Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

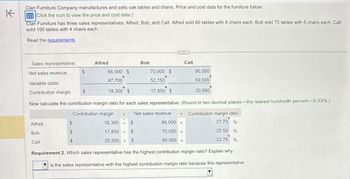

Clan Furniture Company manufactures and sells oak tables and chairs. Price and cost data for the furniture follow:

Click the icon to view the price and cost data.)

Clan Furniture has three sales representatives: Alfred, Bob, and Cait. Alfred sold 60 tables with 8 chairs each. Bob sold 70 tables with 6 chairs each. Cait

sold 100 tables with 4 chairs each.

Read the requirements.

Sales representative:

Alfred

Bob

Cait

Net sales revenue

$

66,000 $

70,000 $

90,000

47,700

Variable costs

Contribution margin

52,150

69,500

$

18,300 $

17,850 $

20,500

Now calculate the contribution margin ratio for each sales representative. (Round to two decimal places-the nearest hundredth percent-X.XX%.)

Contribution margin

÷

Net sales revenue = Contribution margin ratio

Alfred

$

18,300

"

÷

66,000 =

27.73

%

Bob

$

17,850 ÷ $

70,000

=

25.50 %

20,500 +

$

90,000

=

22.78

%

Cait

$

Requirement 2. Which sales representative has the highest contribution margin ratio? Explain why.

is the sales representative with the highest contribution margin ratio because this representative

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Calculate the total contribution margin and the contribution margin ratio for each sales representative (round to two decimals places)arrow_forwardRichardson Ski Racing (RSR) sells equipment needed for downhill ski racing. One of RSR's products is fencing used on downhill courses. The fence product comes in 150-foot rolls and sells for $215 per roll. However, RSR offers quantity discounts. The following table shows the price per roll depending on order size: Quantity Ordered To From 1 30 31 60 61 120 121 and up Price per Roll $215 $195 $175 $155 Click on the datafile logo to reference the data. DATA file (a) Use the XLOOKUP function with the preceding pricing table to determine the total revenue from these orders. Hint: Xlookup is an Excel function available in Excel 2021 and above and in Microsoft 360. VLOOKUP, in this case will result in the same answer. $ 32260 (b) Use the COUNTIF function to determine the number of orders in each price bin. From To Price per Roll Number of Orders 30 $215 40 31 60 $195 50 61 120 $175 60 121 and up $155 22 * * * *arrow_forwardRichardson Ski Racing (RSR) sells equipment needed for downhill ski racing. One of RSR's products is fencing used on downhill courses. The fence product comes in 150-foot rolls and sells for $215 per roll. However, RSR offers quantity discounts. The following table shows the price per roll depending on order size: From Quantity Ordered To 30 Price per Roll 1 31 60 61 120 121 and up $215 $195 $175 $155 Click on the datafile logo to reference the data. DATA file (a) Use the VLOOKUP function with the preceding pricing table to determine the total revenue from these orders. (b) Use the COUNTIF function to determine the number of orders in each price bin. From To Price per Roll Number of Orders 1 31 61 32 80 $215 $195 120 $175 121 and up $155 172 Hint(s) Check My Workarrow_forward

- Stable Paper Delivery has decided to analyze the profitability of five new customers. It buys recycled paper at $12 per case and sells to retail customers at a list price of $14.80 per case. Data pertaining to the five customers are: E (Click the icon to view the data.) Stable Paper Delivery's five activities and their cost drivers are as follows: E (Click the icon to view the activities and cost drivers.) Read the requirements. Requirement 1. Compute the customer-level operating income of each of the five retail Begin by calculating each customer's gross margin. Then calculate the operating incom minus sign for operating losses.) Requirements 1 2 1. Compute the customer-level operating income of each of the five retail customers now being examined (1, 2, 3, 4, and 5). Comment on the results. 2. What insights do managers gain by reporting both the list selling price and the actual selling price for each customer? 3. What factors should managers consider in deciding whether to drop one…arrow_forwardFitness Express sells three different types of elliptical machines. They have manufactured 50 of each machine for a special sale. The store already ha orders for 46 of machine A and 16 of machine B. Use the following information to determine how many of machine C the store needs to sell to break even? Show your work on a separate sheet of paper. Manufacturing Cost $105.00 $140.00 $175.00 Elliptical Machine Machine A Machine B Machine C Total costs of all machines: $ Total revenue: $ Number of machine Cs to sell to break even: Retail Cost $250.00 $305.00 $420.00arrow_forwardPlease help me solve this accounting questionarrow_forward

