FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

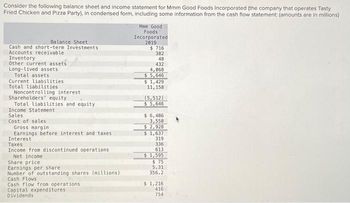

Transcribed Image Text:Consider the following balance sheet and income statement for Mmm Good Foods Incorporated (the company that operates Tasty

Fried Chicken and Pizza Party), in condensed form, including some information from the cash flow statement: (amounts are in millions)

Balance Sheet

Cash and short-term Investments

Accounts receivable

Inventory

Other current assets

Long-lived assets

Total assets

Current liabilities

Total liabilities

Noncontrolling interest

Shareholders equity

Total liabilities and equity

Income Statement.

Sales

Cost of sales

Gross margin

Earnings before interest and taxes

Interest

Taxes

Income from discontinued operations

Net income.

Share price

Earnings per share.

Number of outstanding shares (millions)

Cash Flows

Cash flow from operations

Capital expenditures

Dividends

Mmm Good

Foods

Incorporated

2019

$ 716

382

48

432

4,068

$5,646

$1,429

11,158

(5,512)

$5,646

$ 6,486

3,558

$ 2,928

$1,637

319

336

613

$1,595

$75

5.31

356.2

$1,216

416

754

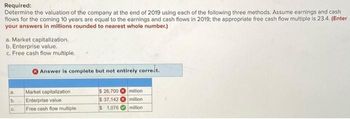

Transcribed Image Text:Consider the following balance sheet and income statement for Mmm Good Foods Incorporated (the company that operates Tasty

Fried Chicken and Pizza Party), in condensed form, including some information from the cash flow statement: (amounts are in millions)

Balance Sheet

Cash and short-term Investments

Accounts receivable

Inventory

Other current assets

Long-lived assets

Total assets

Current liabilities

Total liabilities

Noncontrolling interest

Shareholders equity

Total liabilities and equity

Income Statement.

Sales

Cost of sales

Gross margin

Earnings before interest and taxes

Interest

Taxes

Income from discontinued operations

Net income.

Share price

Earnings per share.

Number of outstanding shares (millions)

Cash Flows

Cash flow from operations

Capital expenditures

Dividends

Mmm Good

Foods

Incorporated

2019

$ 716

382

48

432

4,068

$5,646

$1,429

11,158

(5,512)

$5,646

$ 6,486

3,558

$ 2,928

$1,637

319

336

613

$1,595

$75

5.31

356.2

$1,216

416

754

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information pertains to Diane Company. Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit. Assets Cash and short-term investments $39,930 Accounts receivable (net) 26,035 Inventory 25,780 Property, plant, and equipment 296,952 Total Assets $388,697 Liabilities and Stockholders' Equity Current liabilities $60,554 Long-term liabilities 98,485 Common stock 162,488 Retained earnings 67,170 Total liabilities and stockholders' equity $388,697 Income Statement Sales $89,668 Cost of goods sold 35,867 Gross margin $53,801 Operating expenses (29,364) Interest expense (4,483) Net income $19,954 Number of shares of common stock outstanding 6,717 Market price of common stock $29 Total dividends paid $9,000 Cash provided by operations $30,000 What is the return on total assets for Diane Company? a.6.3% b.1.4% c.3.4% d.9.8%arrow_forwardForten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, and (4) all debits to Accounts Payable reflect cash payments for inventory. Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Other gains (losses) Loss on sale of equipment Income before taxes Income taxes expense Net income Assets Cash FORTEN COMPANY Income Statement For Current Year Ended December 31 Accounts receivable Inventory Prepaid expenses Total current assets FORTEN COMPANY Comparative Balance Sheets December 31 Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Long-term notes payable Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings…arrow_forwardAssume the following relationships for the Brown Corporation: Sales / Assets 1.5Return on assets (ROA) 3%Return on equity (ROE) 5% Calculate the firm’s profit margin and debt-to-assets ratio, assuming the company uses debt and common equity.arrow_forward

- Some recent financial statements for Smolira Golf, Incorporated, follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes SMOLIRA GOLF, INCORPORATED 2022 Income Statement Net income Dividends Retained earnings 2021 Short-term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity $3,061 4,742 12,578 $ 20,381 SMOLIRA GOLF, INCORPORATED Balance Sheets as of December 31, 2021 and 2022 2022 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Other $ 52,746 $ 73,127 2021 $ 188,370 126, 703 5,283 $ 56,384…arrow_forwardPlease provide answer in text (Without image)arrow_forwardThe following information pertains to Diane Company. Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit. Use this information to answer the question that follow. AssetsCash and short-term investments $ 30,000Accounts receivable (net) 20,000Inventory 15,000Property, plant, and equipment 185,000Total assets $250,000 Liabilities and Stockholders' EquityCurrent liabilities $ 45,000Long-term liabilities 70,000Stockholders' equity—Common 135,000Total liabilities and stockholders' equity $250,000 Income StatementSales $85,000Cost of goods sold 45,000Gross margin $40,000Operating expenses (15,000)Interest expenses (5,000)Net income $20,000 Number of shares of common stock outstanding 6,000Market price of common stock $20Total dividends paid $9,000Cash provided by operations $30,000 Using the data provided for Diane Company, what is the return on common stockholders' equity?a.6.75%b.14.8%c.13.5%d.7.4%arrow_forward

- The following information pertains to Carlton Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit. Assets Cash and short-term investments Accounts receivable (net) Inventory Property, plant and equipment Total Assets Current liabilities Long-term liabilities Stockholders' equity-common Total Liabilities and stockholders' equity Sales Cost of goods sold Gross margin Operating expenses Net income Number of shares of common stock Market price of common stock Dividends per share Cash provided by operations Liabilities and Stockholders' Equity Income Statement What is the current ratio for this company? Round your answer to one decimal point. 0.00 Ob.0.80 Oc 1.16 Od 1.42 $ 40,000 25,000 20,000 210.000 $295.000 60,000 85,000 150.000 $295.000 $85.000 45.000 40,000 20.000 5.20.000 6.000000 $20 0.90 $30,000 Darrow_forwardCalculate the following profitability ratios for 2018 and 2019. a. Gross profit ratio b. Return on assets c. Profit margin d. assets turnoverarrow_forwardVishnuarrow_forward

- Hw.24.arrow_forwardPlease calculate the Gross profit percentage, current ratio, debt-to-equity ratio, and earnings per share for Columbia Sportswear Company. Using the ratios, evaluate the financial statements from Columbia Sportswear Company. What does each of your four ratios indicate about the financial performance of the company? Based on your financial analysis: would you invest in this company? Why or why not?arrow_forward"Each of the following items is shown in the financial statements of Exxon Mobil Corporation: 1. Accounts payable 2. Cash equivalents 3. Crude oil inventory 4. Equipment 5. Exploration expenses 6. Income taxes payable 7. Investments 8.Long-term debt 9. Marketable securities 10. Notes and loans payable 11. Notes receivable 12. Operating expenses 13. Prepaid taxes 14. Sales 15. Selling expenses A. Identify the financial statement (balance sheet or income statement) in which each item would appear. B.Can an item appears on more than one financial statement? C.Is the accounting equation relevant for Exxon Mobil Corporation? "Explain?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education