FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

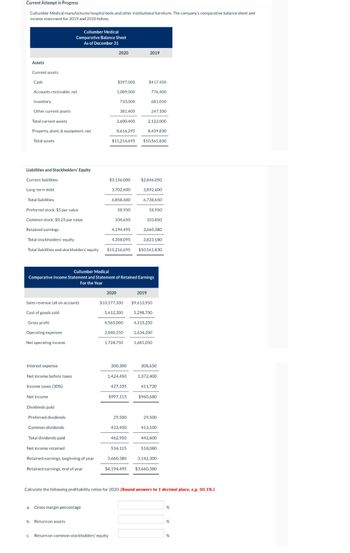

Transcribed Image Text:Current Attempt in Progress

Cullumber Medical manufactures hospital beds and other institutional furniture. The company's comparative balance sheet and

income statement for 2019 and 2020 follow.

Assets

Current assets

Cash

Accounts receivable, net

Inventory

Other current assets

Total current assets

Property, plant, & equipment, net

Total assets

Liabilities and Stockholders' Equity

Current liabilities

Long-term debt

Total liabilities

Sales revenue (all on account)

Cost of goods sold

Gross profit

Operating expenses

Net operating income

Cullumber Medical

Comparative Balance Sheet

As of December 31

Interest expense

Net income before taxes

Income taxes (30%)

Net income

Dividends paid

Preferred dividends

Common dividends

Total dividends paid.

Net income retained

Retained earnings, beginning of year

Retained earnings, end of year

a. Gross margin percentage

b. Return on assets

2020

$397,000

1,089,000

733,000

381,400

2,600,400

8,616,295

Preferred stock, $5 par value

Common stock, $0.25 par value

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity $11,216,695 $10,561,830

2020

$3,156,000

3,702,600

6,858,600

C. Return on common stockholders' equity

8,439,830

$11,216,695 $10.561.830

58,950

104,650

4,194,495

4.358,095

Cullumber Medical

Comparative Income Statement and Statement of Retained Earnings

For the Year

$10,177,300

5,612,300

300,300

1,424,450

427,335

$997,115

2019

$417,450

776,400

433,450

462,950

681,050

534,115

247,100

2,122,000

$2,846,050

3,892,600

6,738,650

2019

58,950

103,850

4,565,000 4.315,250

2,840,250

2,634,200

1,724,750 1,681,050

3,660,380

3,823,180

$9,613,950

5,298,700

308,650

1,372,400

411,720

$960,680

29,500

413,100

442,600

Calculate the following profitability ratios for 2020. (Round answers to 1 decimal place, e.g. 50.1%.)

518,080

3,660,380 3,142,300

$4,194,495 $3,660,380

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose these selected condensed data are taken from recent balance sheets of Bob Evans Farms (in thousands). 2020 2019 Cash $12,983 $8,308 Accounts receivable 22,433 18,683 Inventory 27,299 32,052 Other current assets 13,635 13,016 Total current assets $76,350 $72,059 Total current liabilities $254,500 $313,300 what is the current ratio for 2020 and 2019arrow_forwardGranite, Incorporated is the largest uniform supplier in North America. Selected information from its annual report follows. For the 2019 fiscal year, the company reported sales revenue of $6.1 billion and Cost of Goods Sold of $4.3 billion. Fiscal Year Balance Sheet (amounts in millions) Cash and Cash Equivalents Accounts Receivable, Net Inventory Prepaid Rent and Other Current Assets Accounts Payable Salaries and Wages Payable Notes Payable (short-term) Other Current Liabilities 2019 Current Ratio Inventory Turnover Ratio Accounts Receivable Turnover Ratio $ 540 860 330 795 210 520 116 28 2018 $430 810 340 660 190 520 28 320 Required: Assuming that all sales are on credit, compute the following ratios for 2019. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places.arrow_forwardShelcal, Inc. provides the following data for the year 2019: Net Sales Revenue, $437,690; Cost of Goods Sold, $255,000. O The gross profit as a percentage of net sales is (Round your answer to two decimal places.) OA) 37.96% OB) 39.80% OC) 60.20% OD) 40.8%arrow_forward

- .arrow_forwardThe following are Grouper Corp.’s comparative balance sheet accounts at December 31, 2020 and 2019, with a column showing the increase (decrease) from 2019 to 2020. COMPARATIVE BALANCE SHEETS 2020 2019 Increase(Decrease) Cash $818,200 $696,600 $121,600 Accounts receivable 1,132,100 1,177,800 (45,700 ) Inventory 1,841,000 1,713,900 127,100 Property, plant, and equipment 3,334,900 2,970,400 364,500 Accumulated depreciation (1,157,500 ) (1,030,100 ) (127,400 ) Investment in Myers Co. 308,600 273,500 35,100 Loan receivable 249,300 — 249,300 Total assets $6,526,600 $5,802,100 $724,500 Accounts payable $1,007,200 $949,700 $57,500 Income taxes payable 30,200 50,300 (20,100 ) Dividends payable 80,000 99,900…arrow_forwardCollege Spirit sells sportswear with logos of major universities. At the end of 2019, the followingbalance sheet account balances were available.Accounts payable $104,700Accounts receivable 6,700Accumulated depreciation 23,700Bonds payable 180,000Cash 13,300Common stock 300,000Furniture 88,000Income taxes payable $ 11,400Inventory 481,400Long-term investment 110,900Note payable, short-term 50,000Prepaid rent (current) 54,000Retained earnings, 12/31/2019 84,500Required:1. Prepare a classified balance sheet for College Spirit at December 31, 2019.2. Compute College Spirit’s working capital and current ratio at December 31, 2019.3. CONCEPTUAL CONNECTION Comment on College Spirit’s liquidity as of December 31,2019.arrow_forward

- Potaw Company reported the following data at the end of 2019: Sales revenue (80% on credit) Expenses (25% on credit) Accounts receivable, net at December 31, 2019 (a decrease of $12,500 during 2019) Total assets Stockholders' equity The average number of days to collect receivables during 2019 is closest to: (Do not round your intermediate calculations. Use 365 days a year.) Multiple Choice The average number of days to collect receivables during 2019 is closest to: (Do not round your intermediate calculations. Use 365 days a year.) O O O 17.67. 22.08. $470,000 77,000 12.81. 16,500 370,000 170,000 30.90.arrow_forwardCalculate the allowance ratio for the year ending 30 June 2020. Assume the number of days in the year is 365. Round the percentage change to one decimal placearrow_forwardIn alphabetical order below are current asset items for Roland Company's balance sheet at December 31, 2020. Accounts receivable Cash Finished goods Prepaid expenses Raw materials Work in process $214,000 65,000 88,000 39,000 91,000 94,000 Prepare the current assets section. (List Current Assets in order of liquidity.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education