FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting

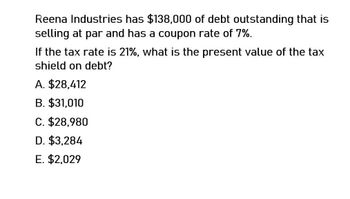

Transcribed Image Text:Reena Industries has $138,000 of debt outstanding that is

selling at par and has a coupon rate of 7%.

If the tax rate is 21%, what is the present value of the tax

shield on debt?

A. $28,412

B. $31,010

C. $28,980

D. $3,284

E. $2,029

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need help with this accounting questionarrow_forwardReena Industries has $10,000 of debt outstanding that is selling at par and has a coupon rate of 7%. The tax rate is 34%. What is the present value of the tax shield? A. $2,800 B. $3,000 C. $3,400 D. $3,800 E. $7.000arrow_forwardSamuel Corp. provides the following information: EBIT = $386.50 Tax (TC ) = 21% Debt = $700 RU = 10% Question: What is the value of Samuel’s equity?arrow_forward

- 1. ACT Inc. has a $1,000 (face value), 20 year bond issue selling for $1,229.40 that pays an annual coupon of 8.0 percent. Their marginal tax rate is 25%. a. What would be BAT's current before-tax component cost of debt? a. What would be BAT's current after-tax component cost of debt?arrow_forwardA firm pays a 6.30% annual interest rate on its bonds with par value $1,000,000. The firm's tax rate is 21%. Sales is $7,325,000, cost of goods sold is $6,664,000 and depreciation expense is $543,000. What is the firm's times interest earned ratio?arrow_forwardAssume that CVC Corp.'s marginal tax rate is 35%, investors in CVC pay a 15% tax rate on income from equity and a 35% tax rate on interest income. CVC is equally likely to have EBIT this coming year of $20 million, $25 million, or $30 million. What is the effective tax advantage of debt if CVC has interest expenses of $8 million this coming year?arrow_forward

- Company Y has a target debt ratio of 55%. Currently its debt ratio is 60% and it expects to revert to the target ratio in the near future. The company has a market cost of equity of 20%. While it has no bonds, it has interest payments of R1 000 000 on liabilities of R10 000 000. Assume the tax rate is 28%. What is the WACC for the company? Ⓒa. 6.36% b. 9.00% c. 12.33% d. 12.96%arrow_forwardCoco Kitchen has a WACC of 14%. It has 19% of return on equity, and 60% of debt-to-asset ratio (i.e., weight on debt). Assume tax equals 0, calculate the interest rate on the debt. O 9.90% O 11.14% O 10.67% O 6.50%arrow_forwardPlease see image to answer question.arrow_forward

- 15. Vodacom SA has a dividend payout ratio of 70%. The personal tax rate on dividend income is 20 %, and the personal tax rate on capital gains is 11%. TC= (Corporate tax rate) = 28%; and TP= Personal tax rate on interest income = 22%: Calculate the relative tax advantage of debt with personal and corporate taxes. a. 1.31 b. 1.28 c. 0.78 d. 0.60 e. 0.17arrow_forwardSuppose the company Powerland borrows the new $2 million debt as perpetual bonds at a 5% cost which is equal to the risk-free rate (rf). If Corporate Income Tax rate is 23% rate and the Personal Tax for Debtholders is 5%, by how much does the interest tax shield increase the value of Powerland? a. $1,621,053 b. $100.000 C. - $100,000 Od. $460,000✓arrow_forwardMalbar Gold has taken a loan of two million on which it pays an interest of 4.5 %. If the current tax rate 37.5 %. What is the firm's after tax cost of debt? Select one: Oa. None of these Ob. 3.44 O c. 4.42 O d. 2.81arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education