FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

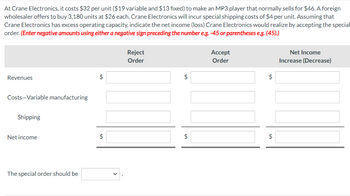

Transcribed Image Text:At Crane Electronics, it costs $32 per unit ($19 variable and $13 fixed) to make an MP3 player that normally sells for $46. A foreign

wholesaler offers to buy 3,180 units at $26 each. Crane Electronics will incur special shipping costs of $4 per unit. Assuming that

Crane Electronics has excess operating capacity, indicate the net income (loss) Crane Electronics would realize by accepting the special

order. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Revenues

Costs-Variable manufacturing

Shipping

LA

Net income

$

LA

The special order should be

Reject

Order

+A

Accept

Order

+A

$

$

+A

Net Income

Increase (Decrease)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A business received an offer from an exporter for 10,000 units of product at a special price of $15.50 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Domestic unit sales price $21 Unit manufacturing costs: Variable 12 Fixed 5 What is the amount of the gain or loss from acceptance of the offer? a. $8,000 loss b. $15,000 loss c. $35,000 gain d. $30,000 gainarrow_forwardAt Blossom Electronics, it costs $33 per unit ($15 variable and $18 fixed) to make an MP3 player that normally sells for $54. A foreign wholesaler offers to buy 4,520 units at $26 each. Blossom Electronics will incur special shipping costs of $1 per unit. Assuming that Blossom Electronics has excess operating capacity, indicate the net income (loss) Blossom Electronics would realize by accepting the special order. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses eg. (45).) Revenues Costs-Variable manufacturing Shipping Net income The special order should be Reject Order $ $ Accept Order Net Income Increase (Decrease) $ $ $ $arrow_forwardJacoby Company received an offer from an exporter for 20,500 units of product at $19 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Domestic unit sales price $24 Unit manufacturing costs: Variable $9 Fixed $5 What is the differential revenue from the acceptance of the offer? a.$389,500 b.$881,500 c.$102,500 d.$492,000arrow_forward

- Problem 7-18 Relevant Cost Analysis in a Variety of Situations [LO 7-2, LO 7-3, LO 7-4] Andretti Company has a single product called a Dak. The company normally produces and sells 81,000 Daks each year at a selling price of $46 per unit. The company's unit costs at this level of activity are given below: 2$ 11.00 1.90 5.00 ($405,000 total) 4.70 5.50 ($445,500 total) $ 35.60 Direct materials 7.50 Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total cost per unit A number of questions relating to the production and sale of Daks follow. Each question is independent.arrow_forwardJacoby Company received an offer from an exporter for 26,200 units of product at $19 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Domestic unit sales price $24 Unit manufacturing costs: Variable Fixed 10 d. $131,000 3 The differential revenue from the acceptance of the offer is O a. $628,800 O b. $497,800 Oc. $1,126,600 Oarrow_forwardAt Sandhill Electronics, it costs $31 per unit ($20 variable and $11 fixed) to make an MP3 player that normally sells for $49. A foreign wholesaler offers to buy 3,720 units at $28 each. Sandhill Electronics will incur special shipping costs of $3 per unit. Assuming that Sandhill Electronics has excess operating capacity, indicate the net income (loss) Sandhill Electronics would realize by accepting the special order. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Revenues Costs-Variable manufacturing Shipping Net income $ $ The special order should be accepted Reject Order i i $ $ Accept Order 104,160 (74,400) i (3,720) 26,040 $ $ Net Income Increase (Decrease) 104,160 (74,400) (3,720) 26,040arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education