FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

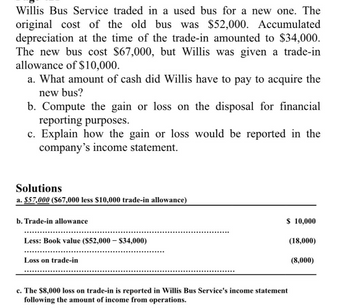

Transcribed Image Text:Willis Bus Service traded in a used bus for a new one. The

original cost of the old bus was $52,000. Accumulated

depreciation at the time of the trade-in amounted to $34,000.

The new bus cost $67,000, but Willis was given a trade-in

allowance of $10,000.

a. What amount of cash did Willis have to pay to acquire the

new bus?

b. Compute the gain or loss on the disposal for financial

reporting purposes.

c. Explain how the gain or loss would be reported in the

company's income statement.

Solutions

a. $57,000 ($67,000 less $10,000 trade-in allowance)

b. Trade-in allowance

Less: Book value ($52,000 - $34,000)

Loss on trade-in

$ 10,000

c. The $8,000 loss on trade-in is reported in Willis Bus Service's income statement

following the amount of income from operations.

(18,000)

(8,000)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The Bomb Pop Corporation sold ice cream equipment for $18,500. The equipment was originally purchased for $40,000, and depreciation through the date of sale totaled $25,000. 1. What was the gain or loss on the sale of the equipment? on salearrow_forwardSage Hill Inc. owns equipment that cost $594,000 and has accumulated depreciation of $154,000. The expected future net cash flows from the use of the asset are expected to be $392,000. The fair value of the equipment is $339,000. Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardPeak, Inc., acquired a machine that involved the following expenditures and related factors: Gross invoice price Sales tax Cash discount taken Freight Assembly of machine Installation of machine Repair of machine damage caused during installation Tuning and adjusting machine before use A) $68,352 The initial accounting cost of the machine should be: B) $63,232 C) $56,032 $54,400 3,520 1,088 1,920 1,600 2,400 5,120 D) $64,032 1,280arrow_forward

- Gadubhaiarrow_forwardA company recently traded in an older model of equipment for a new model. The old model's book value was $216,000 (original cost of $476,000 less $260,000 in accumulated depreciation) and its fair value was $240,000. The company paid $64,000 to complete the exchange which has commercial substance. Required: Prepare the journal entry to record the exchange. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forward1arrow_forward

- Rain Company traded a manual weather machine for an automated weather machine and gave $40,000 cash. The manual machine cost $495,000, had a net book value of $350,000, and a fair value of $360,000. The automated machine was originally purchased by Shine Company for $510,000 and had a net book value of $430,000. It has a fair market value of $450,000. Determine the value of the asset received for Rain and Shine assuming the exchange does not have commercial substance. Please include the appropriate dollar sign and commas (example $25,000).arrow_forwardHadley Company purchased an asset with a list price of $135580. Hadley paid $413 of transportation-in cost, $968 to train an employee to operate the equipment, and $637 to insure the asset against theft after it has been set up in the factory. The asset was purchased under terms 2/20/n30 and Hadley paid for the asset within the discount period. Based on this information, Hadley would capitalize the asset on its books at what dollar amount? $_______________arrow_forwardNgu own equipment that cost 96,500 with accumulated depreciation of 66,000. Ngu asks 35,750 for the equipment but sells it for 33,500. Compute the amount of gains or losses on the salearrow_forward

- Shamrock Inc. owns equipment that cost $605,000 and has accumulated depreciation of $157,000. The expected future net cash flows from the use of the asset are expected to be $400,000. The fair value of the equipment is $346,000. Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardWindsor Company owns equipment that cost $972,000 and has accumulated depreciation of $410,400. The expected future net cash flows from the use of the asset are expected to be $540,000. The fair value of the equipment is $432,000.Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amountarrow_forwardNovak Corp., a small company that follows ASPE, owns machinery that cost $925,000 and has accumulated depreciation of $385,000. The undiscounted future net cash flows from the use of the asset are expected to be $513,000. The equipment's fair value is $440,000. Using the cost recovery impairment model, prepare the journal entry, if any, to record the impairment loss. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education