FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

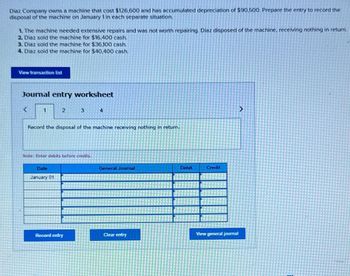

Transcribed Image Text:Diaz Company owns a machine that cost $126,600 and has accumulated depreciation of $90,500. Prepare the entry to record the

disposal of the machine on January 1 in each separate situation.

1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return.

2. Diaz sold the machine for $16,400 cash.

3. Diaz sold the machine for $36,100 cash.

4. Diaz sold the machine for $40,400 cash.

View transaction list

Journal entry worksheet

2

3

4

Record the disposal of the machine receiving nothing in return.

Note: Enter debits before credits.

Date

January 01

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduce to journal entry

VIEW Step 2: Working for book value of machine at the time of sale

VIEW Step 3: Working for gain or loss on sale of machine for case #1

VIEW Step 4: Working for gain or loss on sale of machine for case #2

VIEW Step 5: Working for gain or loss on sale of machine for case #3

VIEW Step 6: Working for gain or loss on sale of machine for case #4

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Henry Oldham purchased the office building in which his CPA firm was housed in 1983 . Henny purchased the building for $225,000. Henry replaced the windows in the building and restructured the lay-out of the offices in the builing. His costs were $32,000 for the improvement. Henry is retiring and has just sold the buulding lor $495,000. Heny has claimed $55,000 in depreciation. Henry will have selling costs of $5,000. What is Henn's gain on the slie?arrow_forward3arrow_forwardCrammer Corporation purchased a machine for $20,000 with no salvage value and a life of 4 years. What is the book value of the machine at the end of year 4?arrow_forward

- Terry purchased a machine for $15,000; the seller is holding the note. Terry paid $2,500 for the required wiring and installation. Terry has deducted depreciation on the machine for 3 years totaling $4,500. Terry owes $5,000 to the Seller. What is Terry’s adjusted basis in the machine? $10,500 $8,000 $13,000 $5,500arrow_forwardHauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $102,000, and it has claimed $ 33,800 of depreciation expense against the building. Required Assuming that Hauswirth receives $80, 500 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. Assuming that Hauswirth exchanges the warehouse in a like kind exchange for some land with a fair market value of $80, 500, compute Hauswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. Assuming that Hauswirth receives $27,500 in cash in year 0 and a S 88,500 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year 0 and in year 1.arrow_forwardGodo Farhana purchased a new stove for $600 and placed it in service in her rental house in June 2018. No special depreciation allowance was claimed. Farhana sold the rental house, including the stove, in October 2021. Her adjusted basis including depreciation on the stove at the time of sale was $139. The stove was included in the sale, but the statement specified a price of $375, leaving a $236 gain. Under what section of the Internal Revenue Code will that gain fall?arrow_forward

- Warren Enterprises purchased a van for $21,510. The van has a salvage value of $3,800, and an estimated useful life of eight years. Warren plans to use the straight line method of depreciation. The accumulated depreciation at the end of year 3 would be $___ Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardNew Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $500,000. The ovens originally cost $690,000, had an estimated service life of 10 years, had an estimated residual value of $40,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Problem 7-8A Part 4 4. Record the sale of the ovens at the end of the second year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardDiaz Company owns a machine that cost $125,400 and has accumulated depreciation of $92,500. Prepare the entry to record the disposal of the machine on January 1 in each seperate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $16,300 cash. 3. Diaz sold the machine for $32,900 cash. 4. Diaz sold the machine for $40,400 cash. View transaction list Journal entry worksheet 3 Record the sale of the machine for $40,400 cash. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Record entry Clear entry View general journalarrow_forward

- Bateman Corporation sold an office building that it used in its business for $800,850. Bateman bought the building ten years ago for $599,575 and has claimed $201,275 of depreciation expense. What is the amount and character of Bateman's gain or loss?arrow_forwardTerry purchased a machine for $15,000; the seller is holding the note. Terry paid $2,500 for the required wiring and installation. Terry has deducted depreciation on the machine for 3 years totaling $4,500. Terry owes $5,000 to the Seller. What is Terry’s adjusted basis in the machine? Group of answer choicesarrow_forwardJake parchased a $235,000 crane for his constraction business. He sold the crane for $175,000 after taking $115,000 of depreciation. Assume take is What is the amount of gain or loss on the sale?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education