Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

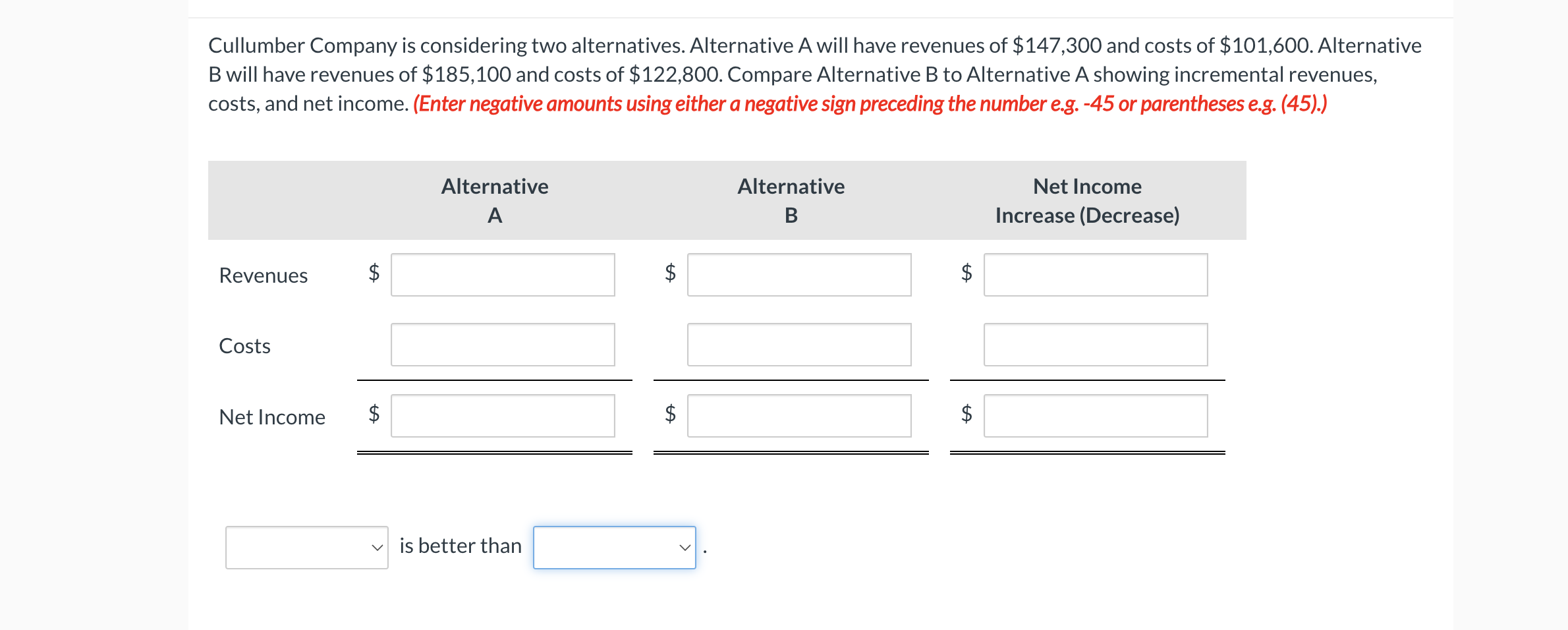

Transcribed Image Text:Cullumber Company is considering two alternatives. Alternative A will have revenues of $147,300 and costs of $101,600. Alternative

B will have revenues of $185,100 and costs of $122,800. Compare Alternative B to Alternative A showing incremental revenues,

costs, and net income. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Revenues

Costs

Net Income

+A

Alternative

A

☑ is better than

A

Alternative

B

$

Net Income

Increase (Decrease)

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cullumber Company is considering two alternatives. Alternative A will have revenues of $147,300 and costs of $101,600. Alternative B will have revenues of $185,100 and costs of $122,800. Compare Alternative A to Alternative B showing incremental revenues, costs, and net income. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Revenues Alternative A Costs Net Income $ is better than $ SA $ Alternative B $ Net Income Increase (Decrease)arrow_forwardWildhorse Company is considering two alternatives. Alternative A will have revenues of $149,900 and costs of $103,900. Alternative B will have revenues of $184,300 and costs of $123,800. Compare Alternative A to Alternative B showing incremental revenues, costs, and net income. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Revenues Costs Net Income Alternative B Alternative A $ tA $ Alternative A is better than $ LA LA $ Alternative B LA LA $ Net Income Increase (Decrease)arrow_forwardOriole Company is considering two alternatives. Alternative A will have revenues of $147,400 and costs of $103,400. Alternative B will have revenues of $188,200 and costs of $121,600. Compare Alternative A to Alternative B showing incremental revenues, costs, and net income. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Revenues $ Costs Alternative A Net Income $ ▾ is better than +A Alternative B Net Income Increase (Decrease) +A +Aarrow_forward

- Crane Company is considering two alternatives. Alternative A will have revenues of $149,100 and costs of $101,400. Alternative B will have revenues of $170,000 and costs of $125,400. Compare Alternative A to Alternative B showing incremental revenues, costs, and net income. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Revenues Costs Net Income $ Alternative A is better than Alternative B Net Income Increase (Decrease)arrow_forwardAcarrow_forwardCarla Vista Company is considering two alternatives. Alternative A will have revenues of $148.000 and costs of $104,200. Alternative Bwill have revenues of $188.000 and costs of $123.800. Compare Alternative A to Alternative B showing incremental revenues. costs, and net income. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses es (45)) Alternative Alternative B Net Income Increase (Decrease) Revenues Costs Net Income is better than 5 Sarrow_forward

- Blossom Company is considering two alternatives. Alternative A will have revenues of $145,100 and costs of $104,800. Alternative B will have revenues of $184,300 and costs of $121,900. Compare Alternative A to Alternative B showing incremental revenues, costs, and net income. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Alternative A $ 145100 Revenues Costs Net Income 104800 40300 Alternative B Vis better than Alternative A Alternative B Net Income Increase (Decrease) 184300 $ 39200 i 121900 62400 17100 22100arrow_forwardBogart Company is considering two alternatives. Alternative A will have revenues of $149,900 and costs of $103,900. Alternative B will have revenues of $184,300 and costs of $123,800. Compare Alternative A to Alternative B showing incremental revenues, costs, and net income. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Alternative Alternative Net Income Increase (Decrease) Revenues 24 2$ Costs Net Income$ is better thanarrow_forwardCoronado Company is considering two alternatives. Alternative A will have revenues of $146,300 and costs of $101,000. Alternative B will have revenues of $187,100 and costs of $124,900. Compare Alternative A to Alternative B showing incremental revenues, costs, and net income. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Alternative A Alternative B Net Income Increase (Decrease) $ $ Revenues Costs $ Net Income $ is better than $ $arrow_forward

- Please do not give solution in image format ?.arrow_forwardCarla Vista Company is considering two alternatives. Alternative A will have sales of $154,800 and costs of $100,100. Alternative B will have sales of $181,400 and costs of $131,800. Compare alternative A with alternative B showing incremental revenues, costs, and net income. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Revenues Costs Net income $ Alternative A is better than Alternative A Alternative B eTextbook and Media $ Alternative B $ Net Income Increase (Decrease)arrow_forwardSandhill Company is considering two alternatives. Alternative A will have sales of $157,300 and costs of $100,800. Alternative B will have sales of $181.500 and costs of $139,600. Compare alternative A with alternative B showing incremental revenues, costs, and net income. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g.-15,000 or parenthesis, e.g. (15,000)) Revenues Costs Net income $ Alternative A is better than $ Alternative B Net Income Increase (Decrease)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning