Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

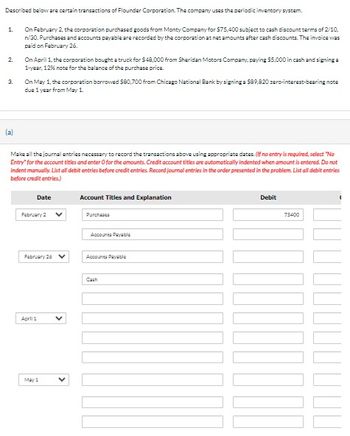

Transcribed Image Text:Described below are certain transactions of Flounder Corporation. The company uses the periodic inventory system.

1.

2.

3.

On February 2, the corporation purchased goods from Monty Company for $75,400 subject to cash discount terms of 2/10,

n/30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was

paid on February 26.

On April 1, the corporation bought a truck for $48,000 from Sheridan Motors Company, paying $5,000 in cash and signing a

1-year, 12% note for the balance of the purchase price.

On May 1, the corporation borrowed $80,700 from Chicago National Bank by signing a $89,820 zero-interest-bearing note

due 1 year from May 1.

(a)

Make all the journal entries necessary to record the transactions above using appropriate dates. (If no entry is required, select "No

Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not

indent manually. List all debit entries before credit entries. Record journal entries in the order presented in the problem. List all debit entries

before credit entries.)

Date

Account Titles and Explanation

February 2

Purchases

Accounts Payable

February 26

Accounts Payable

April 1

May 1

Cash

Debit

75400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Palisade Creek Co. is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 20Y6 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Record the following transactions on Page 21 of the journal: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. Assume that additional common stock of 10,000 was issued in January 20Y6. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account. 10. Prepare a post-closing trial balance.arrow_forwardAnalyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following transactions: a. Made credit sales of $825,000. The cost of the merchandise sold was $560,000. b. Collected accounts receivable in the amount of $752,600. c. Purchased goods on credit in the amount of $574,300. d. Paid accounts payable in the amount of $536,200. Required: Prepare the journal entries necessary to record the transactions. Indicate whether each transaction increased cash, decreased cash, or had no effect on cash.arrow_forwardDescribed below are certain transactions of Sandhill Corporation. The company uses the periodic inventory system. 1. 2. 3. On February 2, the corporation purchased goods from Martinez Company for $73,500 subject to cash discount terms of 2/10, n/30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was paid on February 26. On April 1, the corporation bought a truck for $55,000 from Blossom Motors Company, paying $3,000 in cash and signing a 1- year, 12% note for the balance of the purchase price. On May 1, the corporation borrowed $86,000 from Chicago National Bank by signing a $94,640 zero interest bearing note due 1 year from May 1. (a) Your answer is correct. Make all the journal entries necessary to record the transactions above using appropriate dates. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered.…arrow_forward

- Described below are certain transactions of Cullumber Corporation. The company uses the periodic inventory system. On February 2, the corporation purchased goods from Martin Company for $68,100 subject to cash discount terms of 2/10, n/30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was paid on February 26. On April 1, the corporation bought a truck for $51,000 from General Motors Company, paying $5,000 in cash and signing a one-year, 10% note for the balance of the purchase price. 1. 2. On May 1, the corporation borrowed $88,600 from Chicago National Bank by signing a $97,720 zero-interest-bearing note due one year from May 1. On August 1, the board of directors declared a $288,800 cash dividend that was payable on September 10 to stockholders of record on August 31. 3. 4.arrow_forwardDescribed below are certain transactions of Flint Corporation. The company uses the periodic inventory system. 1. On February 2, the corporation purchased goods from Martin Company for $67,500 subject to cash discount terms of 2/10, n/30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was paid on February 26. 2. On April 1, the corporation bought a truck for $47,000 from General Motors Company, paying $5,000 in cash and signing a one-year, 10% note for the balance of the purchase price. 3. On May 1, the corporation borrowed $82,400 from Chicago National Bank by signing a $91,040 zero-interest-bearing note due one year from May 1. 4. On August 1, the board of directors declared a $307,900 cash dividend that was payable on September 10 to stockholders of record on August 31. (a) Make all the journal entries necessary to record the transactions above using appropriate dates. (If no…arrow_forwardDescribed below are certain transactions of Edwardson Corporation. The company uses the periodic inventory system. 1. On February 2, the corporation purchased goods from Martin Company for $70,000 subject to cash discount terms of 2/10, n/30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was paid on February 26. 2. On April 1, the corporation bought a truck for $50,000 from General Motors Company, paying $4,000 in cash and signing a 1-year, 12% note for the balance of the purchase price. 3. On May 1, the corporation borrowed $83,000 from Chicago National Bank by signing a $92,000 zero-interest-bearing note due 1 year from May 1. 4. On August 1, the board of directors declared a $300,000 cash dividend that was payable on September 10 to stockholders of record on August 31. Questions a) Edwardson Corporation’s year-end is December 31. Assuming that no adjusting entries relative to the transactions above have been…arrow_forward

- Current Attempt in Progress Described below are certain transactions of Pharoah Corporation. The company uses the periodic inventory system. On February 2, the corporation purchased goods from Martin Company for $68,100 subject to cash discount terms of 2/10, n/30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was 1. paid on February 26 On April 1, the corporation bought a truck for $51,000 from General Mators Company, paying $5,000 in cash and signing a one-year, 109% note for the balance of the purchase price. 2. On May 1, the corporation borrowed SBB,600 from Chicago National Bank by signing a $97,720 zero-interest-bearing note due one year from May 1. 3. On August 1, the board of directors declared a $288,800 cash dividend that was payable on September 10 to stockholders of record on August 31. 4. Part 1 Your answer is partially correct. L Make all the journal entries necessary to record the transactions above using…arrow_forwardTransactions of Edwardson Corporation. The company uses the periodic inventory system. On February 2, the corporation purchased goods from Martin Company for $70,000 subject to cash discount terms of 2/10, n/30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was paid on February 26. On April 1, the corporation brought a truck for $50,000 from General Motors Company, paying $4,000 in cash and signing a 1-year, 12% note for the balance of the purchase price On May 1, the corporation borrowed $83,000 from Chicago National Bank by signing a $92,000 zero-interest-bearing note due 1 year from May 1 On August 1, the board of directors declared a $300,000 cash dividend that was payable on September 10 to stockholders of record on August 31. Instructions: (A) Make all the journal entries necessary to record the transactions above using appropriate dates. (B) Edwardson Corporations year-end is December 31. Assuming that no…arrow_forwardPLEASE HELP!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning