FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

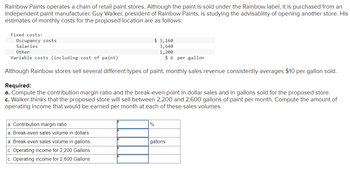

Transcribed Image Text:Rainbow Paints operates a chain of retail paint stores. Although the paint is sold under the Rainbow label, it is purchased from an

independent paint manufacturer. Guy Walker, president of Rainbow Paints, is studying the advisability of opening another store. His

estimates of monthly costs for the proposed location are as follows:

Fixed costs:

Occupancy costs

Salaries

Other

Variable costs (including cost of paint)

$6 per gallon

Although Rainbow stores sell several different types of paint, monthly sales revenue consistently averages $10 per gallon sold.

Required:

a. Compute the contribution margin ratio and the break-even point in dollar sales and in gallons sold for the proposed store.

c. Walker thinks that the proposed store will sell between 2,200 and 2,600 gallons of paint per month. Compute the amount of

operating income that would be earned per month at each of these sales volumes.

a. Contribution margin ratio

a. Break-even sales volume in dollars

a. Break-even sales volume in gallons

c. Operating income for 2,200 Gallons

c. Operating income for 2,600 Gallons

$ 3,160

3,640

1,200

%

gallons

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The Mighty Music Company produces and sells a desktop speaker for $200. The company has the capacity to produce 60,000 speakers each period. At capacity, the costs assigned to each unit are as follows: Unit-level costs Product-level costs Facility-level costs The company has received a special order for 11,000 speakers. If this order is accepted, the company will have to spend $20,000 on additional costs. Assuming that no sales to regular customers will be lost if the order is accepted, at what selling price will the company be indifferent between accepting and rejecting the special order? Multiple Choice O O $96.82 $146.82 $104.32 $95 $25 $15 $107.32arrow_forwardNative Wood Products Ltd sells hand-made coffee tables. The shop owner has divided sales into two categories according to the type of wood used in the tables, as follows: Product type Kahikatea Rimu Sales price $2,000 $1,200 Costs $1,200 $520 Sales commission $100 $60 Seventy percent (70%) of the shop's sales are rimu tables. The shop's annual fixed costs are $161,000. Calculate the weighted average contribution margin, assuming the sales mix stays the same.arrow_forwardMicrohard produces tablets, laptops and televisions. Microhard typically sells 1,000 tablets a year. The tablet information is as follows: Selling price per unit $70 Direct material cost per unit $30 Direct labor cost per unit $10 Total unavoidable allocated overhead $47,000 How much would Operating Income decrease if Microhard were to eliminate the tablets? DO NOT INCLUDE PARENTHESES OR NEGATIVE SIGNS IN YOUR ANSWER.arrow_forward

- The Slate Company manufactures and sells television sets. Its assembly division (AD) buys television screens from the screen division (SD) and assembles the TV sets. The SD, which is operating at capacity, incurs an incremental manufacturing cost of $65 per screen. The SD can sell all its output to the outside market at a price of $100 per screen, after incurring a variable marketing and distribution cost of $8 per screen. If the AD purchases screens from outside suppliers at a price of $100 per screen, it will incur a variable purchasing cost of $7 per screen. Slate’s division managers can act autonomously to maximize their own division’s operating income. Q. Now suppose that the SD can sell only 70% of its output capacity of 20,000 screens per month on the open market. Capacity cannot be reduced in the short run. The AD can assemble and sell more than 20,000 TV sets per month. a. From the point of view of Slate’s management, how much of the SD output should be transferred to the AD?arrow_forwardDiamond Boot Factory normally sells its specialty boots for $35 a pair. An offer to buy 125 boots for $31 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organizatioarrow_forwardThe Knot manufactures men’s neckwear at its Spartanburg plant. The Knot is considering implementing a JIT production system. The following are the estimated costs and benefits of JIT production: a. Annual additional tooling costs $250,000 annually. b. Average inventory would decline by 80% from the current level of $1,000,000. c. Insurance, space, materials-handling, and setup costs, which currently total $400,000 annually, would decline by 20%. d. The emphasis on quality inherent in JIT production would reduce rework costs by 25%. The Knot currently incurs $160,000 in annual rework costs. e. Improved product quality under JIT production would enable The Knot to raise the price of its product by $2 per unit. The Knot sells 100,000 units each year. The Knot’s required rate of return on inventory investment is 15% per year. Q. Suppose The Knot implements JIT production at its Spartanburg plant. Give examples of performance measures The Knot could use to evaluate and control JIT…arrow_forward

- Miller Books is considering publishing a book about meditation. The fixed costs to publish the book is estimated at $160,000. Variable material costs are estimated at $6 per book. Demand over the life of the textbook is estimated at 4,000 copies. Miller books anticipates that they can sell the books for $46 per unit. a) Write an expression for total revenue b) Write an expression for total cost c) Write an expression for total profit d) Find the break-even point e) Recommend a strategy if Miller will not be able to sell more than 3,500 copies.arrow_forwardA distributor of fasteners is opening a new plant and considering whether to use a mechanized process or a manual process to package the product. The manual process will have a fixed cost of $36,234 and a variable cost of $2.14 per bag. The mechanized process would have a fixed cost of $84,420 and a variable cost of $1.85 per bag. The company expects to sell each bag of fasteners for $2.75. a) What is the break-even point for the manual process (in units)? b) What is the break-even point for the mechanized process (in units)? c) A point of indifference for two processes is quantity at which each process generates the same amount of profit (review video). What is the point of indifference for the two processes? (Hint: 1) Use equations to set profit of manual process equal to mechanized process and solve for quantity; 2) (Excel) If you have a break-even for each process - have only one cell that represents quantity that be used to calculates costs/revenues for each process and use Goal…arrow_forwardNovak Inc. makes unfinished bookcases that it sells for $60. Production costs are $38 variable and $10 fixed. Because it has unused capacity, Novak is considering finishing the bookcases and selling them for $72. Variable finishing costs are expected to be $9 per unit with no increase in fixed costs. Prepare an analysis on a per-unit basis that shows whether Novak should sell unfinished or finished bookcases. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Net Income Sell Process Further Increase (Decrease) $ $ $ Sales per unit Variable cost per unit Fixed cost per unit Total per unit cost $ Net income per unit The bookcases processed further. $ $arrow_forward

- Alternate cost structures, uncertainty, and sensitivity analysis. Corporate Printing Company currently leases its only copy machine for $1,500 a month. The company is considering replacing this leasing agreement with a new contract that is entirely commission based. Under the new agreement, Corporate would pay a commission for its printing at a rate of $20 for every 500 pages printed. The company currently charges $0.20 per page to its customers. The paper used in printing costs the company $0.05 per page and other variable costs, including hourly labor, amount to $0.10 per page. Required: What is the company’s breakeven point under the current leasing agreement? What is it under the new commission-based agreement? For what range of sales levels will Corporate prefer (a) the fixed lease agreement and (b) the commission agreement? Do this question only if you have covered the chapter appendix in your class. Corporate estimates that the company is equally likely to sell 20,000, 30,000,…arrow_forwardMake or Buy A company manufactures various sized plastic bottles for its medicinal product. The manufacturing cost for small bottles is $56 per unit (100 bottles), including fixed costs of $18 per unit. A proposal is offered to purchase small bottles from an outside source for $29 per unit, plus $4 per unit for freight. Prepare a differential analysis dated March 30 to determine whether the company should Make Bottles (Alternative 1) or Buy Bottles (Alternative 2), assuming that fixed costs are unaffected by the decision. If an amount is zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Make Bottles (Alt. 1) or Buy Bottles (Alt. 2) March 30 Make Buy Differential Bottles Bottles Effect (Alternative 1) (Alternative 2) (Alternative 2) Unit Costs: Purchase price Freight Variable costs Fixed factory overhead Total unit costs Determine whether the company should make (Alternative 1) or buy (Alternative 2) the…arrow_forwardMake or Buy A company manufactures various sized plastic bottles for its medicinal product. The manufacturing cost for small bottles is $67 per unit (100 bottles), including fixed costs of $22 per unit. A proposal is offered to purchase small bottles from an outside source for $35 per unit, plus $5 per unit for freight. Prepare a differential analysis dated March 30 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the bottles, assuming that fixed costs are unaffected by the decision. If an amount is zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Make Bottles (Alt. 1) or Buy Bottles (Alt. 2) March 30 Make Bottles(Alternative 1) Buy Bottles(Alternative 2) Differential Effecton Income(Alternative 2) Sales price $0 $0 $0 Unit Costs: Purchase price $fill in the blank 89d8f6f64ff1ff3_1 $fill in the blank 89d8f6f64ff1ff3_2 $fill in the blank…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education