Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

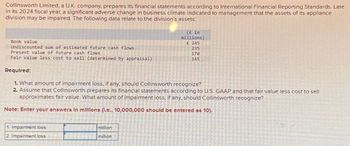

Transcribed Image Text:Collinsworth Limited, a U.K. company, prepares its financial statements according to International Financial Reporting Standards. Late

in its 2024 fiscal year, a significant adverse change in business climate indicated to management that the assets of its appliance

division may be impaired. The following data relate to the division's assets:

Book value

Undiscounted sum of estimated future cash flows

Present value of future cash flows

Fair value less cost to sell (determined by appraisal)

Required:

(£ in

millions)

£ 245

235

170

165

1. What amount of impairment loss, if any, should Collinsworth recognize?

2 Assume that Collinsworth prepares its financial statements according to U.S. GAAP and that fair value less cost to sell

approximates fair value. What amount of impairment loss, if any, should Collinsworth recognize?

Note: Enter your answers In millions (l.e., 10,000,000 should be entered as 10).

1. Impairment loss

2. Impairment loss

million

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Collinsworth LTD., a U.K. company, prepares its financial statements according to International Financial Reporting Standards. Late in its 2021 fiscal year, a significant adverse change in business climate indicated to management that the assets of its appliance division may be impaired. The following data relate to the division’s assets: (£ in millions)Book value £220Undiscounted sum of estimated future cash flows 210Present value of future cash flows 150Fair value less cost to sell (determined by appraisal) 145 Required:1. What amount of impairment loss, if any, should Collinsworth recognize?2. Assume that Collinsworth prepares its financial statements according to U.S. GAAP and that fair value less cost to sell…arrow_forwardThe 2020 comparative balance sheet and 2020 income statement of Maple Group Ltd, have just been prepare and presented to the owners by the company’s Accountant. Upon close examination of the financial information received, it was discovered that some figures in the balance sheet were erroneously omitted due to an oversight by the accountant who is not available to fix the problem due to his unavoidable absence from work. In addition, the owners were concerned about the movement in the company’s cash and cash equivalent given that the balance sheet does not show or explain the reason or reasons why there was an increase or decrease in this area. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners. Maple Group Ltd Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/(Decrease) Assets Cash and…arrow_forwardThe 2020 comparative balance sheet and 2020 income statement of Maple Group Ltd, have just been prepare and presented to the owners by the company’s Accountant. Upon close examination of the financial information received, it was discovered that some figures in the balance sheet were erroneously omitted due to an oversight by the accountant who is not available to fix the problem due to his unavoidable absence from work. In addition, the owners were concerned about the movement in the company’s cash and cash equivalent given that the balance sheet does not show or explain the reason or reasons why there was an increase or decrease in this area. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners. The owners have asked each student from your accounting course to assist with the needed clarification and have put forward the following financial information grouped…arrow_forward

- Vison software reported the following amounts on its balance sheets at December 31, 2020, 2019, and 2018 *Data table provided* Sales and profits are high. Nevertheless, Vision is experiencing a cash shortage. Perform a vertical analysis of Vision Software's assets at the end of years 2020, 2019, and 2018. Use the analysis to explain the reason for the cash shortage.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPlease do not give solution in image format ?.arrow_forward

- Numbers and descriptions match what really existed or happened. Economic entity assumption Kodak Company's income is projected to be lower than in previous years, so a switch from accelerated depreciation to straight-line depreciation is made in this year. Going concern assumption Presentation of timely information with predictive and confirmatory value. Monetary unit assumption Stable dollar assumption (do not use historical cost principle). Consistency characteristic The president of Selectron Corporation believes it is not necessary to report financial information on a yearly basis. The president believes that financial information should only be disclosed when significant new information is available related to the company's operations. Periodicity assumption The performance obligation is satisfied. Faithful representation characteristic Walgreen Pharmaceutical Corporation reports information…arrow_forwardnot use ai pleasearrow_forwardRequired: 1. Prepare revised income statements according to generally accepted accounting principles, beginning with income from continuing operations before income taxes. Ignore EPS disclosures. 2. Assume that by December 31, 2016, the division had not yet been sold but was considered held for sale. The fair value of the division’s assets on December 31 was $5,000,000. How would the presentation of discontinued operations be different from your answer to requirement 1? 3. Assume that by December 31, 2016, the division had not yet been sold but was considered held for sale. The fair value of the division’s assets on December 31 was $3,900,000. How would the presentation of discontinued operations be different from your answer to requirement 1?arrow_forward

- You have partial information from an entity financial statements as follows: Accounts receivable Allowance for doubtful accounts Inventory FV-NI Investments Accounts payable Unearned revenues Equipment Accumulated depreciation - equipment Sales Cost of goods sold Depreciation expense Bad debt expense Loss on sale of equipment Loss on sale of FV-NI investments Holding gain- FV-NI investments Note also the following: Accounts written off that were recoved during 2024: $ $ $ $ $ 2024 4,450,000 $ (198,000) $ 3,820,000 $ 1020000 2,740,000 $ 365,000 $ 200,000 -98,000 $ $ $ $ $ 2023 3,690,000 (165,000) 4,490,000 925000 2,630,000 430,000 189,000 -89,000 20,560,000 9,250,000 10,000 356,000 5,500 5000 33000 25,000 Required 1) Calculate the cash collected from customers in 2024. 2) Calculate the cash paid to suppliers for purchase of inventory. 3) One FV-NI investment was sold during the year. Its carrying value at the beginning of the year was: $ 125,000 Calculate the NET cash generated/used up…arrow_forwardI know in order to find changes in current operating assets using the indirect method you start with the net income and subtract the increase in liabilities which would be your accounts receivable and add your decrease in inventory and subtract your decrease in accounts payable in order to find the net income. However when I compute this it says I am incorrect.arrow_forwardFinancial accounting rules require firms to assess whether they will recover carrying amounts of long-lived assets and, if not, to write down the assets to their fair value and recognize an impairment loss in income from continuing operations. Impairment charges often appear as a separate line item on the income statement of companies that experience reductions in the future benefits originally anticipated from the long-lived assets. Conduct a search to identify a firm (other than those given in this chapter) that has recently reported an impairment charge. Discuss how the firm (a) reported the charge on the income statement, (b) determined the amount of the charge, and (c) used cash related to the charge.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning