Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

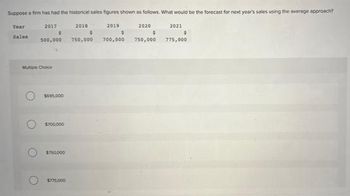

Transcribed Image Text:Suppose a firm has had the historical sales figures shown as follows. What would be the forecast for next year's sales using the average approach?

Year

2017

2018

Sales

$

750,000

500,000

Multiple Choice

O

$695,000

$700,000

$750,000

$775.000

2019

$

700,000

2020

$

750,000

2021

$

775,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Lewellen Products has projected the following sales for the coming year: 01 02 03 04 Sales $940 $1,020 $980 $1,080 Sales in the year following this one are projected to be 20 percent greater in each quarter a. Calculate payments to suppliers assuming that the company places orders during each quarter equal to 30 percent of projected sales for the next quarter. Assume that the company pays immediately. What is the payables period in this case? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate payments to suppliers assuming a 90-day payables period. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Calculate payments to suppliers assuming a 60-day payables period. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. b. Payment of accounts Payment of accounts Payment of accounts 01 02 Q3 Q4arrow_forwardThe following table presents forecasted financial and other information for Scandinavian Furniture: Projected EBIT Earnings after tax Free cash flow Havasham's WACC Expected growth rate in FCFs after 2014 Warranted MV firm/FCF in 2014 Warranted P/E in 2014 O $3,628 million O $363 million O $3,833 million 2012 $317 197 135 O $161 million 8.2% 4.0% What is an appropriate estimate of Scandinavian Furniture's terminal value as of the end of 2014, using the perpetual-growth equation as your estimate? 19.4 18.7 2013 $339 210 144 2014 $363 225 155arrow_forwardQuestion is in the screen shotarrow_forward

- If a company's sales are $650,000 in 2021, and this represents an 5% increase over sales in 2020, what were sales in 2020? (Round your answer to the nearest dollar amount.) Salesarrow_forwardSuppose a firm has had the following historic sales figures. What would be the forecast for next year's sales using the average approach? You must use the built-in Excel function to answer this question. Input area: Year Sales 2016 2017 2018 es es e $ 1,500,000 $ 1,750,000 $ 1,400,000 2019 $ 2,000,000 2020 $ 1,600,000 Output area: Next year's salesarrow_forwardEstimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for Texas Roadhouse for 2016 through 2019. a. Forecast the terminal period values assuming a 1% terminal period growth rate for all three model inputs: Sales, NOPAT, and NOA. Round your answers to the nearest dollar. Reported Forecast Horizon Terminal $ thousands 2015 2016 2017 2018 2019 Period Sales $1,807,368 $2,078,473 $2,390,244 $2,581,464 $2,787,981 Answer NOPAT 102,495 170,435 196,000 211,680 228,614 Answer NOA 662,502 761,904 876,189 946,284 1,021,987 Answer b. Estimate the value of a share of TXRH common stock using the discounted cash flow (DCF) model as of December 29, 2015; assume a discount rate (WACC) of 7%, common shares outstanding of 70,091 thousand, net nonoperating obligations (NNO) of $(14,680) thousand, and noncontrolling interest (NCI) from the balance sheet of $7,520 thousand. Note that NNO is negative because the company’s cash exceeds its…arrow_forward

- You are given the dollar value of a product in 2016 and the rate at which the value of the product is expected to change during the next 5 years. Use this information to write a linear equation that gives the dollar value V of the product in terms of the year t. (Let t = 16 represent 2016.) 2016 Value Rate $5000 $170 decrease per yeararrow_forwardWhy did Estee Lauder greatly increase the payout ratio in 2020 when the pandemic broke out. Why Did it decrease its payout ratio dramatically in 2021arrow_forwardSuppose a firm has had the following historic sales figures. Year: 2016 Sales $1,420,000 2017 $1,720,000 Next year's sales 2018 2019 2020 $1,600,000 $2,010,000 $1,770,000 What would be the forecast for next year's sales using FORECAST.ETS to estimate a trend? Note: Round your answer to the nearest whole dollar. 27arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education