Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I NEED HELP PLEASE

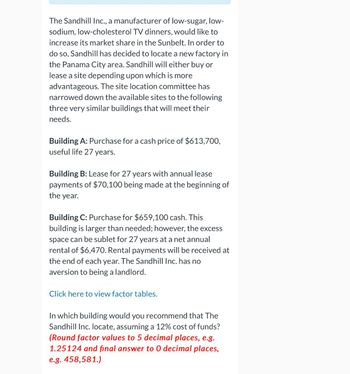

Transcribed Image Text:The Sandhill Inc., a manufacturer of low-sugar, low-

sodium, low-cholesterol TV dinners, would like to

increase its market share in the Sunbelt. In order to

do so, Sandhill has decided to locate a new factory in

the Panama City area. Sandhill will either buy or

lease a site depending upon which is more

advantageous. The site location committee has

narrowed down the available sites to the following

three very similar buildings that will meet their

needs.

Building A: Purchase for a cash price of $613,700,

useful life 27 years.

Building B: Lease for 27 years with annual lease

payments of $70,100 being made at the beginning of

the year.

Building C: Purchase for $659,100 cash. This

building is larger than needed; however, the excess

space can be sublet for 27 years at a net annual

rental of $6,470. Rental payments will be received at

the end of each year. The Sandhill Inc. has no

aversion to being a landlord.

Click here to view factor tables.

In which building would you recommend that The

Sandhill Inc. locate, assuming a 12% cost of funds?

(Round factor values to 5 decimal places, e.g.

1.25124 and final answer to O decimal places,

e.g. 458,581.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Cullumber Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Cullumber has decided to locate a new factory in the Panama City area. Cullumber will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $612,100, useful life 26 years. Building B: Lease for 26 years with annual lease payments of $71,490 being made at the beginning of the year. Building C: Purchase for $655,200 cash. This building is larger than needed; however, the excess space can be sublet for 26 years at a net annual rental of $6,850. Rental payments will be received at the end of each year. The Cullumber Inc. has no aversion to being a landlord. Click here to view factor tables. In which building would you recommend that…arrow_forwardBundbasher Inc., a manufacturer of high-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Bundbasher has decided to locate a new factory in the Panama City area. Bundbasher will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three buildings. Building A: Purchase for a cash price of $610,000, useful life 25 years. Building B: Lease for 25 years with annual lease payments of $70,000 being made at the beginning of the year. Building C: Purchase for $650,000 cash. This building is larger than needed; however, the excess space can be sublet for 25 years at a net annual rental of $6,000. Rental payments will be received at the end of each year. The Bundbasher Inc. has no aversion to being a landlord. In which building would you recommend that Brubaker Inc. locate, assuming a 12% cost of funds?arrow_forwardThe Metlock Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Metlock has decided to locate a new factory in the Panama City area, Metlock will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $ 610,600, useful life 27 years. Building B: Lease for 27 years with annual lease payments of $ 70,870 being made at the beginning of the year. Building C: Purchase for $ 657,200 cash. This building is larger than needed; however, the excess space can be sublet for 27 years at a net annual rental of $ 6,110. Rental payments will be received at the end of each year. The Metlock Inc. has no aversion to being a landlord.arrow_forward

- Brubaker Inc., a manufacturer of high-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Brubaker has decided to locate a new factory in the Panama City area. Brubaker will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three buildings. Building A: Purchase for a cash price of $610,000, useful life 25 years. Building B: Lease for 25 years with annual lease payments of $70,000 being made at the beginning of the year. Building C: Purchase for $650,000 cash. This building is larger than needed; however, the excess space can be sublet for 25 years at a net annual rental of $6,000. Rental payments will be received at the end of each year. The Brubaker Inc. has no aversion to being a landlord. In which building would you recommend that Brubaker Inc. locate, assuming a 12% cost of funds? (Show work please)arrow_forwardThe Marigold Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Marigold has decided to locate a new factory in the Panama City area. Marigold will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs.Building A: Purchase for a cash price of $611,000, useful life 25 years.Building B: Lease for 25 years with annual lease payments of $71,370 being made at the beginning of the year.Building C: Purchase for $657,400 cash. This building is larger than needed; however, the excess space can be sublet for 25 years at a net annual rental of $6,800. Rental payments will be received at the end of each year. The Marigold Inc. has no aversion to being a landlord. In which building would you recommend that The Marigold Inc. locate, assuming a 12%…arrow_forwardThe Sandhill Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Sandhill has decided to locate a new factory in the Panama City area. Sandhill will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs.Building A: Purchase for a cash price of $612,300, useful life 26 years.Building B: Lease for 26 years with annual lease payments of $70,170 being made at the beginning of the year.Building C: Purchase for $652,900 cash. This building is larger than needed; however, the excess space can be sublet for 26 years at a net annual rental of $6,430. Rental payments will be received at the end of each year. The Sandhill Inc. has no aversion to being a landlord.Click here to view factor tablesIn which building would you recommend that The Sandhill…arrow_forward

