Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please help me answer this question

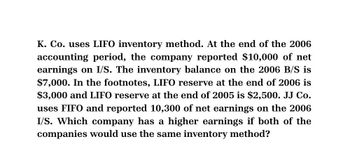

Transcribed Image Text:K. Co. uses LIFO inventory method. At the end of the 2006

accounting period, the company reported $10,000 of net

earnings on I/S. The inventory balance on the 2006 B/S is

$7,000. In the footnotes, LIFO reserve at the end of 2006 is

$3,000 and LIFO reserve at the end of 2005 is $2,500. JJ Co.

uses FIFO and reported 10,300 of net earnings on the 2006

I/S. Which company has a higher earnings if both of the

companies would use the same inventory method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I want to answer this questionarrow_forwardKante Company uses periodic FIFO for its internal report and periodic LIFO for its external reports. In its FIFO-based internal reports, Kante had a beginning inventory of $96,000, an ending inventory of $116,000, and a pretax income of $750,000. Under LIFO, Kante's beginning inventory would have been $78,000, and its ending inventory would have been $109,000. How much pretax income would Kante report in its external reports?arrow_forwardAssume that Merryland’s Markets had an inventory balance of $32 570 at the close of the last accounting period. The following sales and purchase transactions are for the current period. NOTE: GST at 10% is included in the amount where applicable. 1. 2. 3. 4. Purchased goods on account for $29,909. Returned part of the above purchase that had an original invoice price of $1,749. Paid for the balance of the purchase in time to receive a discount of 2% of the invoice price. Sold goods on account costing $24 900 for an invoice price of $54 802. Required (a) Prepare general journal entries assuming the perpetual inventory system is used. (b) Suppose that a physical count of the inventory at the end of the current period shows inventory of $30,420 to be on hand. Present the entries (if any) required to adjust for any discrepancy.arrow_forward

- A company has the following information available that was used to report inventory using the dollar-value LIFO method. Year Year-End Cost Cost Index 12/31/2020 $250,000 1.00 12/31/2021 259,000 1.06 For the year ended 12/31/2021, the company reported inventory of $274,540 ($259,000 × 1.06). Which of the following statements is correct? O The amount reported for ending inventory should be calculated as $250,000 + ($9,000 × 1.06). O The amount reported for ending inventory should be calculated as $250,000 + ($9,000/1.06). The amount reported for ending inventory is correct. O The amount reported for ending inventory should be calculated as $259,000/1.06.arrow_forwardSandhill Inc. reported inventory at the beginning of the current year of $440000 and at the end of the current year of $491000. If net sales for the current year are $4829200 and the corresponding cost of sales totaled $3724000, what is the inventory turnover for the current year? 10.37. 7.58. 9.84. 8.00.arrow_forwardIn March 2015, XYZ Corp. purchased an item of inventory for $30. By June, that item could be purchased for $26 and re-sold for $31. XYZ's normal profit for the item is $4. At what amount should XYZ report the item in its June 30 balance sheet? XYZ uses the LIFO inventory cost flow assumption. (omit , and $ in the answer) 30arrow_forward

- In 2020, MAKISIG Company which uses the periodic system of recording inventory, reported a net income of P200,000. The correct net income was P250,000. lt was determined that the beginning and ending inventory were overstated by P20,000 and P15,000 respectively. The remaining error was due to purchases which was 15,000 A. overstated 15,000 B. 45,000 C. understated 45,000 D. overstated understated O A OB C. ODarrow_forwardEsquire Incorporated uses the LIFO method to report its inventory. Inventory at the beginning of the year was $768,000 (32,000 units at $24 each). During the year, 104,000 units were purchased, all at the same price of $27 per unit. 112,000 units were sold during the year. Calculate ending inventory and cost of goods sold at the end of the year based on a periodic inventory system. Beginning Inventory Purchases Total Cost of Goods Available for Sale Cost per unit 32,000 $24 $ 104,000 27 136,000 Number of units Cost of Goods Available for Sale $ 768,000 2,808,000 3,576,000 Cost of Goods Sold - Periodic LIFO Cost per unit $ 24 $ $27 Number of units sold 0 Cost of Goods Sold $ 0 0 0 Ending Inventory - Periodic LIFO Cost Number of units in per ending inventory unit $ 24 $ $27 0 Ending Inventory $ 0 0 0arrow_forwardLM ltd has the following products in inventory at the year end. Product Quantity Cost Selling price Selling cost X 1,000 GHS40 GHS55 GHS8 Y 2,500 GHS15 GHS25 GHS4 Z 800 GHS23 GHS27 GHS5 At what amount should total inventory be stated in the statement of financial position?arrow_forward

- Brooke Company used a perpetual inventory system. At the end of 2012, the inventory account was P360,000 and P30,000 of those goods. included in ending inventory were purchased FOB shipping point and did not arrive until 2013. Purchases in 2013 were P3,000,000. The perpetual inventory records showed an ending inventory of P420,000 for 2013. A physical count at the end of 2013 showed an inventory of P380,000. Inventory shortages are included in cost of goods sold. What amount should be reported as cost of goods sold for 2013?arrow_forwardIn 2017, Blue company adopted the Dollar-Value LIFO method for externally reporting inventory. The following data was available for the first two years in which Blue used Dollar-Value LIFO: Ending inventory Year at year end costs Price index 12/31/17 $300,000 1.00 12/31/18 $345,600 1.08 Under the Dollar-Value LIFO method, at what amount should Blue record ending inventory as of DEC 31, 2018? Gooim, co, uses a periodic inventory system. IN 2018, the internal auditors of Gooim, discovered the following two errors related to the 2017 fianacial statements: (1) a $35 million purchase of inventory was recorded for $20 million and (2) ending inventory was understand by $6 million The journal entry needed in 2018 to correct these errors would included which of the follwing Debit ?, Credit ? During 2018, Blud corp paid $18,000,000 in cash to acquire a manufacturing plant, which consisted of both a tract of land and a building, in a lump sum purchase.. At what value should the land be…arrow_forwardRomanoff Industries had the following inventory transactions occur during 2013: Units Cost/unit 2/1/13 Purchase 18 $45 3/14/13 Purchase 31 $47 5/1/13 Purchase 22 $49 The company sold 50 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? a. $1,106 b. $1,184 c. $2,316 d. $2,394arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT