FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

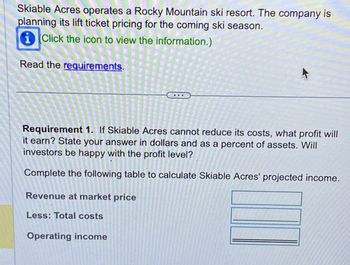

Transcribed Image Text:Skiable Acres operates a Rocky Mountain ski resort. The company is

planning its lift ticket pricing for the coming ski season.

Click the icon to view the information.)

Read the requirements.

Requirement 1. If Skiable Acres cannot reduce its costs, what profit will

it earn? State your answer in dollars and as a percent of assets. Will

investors be happy with the profit level?

Complete the following table to calculate Skiable Acres' projected income.

Revenue at market price

Less: Total costs

Operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rerun the NPV analysis for Helen. Did she correctly determine a positive NPV related to her investment for this 8 year period? State the NPV amount. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardWarm and Dry is considering adding a new line of winter footwear to its product lineup. Which of the following are relevant cash flows for this project?I. Decreased revenue from products currently being offered if this new footwear is added to the lineupII. Revenue from the new line of footwearIII. Money spent to date looking for a new product line to add to the store's offeringsIV. Cost of new counters to display the new line of footwear a) I and IV only b) II and IV only c) II and III only d) I, II, and IV only e) II, III, and IV onlyarrow_forwardHighland holidays operates a holiday part, letting small log cabin on short lets. Which action would to be considered as the efficient management of the asset conversion cycle? a. Increasing the rental price for each unit b. Negotiating lower costs with key suppliers C. Improving the occupancy rate, getting more nights of rental income for each cabin. d. Improving the payment term with supplier.arrow_forward

- A coat manufacturer wants to build a large factory or a small factory. The profit per coat is estimated as $12. Per year, a small factory's cost is $200,000, with a production capacity of 50,000 coats and a large factory's cost is $450,000, with a production capacity of 100,000 coats. The four levels of manufacturing demand that are considered likely are 30,000, 40,000, 50,000, and 100,000 coats per year. Complete parts (a) through (e). a. Determine the payoffs for the possible levels of production for a small factory. Manufacturing demand (coats per year) Payoff ($) 30,000 40,000 50,000 100,000 (Simplify your answers.)arrow_forwardLamphere Lawn Care provides lawn and gardening services. The price of the service is fixed at a flat rate for each service, and most costs of providing the service are the same, given the similarity in the lawns and lots. The owner budgets income by estimating two factors that fluctuate with the economy: the contribution margin associated with each service call and the number of customers who will request lawn service. Looking at next year, the owner develops the following estimates of contribution margin (price less variable cost of the service, including labor) and the estimated number of service calls. Although the owner understands that it is not strictly true, the owner assumes that the cost of fuel and the number of customers are independent. Contribution Margin per Service Call (Price - Scenario Excellent Fair Poor Excellent Fair Poor Excellent In addition to the variable costs of service, the owner estimates that other costs are $49,000 plus $8 for each service call in excess…arrow_forwardPlease dont copy from chegg. Show work and formulas, pleasearrow_forward

- Air Americo is about to introduce a daily round-trip flight from New York to Los Angeles and is determining how to price its round-trip tickets. The market research group at Air Americo segments the market into business and pleasure travelers. It provides the following information on the effects of two different prices on the number of seats expected to be sold and the variable cost per ticket, including the commission paid to travel agents: Price Charged Variable Costs per Ticket # of Seats Expected to be Sold Business Pleasure 800 2,100 75 300 150 185 285 30 Pleasure travelers start their travel during one week, spend at least I weekend at their destination, and return the following week or thereafter. Business travelers usually start and complete their travel within the same workweek. They do not stay over weekends. Assume that round-trip fuel costs are fixed costs of $24,500 and that fixed costs allocated to the round-trip flight for airplane-lease costs, ground services, and…arrow_forwardPlease Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Pleasearrow_forward(Related to Checkpoint 13.4) (Using break-even analysis) Mayborn Enterprises, LLC runs a number of sporting goods businesses and is currently analyzing a new T-shirt printing business. Specifically, the company is evaluating the feasibility of this business based on its estimates of the unit sales, price per unit, variable cost per unit, and fixed costs. The company's initial estimates of annual sales and other critical variables are shown here: a. Calculate the accounting and cash break-even annual sales volume in units. b. Bill Mayborn is the grandson of the founder of the company and is currently enrolled in his junior year at the local state university. After reviewing the accounting break-even calculation done in part a, Bill wondered if the depreciation expense should be included in the calculation. Bill had just completed his first finance class and was well aware that depreciation is not an actual out-of-pocket expense but rather an allocation of the cost of the printing…arrow_forward

- Conrad Coding Institute (CCI) offers online courses in coding. One of CCI's most popular courses is the introductory course that teaches basic coding skills. CCI prices this course aggressively, because of the potential for creating demand for the more advanced (and more profitable) courses. The Introductory coding course has the following price and cost characteristics: Tuition Variable costs (instruction, support, and so on) Fixed costs (advertising, salaries, and so on) Required: 4. Suppose that fixed costs for the year are 15 percent lower than projected, whereas variable costs per swuent are 15 percent higher than projected. What would be the operating profit/loss for the Introductory coding course for the year? Complete this question by entering your answers in the tabs below. Req A Req B Operating profit Req C1 Req C2 $ 65 per student 40 per student 180,000 per year Req C3 Show lessarrow_forwardExplain why proponents of LIFO argue that it provides a better match of revenue and expenses. In what situations would it not provide a better match? Be specific. The management of the Esquire Oil Company believes that the wholesale price of heating oil that they sell to homeowners will increase again as the result of increased political problems in the Middle East. The company is currently paying $0.80 per gallon. If they are willing to enter an agreement in November 2021 to purchase a million gallons of heating oil during the winter of 2022, their supplier will guarantee the price at $0.80 per gallon. However, if the winter is a mild one, Esquire would not be able to sell a million gallons unless they reduced their retail price and thereby increase the risk of a loss for the year. On the other hand, if the wholesale price did increase substantially, they would be in a favorable position with respect to their competitors. The company’s fiscal year-end is December 31. Discuss the…arrow_forwardMohave Corp. is considering eliminating a product from its Sand Trap line of beach umbrellas. This collection is aimed at people who spend time on the beach or have an outdoor patio near the beach. Two products, the Indigo and Verde umbrellas, have impressive sales. However, sales for the Azul model have been dismal. Mohave’s information related to the Sand Trap line is shown below. Segmented Income Statement for Mohave’s Sand Trap Beach Umbrella Products Indigo Verde Azul Total Sales revenue $ 60,000 $ 60,000 $ 30,000 $ 150,000 Variable costs 34,000 31,000 26,000 91,000 Contribution margin $ 26,000 $ 29,000 $ 4,000 $ 59,000 Less: Direct fixed costs 1,900 2,500 2,000 6,400 Segment margin $ 24,100 $ 26,500 $ 2,000 $ 52,600 Common fixed costs* 17,840 17,840 8,920 44,600 Net operating income (loss) $ 6,260 $ 8,660 $ (6,920 ) $ 8,000 *Allocated based on total…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education