FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the UAE. They are now looking to finance their new project, are looking for a bank to give them a loan. Calculate the following ratios for both 2018 and 2019, interpret and analyze them:

- Days Sales in Inventory

- Average Collection Period

Transcribed Image Text:Standalone statement of financial position

As at 31 December

2019

2018

Note

AED

AED

ASSETS

Non-current asset

Property and equipment

4

1,012,984

1,213,595

Investments in subsidiaries

1,343,582

2,356,566

2.2

1,213,595

Current assets

Inventories

5,529,691

193,441,503

52,580,863

33,455,659

24,349,497

309,357,213

310,570,808

Trade and other receivables

6.

Due from related parties

Loan to related parties

179,413,089

121,670,892

80,115,253

26,318,739

11

11

Cash and bank balances

7

407,517,973

409,874,539

Total assets

EQUITY AND LIABILITIES

EQUITY

Share capital

Retained earnings

Total equity

3,900,000

358,743,239

3,900,000

279,803,469

283,703,469

362,643,239

LIABILITIES

Non-current liabilities

252,073

252,073

Provision for employees' end of service benefits

355,785

355,785

Current liabilities

Trade and other payables

Due to a related party

Bank borrowings

10

1,123,523

26,729,064

19,022,928

46,875,515

47,231,300

409,874,539

6,079,568

20,415,438

120,260

26,615,266

26,867,339

310,570,808

11

17

Total liabilities

Total equity and liabilities

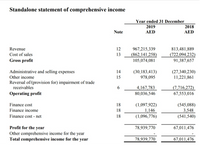

Transcribed Image Text:Standalone statement of comprehensive income

Year ended 31 December

2019

2018

Note

AED

AED

967,215,339

(862,141,258)

105,074,081

Revenue

12

813,481,889

Cost of sales

13

(722,094,232)

91,387,657

Gross profit

Administrative and selling expenses

14

(30,183,413)

978,095

(27,340,230)

11,221,861

Other income

Reversal of/(provision for) impairment of trade

receivables

15

(7,716,272)

67,553,016

6.

4,167,783

80,036,546

Operating profit

Finance cost

18

(1,097,922)

1,146

(1,096,776)

(545,088)

3,548

(541,540)

Finance income

18

Finance cost - net

18

Profit for the year

78,939,770

67,011,476

Other comprehensive income for the year

Total comprehensive income for the year

78,939,770

67,011,476

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Jill Barksalot owns Jill's Jams, a condiment conglomerate focused on world dominance. She sells a variety of jellies and jams that are just to die for mwhahaha. Using the provided data on her last several years of sales, prepare a statement of trend percentages using 2017 as the base year. (in millions) 2017 2018 2019 2020 Sales 13,241 14,122 11,957 13,244 Cost of goods sold 8,987 9,534 8,272 9,101 Gross margin 4,254 4,588 3,685 4,143 2017 2018 2019 2020 Sales Cost of Goods Sold Gross Marginarrow_forwardSuppose a firm has had the historical sales figures shown as follows. What would be the forecast for next year's sales using the average approach? Year 2017 2018 Sales $ 750,000 500,000 Multiple Choice O $695,000 $700,000 $750,000 $775.000 2019 $ 700,000 2020 $ 750,000 2021 $ 775,000arrow_forwardThe Simpson Corporation has gathered information regarding past sales of custom t-shirts. Year Sales 2013 $225,000 2014 $193,000 2015 $248,000 2016 $360,000 2017 $340,000 2018 $295,000 2019 $310,000 Answer the following questions. Predict the sales for 2020 using the moving average method. You noticed a sudden jump in sales for 2016. After inquiring about this jump, you were notified by your manager about a one-time special order sale for $60,000 in that year that is not likely to be repeated. What revision, if any, would you make in the sales information used for projection? If you revised your historical sales to be used to project 2020 sales, please recalculate your projection using the moving average method. Which projection (Question 1 or Question 3) do you feel is more representative of the Simpson Corporation's historical sales? Why?arrow_forward

- Based on this information, create and solve a ratio analysis: In their most recent discussion with VP Finance, they were informed that total sales next year (2022) was expected to be $1,500,000. You should assume the same amount of turnover in 2022 as there was in the past 5 years. Number of new hires and turnover by year Year New Hires Turnover 2017 10 5 2018 20 7 2019 22 9 2020 25 12 2021 15 15 Sales per year Year Service Sales Product Sales 2017 $250,000 $ 200,000 2018 $350,000 $325,000 2019 $400,000 $450,000 2020 $550,000 $600,000 2021 $625,000 $675,000 How many employees need to be hired in 2022, show all calculationsarrow_forwardPlease help mearrow_forwardNordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2025 are presented below. Cash and cash equivalents Accounts receivable (net) Inventory Other current assets Total current assets Total current liabilities End of Year Current ratio: $740 2,080 Accounts receivable turnover Average collection period 860 650 $4,330 $2,010 Beginning of Year $79 1.900 For the year, net credit sales were $8,258 million, cost of goods sold was $5,328 million, and net cash provided by opcing activities was $1,251 million. 890 Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the current year. (Round current ratio to 2 decimal places, eg 1.83 and all other answers to 1 decimal place, e.g. 1.8. Use 365 days for calculation) 371 $3,240 $1,640 :1 times days Carrow_forward

- The following tables summarizes the 2019 income statement and end-year balance sheet of Drake’s Bowling Alleys. Drake’s financial manager forecasts a 10% increase in sales and costs in 2020. The ratio of sales to average assets is expected to remain at 0.40. Interest is forecasted at 5% of debt at the start of the year. INCOME STATEMENT, 2019 (Figures in $ thousands) Sales $ 1,120 (40% of average assets)a Costs 840 (75% of sales) Interest 26 (5% of debt at start of year)b Pretax profit $ 254 Tax 101 (40% of pretax profit) Net income $ 152 a Assets at the end of 2018 were $2,700,000. b Debt at the end of 2018 was $530,000. BALANCE SHEET, YEAR-END (Figures in $ thousands) Assets $ 2,900 Debt $ 530 Equity 2,370 Total $ 2,900 $ 2,900 a. What is the implied level of assets at the end of 2020? (Do not round your intermediate calculations. Enter your answer in thousands.) b. If the…arrow_forwardUsing the income statement below, please compute the correct variance in total revenue (horizontal analysis) in Korean Won (Billion) and in percentage between the years ending 12/31/2023 and 12/31/2020 and chose the correct answer": yahoo/finance Search for news, symbols or companies a News Finance Sports More My Portfolio News Markets Research Personal Finance Videos Follow Compare News Research Chart Community Statistics Hyundai Motor Company (HYMTF) 60.50 -0.30 (-0.49%) At close: August 13 at 4:00 PM EDT Balance Sheet Cash Flow Dividends Historical Data All numbers in thousands יוויון Sustainability Breakdown Currency in KRW Annual Quarterly Download Collapse All 15 TTM 12/31/2023 12/31/2022 12/31/2021 12/31/2020 165,543,425,000 162,663,579,000 142,151,469,000 117,610,626,000 103,997,601,000 Total Revenue Operating Revenue Cost of Revenue Gross Profit Operating Expense 165,543,425,000 162,663,579,000 142,151,469,000 117,610,626,000 103,997,601,000 131.353,259,000 129.179.183.000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education