Financial & Managerial Accounting

13th Edition

ISBN: 9781285866307

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I need the answer to price variance and efficieny

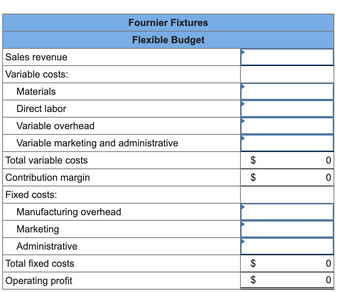

Transcribed Image Text:Sales revenue

Variable costs:

Materials

Direct labor

Variable overhead

Fournier Fixtures

Flexible Budget

Variable marketing and administrative

Total variable costs

Contribution margin

Fixed costs:

Manufacturing overhead

Marketing

Administrative

Total fixed costs

Operating profit

$

0

ᏌᏊ

$

0

EAEA

$

0

$

0

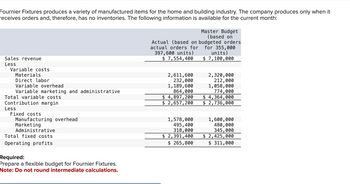

Transcribed Image Text:Fournier Fixtures produces a variety of manufactured items for the home and building industry. The company produces only when it

receives orders and, therefore, has no inventories. The following information is available for the current month:

Master Budget

(based on

Actual (based on budgeted orders

actual orders for

for 355,000

units)

$ 7,100,000

Sales revenue

Less

Variable costs

Materials

Direct labor

Variable overhead

Variable marketing and administrative

Total variable costs

Contribution margin

Less

Fixed costs

Manufacturing overhead

Marketing

Administrative

Total fixed costs

Operating profits

Required:

Prepare a flexible budget for Fournier Fixtures.

Note: Do not round intermediate calculations.

397,600 units)

$ 7,554,400

2,611,600

232,000

1,189,600

864,000

$ 4,897,200

$ 2,657,200

1,578,000

495,400

318,000

$ 2,391,400

$ 265,800

2,320,000

212,000

1,058,000

774,000

$ 4,364,000

$ 2,736,000

1,600,000

480,000

345,000

$ 2,425,000

$ 311,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Wade Company expects to produce 6,000 units of product IOA during the current year. Budgeted variable manufacturing costs per unit are direct materials $5, direct labour $12, and overhead $18. Monthly budgeted fixed manufacturing overhead costs are $8,300 for depreciation and $4,000 for supervision. In the current month, Wade produced 6,500 units and incurred the following costs: direct materials $30,270, direct labour $74,000, variable overhead $127,656, depreciation $8,300, and supervision $4,224. Prepare a static budget report. (List variable costs before fixed costs.)arrow_forwardContribution Margin, Cost-Volume-Profit Analysis and Break-Even Point (Overview) Fixed, Variable and Mixed Costs An appreciation of cost behavior is needed in order for management to understand and predict profitability as the costs of material, labor and other operating expenses and levels of production and sales change. It's important to review the cost behavior of fixed, variable and mixed costs before contribution margins, cost-volume-profit analysis, and break-even points. 1. In the table below, Have-A-Seat Inc. has outlined many of the costs associated with producing office chairs. With respect to the production and sale of office chairs, classify each cost as fixed, mixed, or variable. a. Pressure-molded plastic for chair frames b. Pension cost: $0.50 per employee hour on the job c. Insurance premiums for inventory: $2,100 per month plus $0.01 for each dollar of inventory over $2 million d. Property taxes: $120,000 per year for the factory building and…arrow_forwardNottingham Forest Products reports the following information concerning operations for the most recent month: Master Budget (based on Sales revenue Less Manufacturing costs Direct labor Materials Variable overhead Marketing Administrative Total variable costs Contribution margin Fixed costs Manufacturing Marketing Administrative Total fixed costs Operating profits There are no inventories. Actual (based on actual sales budgeted sales of 4,800 units) of 4,000 units) $ 188,000 $ 228,700 50,302 31,520 16,608 7,805 7,215 $ 113,450 $ 115,250 38,930 14,860 9,510 $ 63,300 $ 51,950 Required: Prepare a flexible budget for Nottingham Forest Products. 39,000 27, 200 13,100 6, 200 6,500 $ 92,000 $ 96,000 37,400 12, 200 10,400 $ 60,000 $ 36,000arrow_forward

- Please do not give solution in image format thank youarrow_forwardMastery Problem: Contribution Margin, Cost-Volume-Profit Analysis and Break-Even Point (Overview) Fixed, Variable and Mixed Costs An appreciation of cost behavior is needed in order for management to understand and predict profitability as the costs of material, labor and other operating expenses and levels of production and sales change. It's important to review the cost behavior of fixed, variable and mixed costs before contribution margins, cost-volume-profit analysis, and break-even points. 1. In the table below, Have-A-Seat Inc. has outlined many of the costs associated with producing office chairs. With respect to the production and sale of office chairs, classify each cost as: a.fixed b.mixed c.variable. a. Pressure-molded plastic for chair frames b. Pension cost: $0.50 per employee hour on the job c. Insurance premiums for inventory: $2,100 per month plus $0.01 for each dollar of inventory over $2 million d. Property taxes: $120,000 per year for…arrow_forwardSupport department costs are applied to products as a part of a.fixed manufacturing costs b.fixed selling and administrative expenses c.variable cost of goods sold d.overheadarrow_forward

- Under variable costing, which of the following are costs that can be inventoried Select one: O O a. variable manufacturing overhead b. fixed selling and administrative expense c. variable selling and administrative expense d. fixed manufacturing overheadarrow_forwardThe difference between marginal costing and absorption costing net income centres on how to account for O a. direct material costs O b. fixed manufacturing overhead costs O C. variable and fixed manufacturing overhead costs O d. variable manufacturing overhead costsarrow_forwardQuestion Content Area Which of the following is a reason for easy identification and control of variable manufacturing costs under the variable costing method? a. Fixed costs, such as property insurance, are normally the responsibility of higher management not the operating management. b. Variable and fixed costs are reported separately. c. Variable costs can be controlled by the operating management. d. all of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning