Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help with this accounting question

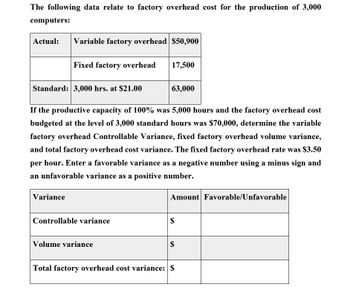

Transcribed Image Text:The following data relate to factory overhead cost for the production of 3,000

computers:

Actual: Variable factory overhead $50,900

Fixed factory overhead

17,500

Standard: 3,000 hrs. at $21.00

63,000

If the productive capacity of 100% was 5,000 hours and the factory overhead cost

budgeted at the level of 3,000 standard hours was $70,000, determine the variable

factory overhead Controllable Variance, fixed factory overhead volume variance,

and total factory overhead cost variance. The fixed factory overhead rate was $3.50

per hour. Enter a favorable variance as a negative number using a minus sign and

an unfavorable variance as a positive number.

Variance

Amount Favorable/Unfavorable

Controllable variance

$

Volume variance

$

Total factory overhead cost variance: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardABC Inc. spent a total of $48,000 on factory overhead. Of this, $28,000 was fixed overhead. ABC Inc. had budgeted $27,000 for fixed overhead. Actual machine hours were 5.000. Standard hours for units made were 4,800. The standard variable overhead rate was $4.10. What is the variable overhead rate variance?arrow_forwardFactory overhead cost variances The following data relate to factory overhead cost for the production of 10,000 computers: If productive capacity of 100% was 15,000 hours and the total factory overhead cost budgeted at the level of 14,000 standard hours was 356,000, determine the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance. The fixed factory overhead rate was 6.00 per hour.arrow_forward

- At the end of the period, the factory overhead account has a credit balance of 10,000. (a) Is the total factory cost variance favorable or unfavorable? (b) Are the controllable and volume variances favorable or unfavorable?arrow_forwardA manufacturer planned to use $78 of variable overhead per unit produced, but in the most recent period, it actually used $76 of variable overhead per unit produced. During this same period, the company planned to produce 500 units but actually produced 540 units. What is the variable overhead spending variance?arrow_forwardCarlo Lee Corp. has established the following standard cost per unit: Although 10,000 units were budgeted, only 8,800 units were produced. The purchasing department bought 55,000 lb of materials at a cost of $123,750. Actual pounds of materials used were 54,305. Direct labor cost was $186,550 for 18,200 hours worked. Required: Make journal entries to record the materials transactions, assuming that the materials price variance was recorded at the time of purchase. Make journal entries to record the labor variances.arrow_forward

- Eagle Inc. uses a standard cost system. During the most recent period, the company manufactured 115,000 units. The standard cost sheet indicates that the standard direct labor cost per unit is $1.50. The performance report for the period includes an unfavorable direct labor rate variance of $3,700 and a favorable direct labor time variance of $10,275. What was the total actual cost of direct labor incurred during the period?arrow_forwardDirect materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forwardDirect materials, direct labor, and factory overhead cost variance analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 40,000 units of product were as follows: Each unit requires 0.3 hour of direct labor. Instructions Determine (A) the direct materials price variance, direct materials quantity variance, and total direct materials cost variance; (B) the direct labor rate variance, direct labor time variance, and total direct labor cost variance; and (C) the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance.arrow_forward

- Factory overhead controllable variance Bellingham Company produced 15,000 units of product that required 4 standard direct labor hours per unit. The standard variable overhead cost per unit is 0.90 per direct labor hour. The actual variable factory overhead was 52,770. Determine the variable factory overhead controllable variance.arrow_forwardFitzgerald Company manufactures sewing machines, and they produced 2,500 this past month. The standard variable manufacturing overhead (M0H) rate used by the company is $6.75 per machine hour. Each sewing machine requires 13.5 machine hours. Actual machine hours used last month were 33,500, and the actual variable MOH rate last month was $7.00. Calculate the variable overhead rate variance and the variable overhead efficiency variance.arrow_forwardThe normal capacity of a manufacturing plant is 30,000 direct labor hours or 20,000 units per month. Standard fixed costs are 6,000, and variable costs are 12,000. Data for two months follow: For each month, make a single journal entry to charge overhead to Work in Process, to close Factory Overhead, and to record variances. Indicate the types of variances and state whether each is favorable or unfavorable. (Hint: You must first compute the flexible-budget and production-volume variances.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning