FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

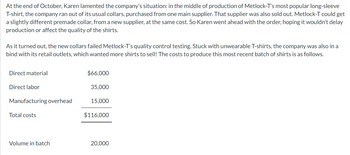

Transcribed Image Text:At the end of October, Karen lamented the company's situation: in the middle of production of Metlock-T's most popular long-sleeve

T-shirt, the company ran out of its usual collars, purchased from one main supplier. That supplier was also sold out. Metlock-T could get

a slightly different premade collar, from a new supplier, at the same cost. So Karen went ahead with the order, hoping it wouldn't delay

production or affect the quality of the shirts.

As it turned out, the new collars failed Metlock-T's quality control testing. Stuck with unwearable T-shirts, the company was also in a

bind with its retail outlets, which wanted more shirts to sell! The costs to produce this most recent batch of shirts is as follows.

Direct material

Direct labor

Manufacturing overhead

Total costs

Volume in batch

$66,000

35,000

15,000

$116,000

20,000

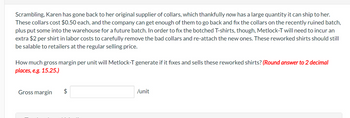

Transcribed Image Text:Scrambling, Karen has gone back to her original supplier of collars, which thankfully now has a large quantity it can ship to her.

These collars cost $0.50 each, and the company can get enough of them to go back and fix the collars on the recently ruined batch,

plus put some into the warehouse for a future batch. In order to fix the botched T-shirts, though, Metlock-T will need to incur an

extra $2 per shirt in labor costs to carefully remove the bad collars and re-attach the new ones. These reworked shirts should still

be salable to retailers at the regular selling price.

How much gross margin per unit will Metlock-T generate if it fixes and sells these reworked shirts? (Round answer to 2 decimal

places, e.g. 15.25.)

Gross margin

$

/unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Bert Asiago, as salesperson at Convertco, received an order from a potential new customer for 50,000 units of the company's single product. The price came in at $25 below the regular selling price of $65. Asiago knows that Convertco has the capacity to produce the product without affecting regular sales. He spoke to Bia Morgan, the controller, who informed him that at the $40 selling price, it's $42 of variable costs won't be covered. She recommends rejecting the order. Bert knows that $4 of the $42 per unit in variable cost is due to sales commission. If he accepts a commission of $2 per unit, that will make contribution margin per unit zero. He wants to try this in hopes that a new, regular customer might be obtained. 1. Determine CM/unit per the controller 2. Determine CM/unit under Bert's plan 3. Do you recommend this special order? Why or why not? 4. What other factors should management consider?arrow_forwardFeinan Sports, Inc., manufactures sporting equipment, including weight-lifting gloves. A national sporting goods chain recently submitted a special order for 4,000 pairs of weight-lifting gloves. Feinan Sports was not operating at capacity and could use the extra business. Unfortunately, the order's offering price of $12.70 per pair was below the cost to produce them. The controller was opposed to taking a loss on the deal. However, the personnel manager argued in favor of accepting the order even though a loss would be incurred; it would avoid the problem of layoffs and would help maintain the community image of the company. The full cost to produce a pair of weight-lifting gloves is presented below. Direct materials $ 7.40 Direct labor 3.80 Variable overhead 1.60 Fixed overhead 3.10 $15.90 Total No variable selling or administrative expenses would be associated with the order. Non-unit- level activity costs are a small percentage of total costs and are therefore not considered.…arrow_forwardHult Games buys electronic components for manufacturing from two suppliers, Milan Components and Dundee Parts. If the components are delivered late, the shipment to the customer is delayed. Delayed shipments lead to contractual penalties that call for Hult to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following. Milan Dundee Total Total purchases (cartons) 98,000 42,000 140,000 Average purchase price (per carton) $ 20.00 $ 22 $ 20.60 Number of deliveries 80 20…arrow_forward

- Elijah Electronics makes wireless headphone sets. The firm produced 27,000 wireless headphone sets during its first year of operation. At year-end, it had no inventory of finished goods. Elijah sold 25,380 units through regular market channels, but 270 of the units produced were so defective that they had to be sold as scrap. The remaining units were reworked and sold as seconds. For the year, the firm spent $144,000 on prevention costs and $72,000 on quality appraisal. There were no customer returns. An income statement for the year follows. Sales Regular channel $5,076,000 Seconds 128,250 Scrap 9,450 $5,213,700 Cost of goods sold Original production costs $1,725,840 Rework costs 37,800 Quality prevention and appraisal 216,000 $1,979,640 Gross margin $3,234,060 Selling and administrative expenses (all fixed) 882,000 Profit before income taxes $2,352,060 Compute the total pre-tax…arrow_forwardScholes Systems supplies a particular type of office chair to large retailers such as Target, Costco, and Office Max. Scholes is concerned about the possible effects of inflation on its operations. Presently, the company sells 81,000 units for $65 per unit. The variable production costs are $35, and fixed costs amount to $1,410,000. Production engineers have advised management that they expect unit labor costs to rise by 15 percent and unit materials costs to rise by 10 percent in the coming year. Of the $35 variable costs, 40 percent are from labor and 20 percent are from materials. Variable overhead costs are expected to increase by 20 percent. Sales prices cannot increase more than 10 percent. It is also expected that fixed costs will rise by 5 percent as a result of increased taxes and other miscellaneous fixed charges. The company wishes to maintain the same level of profit in real dollar terms. It is expected that to accomplish this objective, profits must increase by 7 percent…arrow_forwardMallory’s Video Supply has changed its focus tremendously and as a result has dropped the selling price of DVD players from $45 to $38. Some units in the work-in-process inventory have costs of $30 per unit associated with them, but Mallory can only sell these units in their current state for $22 each. Otherwise, it will cost Mallory $11 per unit to rework these units so that they can be sold for $38 each. How much is the financial impact if the units are processed further? a. $5 per unit profit b. $3 per unit loss c. $16 per unit profit d. $12 per unit lossarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education