FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

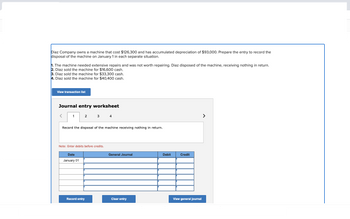

Transcribed Image Text:**Diaz Company Machine Disposal Accounting**

Diaz Company owns a machine that initially cost $126,300 and has accumulated depreciation of $93,000. To accurately record the disposal of this machine on January 1, we must consider each situation separately.

1. **Scenario 1:** The machine required extensive repairs and was deemed not worth repairing. Consequently, Diaz disposed of the machine without receiving anything in return.

2. **Scenario 2:** Diaz sold the machine for $16,600 in cash.

3. **Scenario 3:** Diaz sold the machine for $33,300 in cash.

4. **Scenario 4:** Diaz sold the machine for $40,400 in cash.

### Journal Entry Worksheet

- **Tabs:** The worksheet includes four tabs to record each scenario separately.

- **Instructions:** Record the disposal of the machine according to each scenario. Ensure that debits are entered before credits, as noted below the entry fields.

### Journal Entry Interface

- **Date Field:** The default date provided is January 01.

- **General Journal Columns:** There are columns to enter the description, debit, and credit amounts.

- **Buttons:**

- "Record entry" allows saving the current entry.

- "Clear entry" deletes input in the form.

- "View general journal" displays all recorded entries.

Use this worksheet as a practical exercise in handling asset disposals under different financial outcomes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- helparrow_forward3arrow_forwardTerry purchased a machine for $15,000; the seller is holding the note. Terry paid $2,500 for the required wiring and installation. Terry has deducted depreciation on the machine for 3 years totaling $4,500. Terry owes $5,000 to the Seller. What is Terry’s adjusted basis in the machine? $10,500 $8,000 $13,000 $5,500arrow_forward

- Timmy paid $800,000 cash for all of the assets of Bob’s Chicken Fried Steak Shack, Inc. (Bob’s). Timmy did not buy the stock of Bob’s; rather he bought all of Bob’s assets from Bob’s. Here is a list of the physical assets that Timmy got for his $800,000, showing the stand-alone FMV of each category:*** Land & Building, $350,000 Furniture & Equipment, $160,000 Inventory, $15,000 Bob’s latest property tax appraisal from Dallas County showed the land value at $150,000, the building at $100,000, the furniture and equipment at $75,000. What is Timmy’s depreciable basis in the building? What is Timmy’s depreciable basis in the furniture and equipment? What amount will Timmy eventually record as COGS with respect to the purchased inventory? How much, if any, goodwill did Timmy purchase? Address each item separately. (Each part must be correctly answered to earn a point for this item (3).) *** These FMVs are as agreed and stated in the negotiated Purchase Agreement.arrow_forwardLinda purchased two cars in 2018. A vintage Thunderbird for $72,000 and a Honda Accord for $29,000. Both cars were used solely for personal purposes. During the current year, she sold the Thunderbird for $85,000 and the Honda for $25,000. How much gain or loss will she report for these two transactions? A. $9,000 gain B. $4,000 loss C. No gain or loss D. $13,000 gainarrow_forwardMelody (single) had her home by the state condemned department of transportation. Her basis in the house was $200,000. She received a net condemnation award of $500,000. Rather than replace the property, Melody decided to rent an apartment. Melody had owned the home and used it as her main home for the ten years prior to the condemnation. How much gain does Melody report from the sale? a. $0 b.$50,000 c.$250,000 d.$300,000arrow_forward

- Igor owns a rental house and had to paint the living room, kitchen and bathroom after the most recent tenant moved out. The rooms had not been painted in the last five years and he worried he would not be able to rent it out to another tenant at the current fair market value if he didn’t repaint. The cost to repaint the three rooms was $1,500 ($1,000 labor and $500 paint). What amount, if any, can Igor deduct of this expense and on what form should it be listed?arrow_forwardNonearrow_forwardLast year, Jose and Josefina Munoz bought a home with a dwelling replacement value of $250,000 and insured it (via an HO-5 policy) for $225,000. The policy reimburses actual cash value and has a $500 deductible, standard limits for coverage C items, and no scheduled property. Recently, burglars broke into the house and stole a new computer with a current replacement value of $1,500 and an estimated useful life of three years. They also took jewelry valued at $2,500 and a coin collection valued at $1,500. If the Munozs’ policy has a 90 percent co-insurance clause, do they have enough insurance? Assuming a 50 percent coverage C limit, calculate how much the Munoz family would receive if they filed a claim for the stolen items. What advice would you give the Munoz family about their homeowner’s coverage?arrow_forward

- Blossom Inc. recently replaced a piece of automatic equipment at a net price of $3,500, f.o.b. factory. The replacement was necessary because one of Blossom’s employees had accidentally backed his truck into Blossom’s original equipment and made it inoperable. Because of the accident, the equipment had no resale value to anyone and had to be scrapped. Blossom’s insurance policy provided for a replacement of its equipment and paid the price of the new equipment directly to the new equipment manufacturer, minus the deductible amount paid to the manufacturer by Blossom. The $3,500 that Blossom paid was the amount of the deductible that it has to pay on any single claim on its insurance policy. The new equipment represents the same value in use to Blossom. The used equipment had originally cost $64,000. It had a book value of $45,000 at the time of the accident and a second-hand market value of $50,000 before the accident, based on recent transactions involving similar equipment. Freight…arrow_forwardAmelia’s business goes bankrupt this year. To close her business, Amelia starts by selling off her business assets. Below are the asset disposition transactions: Assets Purchased Date Cost Sold date Sold price Delivery car 5/1/23 30k 12/31/23 25k Furniture 3/20/20 40k 12/31/23 20k Equipment 4/1/20 110k 12/31/23 100k Land 1/1/22 150k 12/31/23 180k Assume there is no Section 179 and bonus depreciation. Use MACRS only for depreciation. Show detailed calculation and explanation a) Calculate total accumulated depreciation of each asset until the sold date (12/31/23). b) Calculate the adjusted basis for each asset c) Calculate the gain/loss for each asset d) Point out the exact character of gain/loss for each asset gain/loss (ex: Ordinary, pure 1231, 1245, 1250, etc.) e) Calculate the Net 1231 Gain/Loss Hint: Be aware of 1245 Depreciation recapture and 1231 lookback rules Hint: Review textbook chapter on this. In the year of disposition, under half-year convention, only ½ of MACRS…arrow_forwardH6. Denver Inc. has an old computer system. The computer originally costs Denver $90,000 and its current book value is $35,000. Answer the following questions: Do not use the account name of book value. There is no such account name as book value in accounting* 1) What is accumulated depreciation on the Denver's computer? 2) Journal entry if Denver discards the computer (for nothing). 3) Journal entry if Denver sells the computer for $90,000. Show proper calculationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education