SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

am.700.

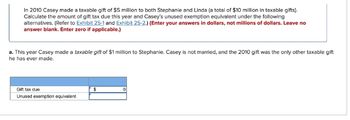

Transcribed Image Text:In 2010 Casey made a taxable gift of $5 million to both Stephanie and Linda (a total of $10 million in taxable gifts).

Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following

alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars, not millions of dollars. Leave no

answer blank. Enter zero if applicable.)

a. This year Casey made a taxable gift of $1 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift

he has ever made.

Gift tax due

Unused exemption equivalent

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How much taxable income should each of the following taxpayers report? a. Kimo builds custom surfboards. During the current year, his total revenues are 90,000, and he incurs 30,000 in expenses. Included in the 30,000 is a 10,000 payment to Kimos five-year-old son for services as an assistant. b. Manu gives hula lessons at a local bar. During the current year, she receives 9,000 in salary and 8,000 in tips. In addition, she engages in illegal behavior, for which she receives 10,000.arrow_forwardIn 2010 Casey made a taxable gift of $6.1 million to both Stephanie and Linda (a total of $12.2 million in taxable gifts). Calculate the amount of gift tax due this year and Casey’s unused exemption equivalent under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable.) a. This year Casey made a taxable gift of $1 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made.arrow_forwardIn 2010 Casey made a taxable gift of $6.9 million to both Stephanie and Linda (a total of $13.8 million in taxable gifts). Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) Note: Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable. a. This year Casey made a taxable gift of $1 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Gift tax due - $0 Unused applicable credit - ? b. This year Casey made a taxable gift of $16.9 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Gift tax due - ? Unused applicable credit - $0 c. This year Casey made a gift worth $16.9 million to Stephanie. Casey married Helen last year, and they live in a common-law state. The 2010 gift was the only other taxable gift Casey or…arrow_forward

- In 2010 Casey made a taxable gift of $5.7 million to both Stephanie and Linda (a total of $11.4 million in taxable gifts). Required: Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable.) a. This year Casey made a taxable gift of $1 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Gift tax due $ Unused exemption equivalentarrow_forwardGadubhaiarrow_forwardIn 2010 Casey made a taxable gift of $5 million to both Stephanie and Linda (a total of $10 million in taxable gifts). Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable.) a. This year Casey made a taxable gift of $1 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Gift tax due Unused exemption equivalent $ 0arrow_forward

- I need help with Gift tax due.arrow_forward[The following information applies to the questions displayed below.] In 2010 Casey made a taxable gift of $5 million to both Stephanie and Linda (a total of $10 million in taxable gifts). Required: Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable.) a. This year Casey made a taxable gift of $1 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. X Answer is complete but not entirely correct. Gift tax due $ Unused exemption equivalent $ 10,700,000arrow_forwardI need help with unused exemption equivalentarrow_forward

- Required information [The following information applies to the questions displayed below.) In 2010 Casey made a taxable gift of $7.2 million to both Stephanie and Linda (a total of $14.4 million in taxable gifts). Calculate the amount of gift tax due this year and Casey's unused applicable credit under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) Note: Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable. a. This year Casey made a taxable gift of $1 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Gift tax due S 0 Unused applicable creditarrow_forwardI need help with unsed exemption equivalentarrow_forwardRequired information [The following information applies to the questions displayed below.] In 2010 Casey made a taxable gift of $5.9 million to both Stephanie and Linda (a total of $11.8 million in taxable gifts). Calculate the amount of gift tax due this year and Casey's unused applicable credit under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) Note: Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable. c. This year Casey made a gift worth $15.9 million to Stephanie. Casey married Helen last year, and they live in a common-law state. The 2010 gift was the only other taxable gift Casey or Helen has ever made. Casey and Helen elect to gift-split this year. Casey's gift tax due $ Casey's unused applicable credit Helen's gift tax due $ 0 Helen's unused applicable creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT