Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Rakesh

Don't upload image please

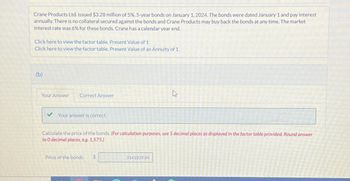

Transcribed Image Text:Crane Products Ltd. issued $3.28 million of 5%, 5-year bonds on January 1, 2024. The bonds were dated January 1 and pay interest

annually. There is no collateral secured against the bonds and Crane Products may buy back the bonds at any time. The market

interest rate was 6% for these bonds. Crane has a calendar year end.

Click here to view the factor table. Present Value of 1

Click here to view the factor table. Present Value of an Annuity of 1

(b)

Your Answer

Correct Answer

Your answer is correct.

Calculate the price of the bonds. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer

to 0 decimal places, e.g. 1,575.)

Price of the bonds $

D

3141839.84

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Can you send another picture or write it down cuz i dont understandarrow_forwardAutoSave Normal 因 Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) v 11 - A^ A Aav A E E O Find - AaBbCcDc AaBbCcDc AABBCC AABBCCC AaB AABBCCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 2 3 4 Winter Company reported the following for the most recent month: Physical Units 700 Beginning work in process (60% complete) Units transferred in (started) during month Ending work in process 4,800 950 Materials are added at the end of the process and conversion costs are added evenly throughout the process. If equivalent whole units of production for conversion using the weighted average were 4,816, what percent complete was ending work in process at the end of the month? (Round to the nearest whole percent.) а. 20% b. 16%…arrow_forwardAutoSave Off H Document2 - Word P Search (Alt+Q) Sign in File Design References Mailings Review View Help Grammarly Picture Format P Comments A Share Home Insert Draw Layout P Find - - A A Aa v A = - E - E G Times New Roman v 12 Normal No Spacing Heading 1 Replace = = 1E v Editor Open Grammarly Paste BIU I U v - 2. A - ab x, x' A . A Select v Undo Clipboard a Font Paragraph Styles Editing Editor Grammarly a. At the beginning of the year, Addison Company's assets are $200,000 and its equity is $150,000. During the year, assets increase $80,000 and liabilities increase $46,000. What is the equity at year-end? Assets Liabilities Equity Beginning $ 200,000 = 150,000 Change 80,000 = 46,000 + Ending Page 1 of 1 O words Text Predictions: On * Accessibility: Good to go O Focus 110% 9:58 PM P Type here to search 49°F 3/20/2022 近arrow_forward

- 42 O Browser geNOWv2 | Online teachin X + n/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false DSU AcadCalendar C crunchy roll crunchy roll A Home - Hudl Spotify EReadir U D2L O DSU Support PDSU WebMail O DSU Account Monaco & Associates Use the following five transactions for Monaco & Associates, Inc. to answer the question(s). October 1 Bills are sent to clients for services provided in September in the amount of $800. Dravo Co. delivers office furniture ($1,060) and office supplies ($160) to Monaco 6 leaving an invoice for $1,220. 15 Payment is made to Dravo Co. for the furniture and office supplies delivered on October 9. 23 A bill for $430 for electricity for the month of September is received and will be paid on its due date in November. 31 Salaries of $850 are paid to employees. Based only on these transactions, what is the total amount of expenses that should appear on the income statement for the month of October? Oa. $1,280 Ob. $430…arrow_forward%24 %23 AutoSave H UnitllILabAssignment Question8 Protected View O Search (Alt+Q) Off Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing :X v fx Function: SUM; Formula: Multiply, Subtract; Cell Referencing D E B. C. F. H. Function: SUM; Formula: Multiply, Subtract; Cell Referencing B Using Excel to Determine Dividends Paid to Common 4 and Preferred Stockholders Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to the Problem or work 5 PROBLEM 6 M. Bot Corporation has common stock and cumulative 7 preferred stock outstanding at December 31, 2022. No 8 dividends were declared in 2020 or 2021. area as indicated. What amount of dividends will common stockholders receive? Total dividend payment in 2022 $ 375,000 11 Preferred stock par value Annual…arrow_forwardPlease rank the websites in order of total number of click-throughs from lowest to highest.arrow_forward

- LutoSave 日 Off UnitlILabAssignment_Question1 O Search (Alt-Q) Protected View Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing fx Formula: Multiply, Subtract; Cell Referencing A D E F G H. K Formula: Multiply, Subtract; Cell Referencing Using Excel to Record Stock Entries Student Work Area PROBLEM Required: Provide input into cells shaded in yellow in this template. Select account names from the drop-down lists. Use cell references to the data area. Use mathematical formulas to calculate any amounts not given. On May 10, Jack Corporation issues common stock for cash. Shares of stock issued Par value per share 2,000 24 %24 10.00 Amount at which stock issued 18.00 Journalize the issuance of the stock. 10 11 Date Debit Credit 12 May 10 13 14 15 16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 32 33 Enter Answer Ready 24arrow_forwardList Paragraph For the... badiya aldujaili BA AutoSave ff Search EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut - A^ A° Aav A E - E - E E E O Find - Calibri (Body) 11 AaBbCcDc AaBbCcDc AaBbC AABBCCC AaB AAB6CCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А I Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em... A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 1. 2 4 5 6. 7 If Busby Corporation's variable cost ratio is 0.75, targeted after tax net income is $27,580 (tax rate of 20%), and targeted sales volume in dollars is $219,000 then Busby's total fixed costs are: a. $27,170 b. $71,380 c. $20,275 d. $136,670 e. $129,775 f. $26,350 g. $54,750 Page 3 of 3 331 words English (United States) Focusם 160% 8:28 PM O Type here to search ENG 2/11/2021 (凸) . I . I ..?. . . E • . . L. . . t .. I ..arrow_forwardne File Edit View History Bookmarks. Profiles Tab Window Help C Netflix Inbox x MACC10 x Accour x Accoux M Questi x Quick! x M Questi × M Quest X wiL47 x N Final Exam 12 Mc Graw Hill ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Q Saved Santana Rey receives the March bank statement for Business Solutions on April 11, 2022. The March 31 bank statement shows an ending cash balance of $68,566. The general ledger Cash account, Number 101, shows an ending cash balance per books of $69,126 as of March 31 (prior to any reconciliation). A comparison of the bank statement with the general ledger Cash account, Number 101, reveals the following. a. The bank erroneously cleared a $570 check against the company account in March that S. Rey did not issue. The check was actually issued by Business Systems. b. On March 25, the bank statement lists a $49 charge for a safety deposit box. Santana has not yet recorded this expense. c.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education