipment assuming Garcia sells the equipment for $47,300

cash.

Note: Enter debits before credits.

General Journal

Debit

Credit

Transaction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Company Inc., exchanged land and cash of $8,000 for equipment. The land was purchased at $55,000 a few years ago and a fair value of $60,000. Prepare the journal entry to record the exchange. Assume the exchange has no commercial substance.arrow_forwardjlp.3arrow_forwardChina Inn and Midwest Chicken exchanged assets. Midwest Chicken received restaurant equipment and gave delivery equipment. The fair value and book value of the delivery equipment given were $28,600 and $31,400 (original cost of $35,400 less accumulated depreciation of $4,000), respectively. To equalize market values of the exchanged assets, Midwest Chicken received $8,600 in cash from China Inn. Record the gain or loss for Midwest Chicken on the exchange of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the gain or loss for Midwest Chicken on the exchange of the equipment. Note: Enter debits before credits. Transaction 1 General Journal Debit Creditarrow_forward

- Lowes Corporation sold its storage building for $86,000 cash. Lowes originally purchased the building for $200,000, and depreciation through the date of sale totaled $120,000. Required:Prepare the journal entry to record the sale of this building. (A separate calculation of any gain or loss is recommended.)arrow_forwardChina Inn and Midwest Chicken exchanged assets. Midwest Chicken received restaurant equipment and gave delivery equipment. The fair value and book value of the delivery equipment given were $25,000 and $28,000 (original cost of $33,000 less accumulated depreciation of $5,000), respectively. To equalize market values of the exchanged assets, Midwest Chicken received $8,000 in cash from China Inn. Record the gain or loss for Midwest Chicken on the exchange of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardCase A. Kapono Farms exchanged an old tractor for a newer model. The old tractor had a book value of $16,500 (original cost of $37,000 less accumulated depreciation of $20,500) and a fair value of $9,900. Kapono paid $29,000 cash to complete the exchange. The exchange has commercial substance. Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $545,000 and a fair value of $790,000. Kapono paid $59,000 cash to complete the exchange. The exchange has commercial substance. Required: What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the fair value of the farmland given is $436,000 instead of $790,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the same facts as Requirement 1 and that the exchange lacked commercial substance. What is the amount of gain or loss that…arrow_forward

- Ronny’s Red Hat Company purchased machinery on August 3, Year 1 for $150,000. Ronny, the owner, estimated that the machinery would be sold for $30,000 in 10 years. If Ronny’s red Hat Company uses straight line depreciation, what is included in the entry to record the disposition of the asset on July 31, Year 3 if the machinery is sold for $120,000 cash? Multiple Choice Dr. Loss on disposition $6,000 Cr. Gain on disposition $4,000 Dr. loss on disposition $4,000 Cannot be determined with the data provided Dr. Loss on disposition $2,500arrow_forwardGarcia Company owns equipment that cost $78,400, with accumulated depreciation of $41,600. Record the sale of the equipment under the following three separate cases assuming Garcia sells the equipment for (1) $48,200 cash, (2) $36,800 cash, and (3) $31,700 cash.arrow_forwardGarcla Co. owns equlipment that cost $77,600, with accumulated depreclation of $41.200. Record the sale of the equipment under the following three separate cases assuming Garcla sells the equipment for (1) $47,600 cash. (2) $36,400 cash, and (3) $31.,300 cash. Vlew transaction Ilat Journal entry worksheet A Record the sale of equipment assuming Garcia sells the equipment for $47,600 cash. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry Vlew general journalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education