- The Crane Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Crane has decided to locate a new factory in the Panama City area. Crane will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $610,000, useful life 27 years. Building B: Lease for 27 years with annual lease payments of $70,500 being made at the beginning of the year. Building C: Purchase for $656,700 cash. This building is larger than needed; however, the excess space can be sublet for 27 years at a net annual rental of $6,570. Rental payments will be received at the end of each year. The Crane Inc. has no aversion to being a landlord. Click here to view factor tables. In which building would you recommend that The Crane Inc.…arrow_forward- Your answer is partially correct. The Pronghorn Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Pronghorn has decided to locate a new factory in the Panama City area. Pronghorn will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $618,100, useful life 26 years. Building B: Lease for 26 years with annual lease payments of $70,340 being made at the beginning of the year. Building C: Purchase for $653,200 cash. This building is larger than needed; however, the excess space can be sublet for 26 years at a net annual rental of $6,540. Rental payments will be received at the end of each year. The Pronghorn Inc. has no aversion to being a landlord. Click here to view factor tables. In which…arrow_forwardThe Novak Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Novak has decided to locate a new factory in the Panama City area. Novak will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs.Building A: Purchase for a cash price of $618,100, useful life 26 years.Building B: Lease for 26 years with annual lease payments of $70,340 being made at the beginning of the year.Building C: Purchase for $653,200 cash. This building is larger than needed; however, the excess space can be sublet for 26 years at a net annual rental of $6,540. Rental payments will be received at the end of each year. The Novak Inc. has no aversion to being a landlord.arrow_forward

- The Monty Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Monty has decided to locate a new factory in the Panama City area. Monty will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs.Building A: Purchase for a cash price of $617,900, useful life 27 years.Building B: Lease for 27 years with annual lease payments of $70,330 being made at the beginning of the year.Building C: Purchase for $655,700 cash. This building is larger than needed; however, the excess space can be sublet for 27 years at a net annual rental of $6,700. Rental payments will be received at the end of each year. The Monty Inc. has no aversion to being a landlord.In which building would you recommend that The Monty Inc. locate, assuming a 12% cost of funds?…arrow_forwardThe Sweet Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Sweet has decided to locate a new factory in the Panama City area. Sweet will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs.Building A: Purchase for a cash price of $ 615,800, useful life 28 years.Building B: Lease for 28 years with annual lease payments of $ 71,850 being made at the beginning of the year.Building C: Purchase for $ 655,900 cash. This building is larger than needed; however, the excess space can be sublet for 28 years at a net annual rental of $ 6,850. Rental payments will be received at the end of each year. The Sweet Inc. has no aversion to being a landlord.What is the Net Present Value for each alternative. In which building would you recommend…arrow_forwardThe Splish Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Splish has decided to locate a new factory in the Panama City area. Splish will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs.Building A: Purchase for a cash price of $616,000, useful life 25 years.Building B: Lease for 25 years with annual lease payments of $70,700 being made at the beginning of the year.Building C: Purchase for $654,700 cash. This building is larger than needed; however, the excess space can be sublet for 25 years at a net annual rental of $6,820. Rental payments will be received at the end of each year. The Splish Inc. has no aversion to being a landlord. In which building would you recommend that The Splish Inc. locate, assuming a 12% cost of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning