FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

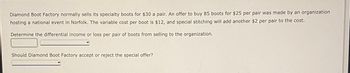

Transcribed Image Text:Diamond Boot Factory normally sells its specialty boots for $30 a pair. An offer to buy 85 boots for $25 per pair was made by an organization

hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost.

Determine the differential income or loss per pair of boots from selling to the organization.

Should Diamond Boot Factory accept or reject the special offer?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Leo Consulting enters into a contract with Highgate University to restructure Highgate's processes for purchasing goods from suppliers. The contract states that Leo will earn a fixed fee of $80,000 and earn an additional $16,000 if Highgate achieves $160,000 of cost savings. Leo estimates a 50% chance that Highgate will achieve $160,000 of cost savings. Assuming that Leo determines the transaction price as the expected value of expected consideration, what transaction price will Leo estimate for this contract? Transaction price for the contractarrow_forwardDiamond Boot Factory normally sells its specialty boots for $35 a pair. An offer to buy 125 boots for $31 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organizatioarrow_forwardA company inadvertently produced 3,000 defective MP3 players. The players cost $12 each to produce. A recycler offers to purchase the defective players as they are for $8 each. The production manager reports that the defects can be corrected for $10 each, enabling them to be sold at their regular market price of $19 each. The company should a. Correct the defect and sell them at the regular price. b. Sell the players to the recycler for $8 each. c. Sell 2,000 to the recycler and repair the rest. d. Sell 1,000 to the recycler and repair the rest. e. Throw the players away.arrow_forward

- Provide answerarrow_forward* Your answer is incorrect. Crane Company sells 302 units of its products for $20 each to John Inc. for cash. Crane allows John to return any unused product within 30 days and receive a full refund. The cost of each product is $13. To determine the transaction price, Crane decides that the approach that is most predictive of the amount of consideration to which it will be entitled is the probability-weighted amount. Using the probability-weighted amount, Crane estimates that (1) 9 products will be returned and (2) the returned products are expected to be resold at a profit. (a) Indicate the amount of net sales. Net sales $ (b) Indicate the amount of estimated liability for refunds. Liability for refunds $ Cost of goods sold 5869 (c) Indicate the amount of cost of goods sold that Crane should report in its financial statements Lassume that none of the products fave been returned at the financial statement date) 5 eTextbook and Media 171 Q Search 3913 (7arrow_forwardLeo Consulting enters into a contract with Highgate University to restructure Highgate’s processes for purchasing goods from suppliers. The contract states that Leo will earn a fixed fee of $66,000 and earn an additional $13,000 if Highgate achieves $130,000 of cost savings. Leo estimates a 70% chance that Highgate will achieve $130,000 of cost savings. Assuming that Leo determines the transaction price as the expected value of expected consideration, what transaction price will Leo estimate for this contract? Transaction price for the contract ?arrow_forward

- The company produces and sells athletic shoes for children. The costs associated with each pair of shoes are estimated to be $14 of variable costs and $5 of fixed costs. The shoes normally sell for $35 per pair. A local children’s athletic league has offered to buy 100 pairs of shoes for $19 each. The company has excess capacity. How much additional revenue would be earned if they accept the offer?arrow_forwardAnnie B's Homemade Ice Cream is an ice cream shop in Asheville, NC. Annie's Homemade currently owns one push cart along with a branded tent to facilitate off-site sales. The company is considering buying a second push cart and tent for $4,500 to expand its off- site sales opportunities. Because the company's cargo trailer has the capacity to transport two push carts, there is no need to buy an additional trailer at this time. Annie's provided the following estimates to assist with analyzing the investment in an additional push cart: Additional sales events per month (in June, July, August, and September) Average number of servings sold per event Selling price per serving Ingredients and packaging cost per serving Average time for manager to make one batch of 100 servings of ice cream Average time for employees to pre-package one serving of ice cream Pickup truck diesel fuel, oil, and diesel exhaust fluid expenses Average duration of each event (including drive time) Average number of…arrow_forwardThe cost of introducing the products in selected geographic areas for gauging consumer response is $150K. If the company decides to introduce the product this way, it would need to see the responses to the products before they decide to launch the product line nationally. The probability of a favorable response in the selected geographical areas is estimated at O.60. La Comida can also decide not to go for the launching in the product in selected geographical areas and go ahead with the nationwide launch or not. If La Comida Foods decides to go full-blast in launching the products nationally and are a success, the company estimates that they will gain an annual income of $1.6 million. If the products are not a hit, the company will realize losses to the tune of $700K. La Comida estimates the probability of success for the sauces and marinades to be 0.50, if these are introduced without gauging consumer response.arrow_forward

- Diamond Boot Factory normally sells its specialty boots for $34 a pair. An offer to buy 85 boots for $30 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost Determine the differential income or loss per pair of boots from selling to the organization. Should Diamond Boot Factory accept or reject the special offer?arrow_forwardAnnie's Homemade currently owns one push cart along with a branded tent to facilitate off-site sales. The company is considering buying a second push cart and tent for $4,500 to expand its off-site sales opportunities. Because the company's cargo trailer has the capacity to transport two push carts, there is no need to buy an additional trailer at this time. Annie's provided the following estimates to assist with analyzing the investment in an additional push cart: Additional sales events per month (in June, July, August, and September) Average number of servings sold per event Selling price per serving Ingredients and packaging cost per serving Average time for manager to make one batch of 100 servings of ice cream Average time for employees to pre-package one serving of ice cream Pickup truck diesel fuel, oil, and diesel exhaust fluid expenses Average duration of each event (including drive time) Average number of employees working at each event Hourly wage rate for managers Hourly…arrow_forwardAt Blossom Electronics, it costs $33 per unit ($15 variable and $18 fixed) to make an MP3 player that normally sells for $54. A foreign wholesaler offers to buy 4,520 units at $26 each. Blossom Electronics will incur special shipping costs of $1 per unit. Assuming that Blossom Electronics has excess operating capacity, indicate the net income (loss) Blossom Electronics would realize by accepting the special order. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses eg. (45).) Revenues Costs-Variable manufacturing Shipping Net income The special order should be Reject Order $ $ Accept Order Net Income Increase (Decrease) $ $ $ $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education