- Please avoid solutions in an image format thanksarrow_forwardPrepare journal entries for the following transactions from Forest Furniture. Oct. 3 Sold 2 couches with a sales price of $2,450 per couch to customer Norman Guzman. Norman Guzman paid with his Draw Plus credit card. The Draw Plus credit card charges Forest Furniture a 3.5% usage fee based on the total sale per transaction. The cost for this sale is $1,700 per couch. Oct. 6 Sold 4 end chairs for a total sales price of $1,250 to April Orozco. April paid in full with cash. The cost of the sale is $800. Oct. 9 Sold 18 can lights with a sales price of $50 per light to customer James Montgomery. James Montgomery paid using his Fund Max credit card. Fund Max charges Forest Furniture a 2.4% usage fee based on the total sale per transaction. The cost for this sale is $29 per light. Oct. 12 Draw Plus made a cash payment in full to Forest Furniture for the transaction from Oct 3, less any usage fees. Oct. 15 Fund Max made a cash payment of 25% of the total due to…arrow_forwardPrepare journal entries for the following transactions from Forest Furniture. Oct. 3 Sold 2 couches with a sales price of $2,450 per couch to customer Norman Guzman. Norman Guzman paid with his Draw Plus credit card. The Draw Plus credit card charges Forest Furniture a 3.50% usage fee based on the total sale per transaction. The cost for this sale is $1,800 per couch. Oct. 6 Sold 4 end chairs for a total sales price of $1,250 to April Orozco. April paid in full with cash. The cost of the sale is $800. Oct. 9 Sold 18 can lights with a sales price of $50 per light to customer James Montgomery. James Montgomery paid using his Fund Max credit card. Fund Max charges Forest Furniture a 2.40% usage fee based on the total sale per transaction. The cost for this sale is $30 per light. Oct. 12 Draw Plus made a cash payment in full to Forest Furniture for the transaction from Oct 3, less any usage fees. Oct. 15 Fund Max made a cash payment of 25% of the total due to Forest Furniture…arrow_forward

- A buyer for home furnishings orders merchandise from a North Carolina vendor totaling 2,800. The vendor offers two options a) 3/10 net 30 FOB Destination (to buyers' warehouse or (b) 6/10 FOB Factory. If transportation costs are @250, which would be the better option for the buyer?arrow_forwardHouse of Organs, Inc., purchases organs from a well-known manufacturer and sells them at the retail level. The organs sell, on the average, for $2,500 each. The average cost of an organ from the manufacturer is $1,500. The costs that the company incurs in a typical month are presented below: Costs Cost Formula Selling: Advertising . . . . . . . . . . . . . . . . . . . . . . . $950 per monthDelivery of organs . . . . . . . . . . . . . . . $60 per organ soldSales salaries and commissions . . . . . . $4,800 per month, plus 4% of salesUtilities . . . . . . . . . . . . . . . . . . . . . . . . . . $650 per monthDepreciation of sales facilities . . . . . . . . $5,000 per month Administrative: Executive salaries . . . . . . . . . . . . . . . $13,500 per monthDepreciation of…arrow_forwardBoston Home Center (BHC) offers customers the use of a truck at $64 per trip to take purchased merchandise home. BHC reports the following information about the trucks it has for customer usage: Cost Driver Rate Cost Driver Volume Resources used Operation $ 0.55 per mile 46,200 miles Administration 25.00 per trip 1,874 trips Resources supplied Operation $ 35,400 Administration $ 62,400 Sales revenue totaled $80,000. Required: Prepare a traditional income statement. Prepare an activity-based income statement. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a traditional income statement. Traditional Income Statement Sales revenue Operation costs Administration costs Operating profit Activity-Based Income Statement Resources Used Unused Resource Capacity…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning