FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

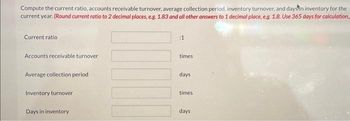

Transcribed Image Text:Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the

current year. (Round current ratio to 2 decimal places, e.g. 1.83 and all other answers to 1 decimal place, e.g. 1.8. Use 365 days for calculation.

Current ratio

Accounts receivable turnover

Average collection period

Inventory turnover

Days in inventory

:1

times

days

times

days

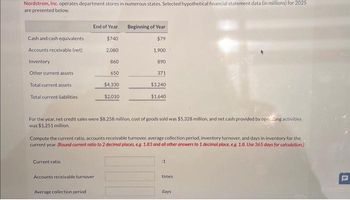

Transcribed Image Text:Nordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2025

are presented below.

Cash and cash equivalents

Accounts receivable (net)

Inventory

Other current assets

Total current assets

Total current liabilities

End of Year

Current ratio:

$740

2,080

Accounts receivable turnover

Average collection period

860

650

$4,330

$2,010

Beginning of Year

$79

1.900

For the year, net credit sales were $8,258 million, cost of goods sold was $5,328 million, and net cash provided by opcing activities

was $1,251 million.

890

Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the

current year. (Round current ratio to 2 decimal places, eg 1.83 and all other answers to 1 decimal place, e.g. 1.8. Use 365 days for calculation)

371

$3,240

$1,640

:1

times

days

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Similar questions

- Suppose that the following information is available for Nike Inc. for the current year. Beginning inventory Ending inventory Cost of goods sold Net sales Inventory turnover Days in inventory $10,000 Calculate the inventory turnover, days in inventory, and gross profit rate for Nike Inc. for the current year. (Round gross profit rate to 2 decimal places, e.g. 12.51 and other answers to 1 decimal place, e.g. 15.2. Use 365 days for calculation.) Gross profit rate 12,500 80,100 140,000 times days % .arrow_forwardBased on the following data for the current year, what is the number of days' sales in inventory (rounded to one decimal place)? Assume 365 days a year. Sales on account during year $404,861 Cost of goods sold during year 187,185 Accounts receivable, beginning of year 41,348 Accounts receivable, end of year 53,834 Inventory, beginning of year 33,236 Inventory, end of year 44,404 a.75.7 b.151.3 c.86.6 d.64.8arrow_forwardA company reports the following: Line Item Description Amount Cost of goods sold $2,007,500 Average inventory 182,500 Determine (a) the inventory turnover and (b) the days’ sales in inventory. Round your answers to one decimal place. Assume a 365-day year. Line Item Description Answer a. Inventory turnover b. Days’ Sales in Inventoryarrow_forward

- Given the following information Compute: (A) age of inventory; and (B) operating cycle. (check the attached picture) Choose the bullet with the correct answer (A) 18.5 days and (B) 25.5 days (A) 28.5 days and (B) 35.5 days (A) 28.5 days and (B) 55.5 days (A) 38.5 days and (B) 75.5 days (A) 38.5 days and (B) 95.5 daysarrow_forwardBased on the following information compute (a) inventory turnover, (b) average daily cost of merchandise sold, and (c) days' sales in inventory for the current year. Use a 365-day year. Item Prior Year Current Year Cost of merchandise sold $172,900 $215,000 Inventory 18,000 12,000 If required, round your answers to two decimal places. (a) Inventory turnover times (b) Average daily cost of merchandise sold $ (c) Days' sales in inventory days (d) If an inventory turnover of 12 is average for the industry, how is this company doing?arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Use FIFO to determine the cost of the ending inventory. Assume 35 FitBits in inventory at the end of the year. b. What was the Cost of Goods Sold (COGS)?arrow_forwardcalculate number of days sales in inventoryarrow_forwardSuppose the following:Beginning Inventory = 11257Ending Inventory= 12407Beginning Receivables = 6167Ending Receivables = 6879Beginning Payables = 8498Ending Payables = 8829Credit Sales = 93480Cost of Goods Sold = 72325Calculate the following (round final answers to 2 decimal places):Operating Cycle = daysCash Cycle = daysarrow_forward

- Next Hope reported the following income statement for the year ended December 31, 2026: View the income statement. Requirements 1. 2. Compute Next Hope's inventory turnover rate for the year. (Round to two decimal places.) Compute Next Hope's days' sales in inventory for the year. (Round to two decimal places.) ... Requirement 1. Compute Next Hope's inventory turnover rate for the year. (Round to two decimal places.) Select the labels and enter the amounts to compute the inventory turnover rate. (Round your answer to two decimal places, X.XX.) Income statement = Inventory turnover = times Next Hope Income Statement Year Ended December 31, 2026 Requirement 2. Compute Next Hope's days' sales in inventory for the year. (Round to two decimal places.) ÷ ÷ Select the labels and enter the amounts to compute the days' sales in inventory for the year. (Enter all amounts to two decimal places, X.XX.) Days' sales in inventory days Net Sales Revenue $ 148,000 Cost of Goods Sold: = Beginning…arrow_forwardSolve for the missing information designated by "?" in the following table. (Use 365 days in a year. Round the inventory turnover ratio to one decimal place before computing days to sell. Round days to sell to one decimal place.) Case a. b. C. $ $ Beginning Inventory Purchases 200 $ 300 900 Cost of Goods Sold $ $ $ 900 $ 1,600 1,400 $ Ending Inventory 200 100 Inventory Turnover Ratio 8.0 Days to Sell 26.1arrow_forwardInventory at the beginning of the year cost $13,900. During the year, the company purchased (on account) inventory costing $86,500. Inventory that had cost $82,500 was sold on account for $97,000. Required: a. Calculate the amount of ending inventory. b. What was the amount of gross profit? c. Prepare journal entry to record sale of inventory assuming a perpetual system is used. Debit Credit Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education