FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

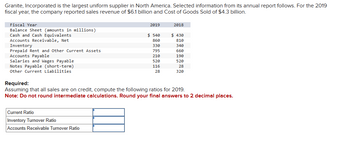

Transcribed Image Text:Granite, Incorporated is the largest uniform supplier in North America. Selected information from its annual report follows. For the 2019

fiscal year, the company reported sales revenue of $6.1 billion and Cost of Goods Sold of $4.3 billion.

Fiscal Year

Balance Sheet (amounts in millions)

Cash and Cash Equivalents

Accounts Receivable, Net

Inventory

Prepaid Rent and Other Current Assets

Accounts Payable

Salaries and Wages Payable

Notes Payable (short-term)

Other Current Liabilities

2019

Current Ratio

Inventory Turnover Ratio

Accounts Receivable Turnover Ratio

$ 540

860

330

795

210

520

116

28

2018

$430

810

340

660

190

520

28

320

Required:

Assuming that all sales are on credit, compute the following ratios for 2019.

Note: Do not round intermediate calculations. Round your final answers to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- MOSS COMPANY Selected Balance Sheet Information 2020 At December 31 Current assets Cash Accounts receivable. Inventory Current liabilities. Accounts payable Income taxes payable $ 84,650 25,000 60,000 Sales Cost of goods sold Gross profit 30,400 2,050 2019 $26,800 32,000 54,100 MOSS COMPANY Income Statement For Year Ended December 31, 2020 25,700 2,200 Operating expenses (excluding depreciation) Depreciation expense Income before taxes Income taxes expense Net income $ 515,000 331,600 183,400 121,500 36,000 25,900 7,700 $ 18,200 Use the information above to calculate cash flows from operating activities using the indirect method. Note: Amounts to be deducted should be indicated by a minus sign. Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by operating activitiesarrow_forwardSales Cost of goods sold Accounts receivable Numerator: 2021 $ 446,762 225,881 21,623 Numerator: Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. Numerator: 1 1 1 1 1 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Net Sales favorable or unfavorable? 2020 $ 290,105 146,803 16,913 Trend Percent for Net Sales: 2019 $ 232,084 119,092 15,828 2021: 2020: 2019: 2018: 2017: Is the trend percent for Cost of Goods Sold favorable or unfavorable? Trend Percent for Cost of Goods Sold: 1 Denominator: 7 1 1 1 1 1 I 1 Denominator: Trend Percent for Accounts Receivable: Denominator: 1 1 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Accounts Receivable favorable or unfavorable? 2018 $ 167,570 84,885 9,820 = = = = = = = = = = 2017 $ 128,900 64,450 8,804 = Trend percent Trend percent Trend percent % % % % % % % % % % % % %…arrow_forwardAnalysis of Loss Allowance Boulder View Corporation accounts for uncollectible accounts receivable using the allowance method. As of December 31, 2021, the credit balance in Loss Allowance was $130,000. During 2022, credit sales totaled $10,000,000, $90,000 of accounts receivable were written off as uncollectible, and recoveries of accounts previously written off amounted to $15,000. An aging of accounts receivable at December 31, 2022, showed the following Classification of Receivable Current 1-30 days past due 31-60 days past due. Over 60 days past due Accounts Receivable Balance Percentage Estimated As of December 31, 2022 $1,140,000 600,000 400,000 120,000 $2,260,000 Uncollectible 2% 10 23 75 Required: 1. Prepare the journal entry to record expected credit loss for 2022, assuming that the aging of the receivable method is applied. 2. Record journal entries to account for the write-off of $90,000 uncollectible accounts receivable and the collection of $15,000 in receivables that had…arrow_forward

- Calculate average receivable turnoverarrow_forwardBased on the financial statement information of Monster Inc. in the following table, answer the following questions: Unit in Million US$ accounts receivable annual sales Cost of goods depreciation fixed assets inventory 2019 150 71 31 Start of 2019 52 222 91 End of 2019 59 275 106 1) Calculate the Fixed-asset turnover, Inventory turnover ratio and Days receivable of Monster Inc 0.87 0.63 72 2) Compare the above results with the following industry average information, comment on their implications in terms of efficiency of asset utilisation. Industry average (Unit 2019 in Million US$) Fixed-asset turnover Inventory turnover ratio Days receivablearrow_forwardThe business is expected to make principal payments totalling $300,000 towards the loan during the fiscal year to June 30 ,2023 Question 1 Using the images and information above prepare the company’s statement of owner’s equity at June 30, 2022 and the company’s classified balance sheet at June 30, 2022arrow_forward

- Current Ratio Data: Year 2018: 787.25% Year 2019: 951.50% Year 2020: 1105.00% Year 2021:1553.51% Year 2022:1540.03% Question: which of the following transactions and events would result in an improvement in Current Ratio in year 2020? receiving cash for unearned sales revenue a cash receipt from a customer for amounts owing on goods previously sold on credit acquiring cash proceeds from a 5-year interest-only bank loan A and B only A and C only B and C only All of the above None of the abovearrow_forward5.Blige Corporation had sales revenue of $12,000,000 in 2019 and$15,000,000 in 2020. Accounts receivable were $1,800,000 at the end of2019 and $2,000,000 at the end of 2020.Required(a)Calculate the accounts receivable turnover ratio for 2019 and 2020.(b)Has the management of accounts receivable improved or worsenedfrom 2019 to 2020?(c)What are the advantages and disadvantages of selling goods oncredit?(d)How much cash did Blige Corporation collect from its customers in2020?(e)If sales in 2021 were expected to be $22,500,000, what would youexpect accounts receivable to be at the end of 2021?Does a major increase in accounts receivable createarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education