FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

How many fixed assets did the company sell during the year?

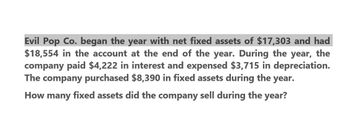

Transcribed Image Text:Evil Pop Co. began the year with net fixed assets of $17,303 and had

$18,554 in the account at the end of the year. During the year, the

company paid $4,222 in interest and expensed $3,715 in depreciation.

The company purchased $8,390 in fixed assets during the year.

How many fixed assets did the company sell during the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Micro, Inc., started the year with net fixed assets of $76,175. At the end of the year, there was $97,925 in the same account, and the company's income statement showed depreciation expense of $13,935 for the year. What was the company's net capital spending for the year? Multiple Choice O $35,685 $43,580 $21,750 $41,170 $83,990arrow_forwardMicro, Inc., started the year with net fixed assets of $76,175. At the end of the year, there was $97,925 in the same account, and the company's income statement showed depreciation expense of $13,395 for the year. What was the company's net capital spending for the year? a. $83,990 b. $35,685 c. $21,750 d. $43,580 e. $41,170arrow_forwardABC Corporation had sales of $125,000. Total assets at the beginning of the year were 53,000 and at the end of the year were $55,000. ABC's asset turnover for the entire year was Blank______. (Use the average total assets to solve)arrow_forward

- Please Solve this Question with calculationarrow_forwardABC industries had the following operating results for last year: sales = $28,900; cost of goods sold = $24,600; depreciation expense = $1,700; interest expense = $1,400; dividends paid = $1,000. At the beginning of the year, net fixed assets were $14,300, current assets were $8,700, and current liabilities were $6,600. At the end of the year, net fixed assets were $23,900, current assets were $9,200, and current liabilities were $7,400. The tax rate for last year was 34 percent. Assume there is no short term investments and notes payable. What was the free cash flow for last year? $7584 $2610 O- $7584 - $2610arrow_forwardNonearrow_forward

- Henryk Inc. just reported an Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) of $55,000, and they incurred $11,500 of Depreciation and Amortization expense. The company had an interest expense of $3,100 and its tax rate was 21%. How much Net Income did the company earn during the year?arrow_forwardDisturbed, Inc., had the following operating results for the past year: sales = $22,616; depreciation = $1,480; interest expense = $1,192; costs = $16,575. The tax rate for the year was 38 percent. What was the company's operating cash flow? $2,089 $3,369 $4,761 $7,321 $3,213arrow_forwardIn its first year of operations, Martha Enterprises Corp. reported the following information: a. Income before income taxes was $640,000. b. The company acquired capital assets costing $2,400,000; depreciation was $160,000, and CCA was $120,000. c. The company recorded an expense of $155,000 for the one-year warranty on the company's products; cash disbursements amounted to $79,000. d. The company incurred development costs of $77,000 that met the criteria for capitalization for accounting purposes. Development work was still ongoing at year-end. These costs could be immediately deducted for tax purposes. e. The company made a political contribution of $30,000 and expensed this for accounting purposes. f. The income tax rate was 28% and the year 2 tax rate was enacted, at 30%. In the second year, the company reported the following: a. Earnings before income tax were $1,700,000. b. Depreciation was $160,000; CCA was $360,000. c. The estimated warranty costs were $250,000, while the cash…arrow_forward

- Sectors, Inc., has an EBIT of $7,221,643 and interest expense of $611,800. Its depreciation for the year is $1,434,500. What is its cash coverage ratio?arrow_forwardAneko Company reports the following: net sales of $18,000 for Year 2 and $17,100 for Year 1; end-of-year total assets of $18,200 for Year 2 and $16,800 for Year 1. Compute its total asset turnover for Year 2. Aneko’s competitor has a turnover of 2.0. Is Aneko performing better or worse than its competitor based on total asset turnover?arrow_forwardACME Corp’s balance sheet reported that it had $650,000 in liabilities and $275,000 in equity. On the income statement the company had revenues of $867,030 and expenses (excluding depreciation) of $356,240. Depreciation was $103,456 and interest expense of $52,423. Assuming a 40% tax rate, what was the company's return on assets?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education