FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Use the information provided from Sapphire Ltd calculate and comment on the following ratios:

1. Profit margin

2. Return on equity

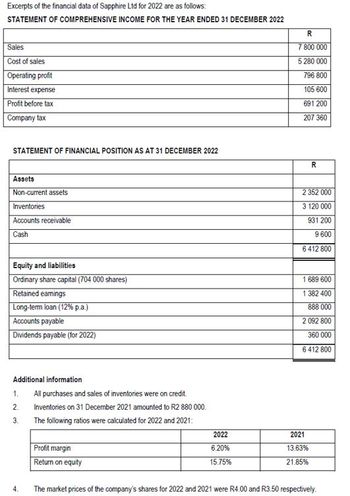

Transcribed Image Text:Excerpts of the financial data of Sapphire Ltd for 2022 are as follows:

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022

R

Sales

Cost of sales

Operating profit

Interest expense

Profit before tax

Company tax

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022

Assets

Non-current assets

Inventories

Accounts receivable

Cash

Equity and liabilities

Ordinary share capital (704 000 shares)

Retained earnings

Long-term loan (12% p.a.)

Accounts payable

Dividends payable (for 2022)

7 800 000

5 280 000

796 800

105 600

691 200

207 360

R

2 352 000

3 120 000

931 200

9 600

6 412 800

1 689 600

1 382 400

888 000

2 092 800

360 000

6 412 800

1.

2.

Additional information

All purchases and sales of inventories were on credit.

Inventories on 31 December 2021 amounted to R2 880 000.

3.

The following ratios were calculated for 2022 and 2021:

2022

2021

Profit margin

6.20%

13.63%

Return on equity

15.75%

21.85%

4.

The market prices of the company's shares for 2022 and 2021 were R4.00 and R3.50 respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Business ratios of financial statements are generally categorized as one of the following areas, EXCEPT Select one: a. Leverage b. Profitability c. Net Present Value d. Liquidity e. Efficiency (or Activity)arrow_forwardUse the attached information to complete the ratio analysis. The Ratio Analysis is for Profitability.arrow_forwardI need help to determine the following; 5. For P & B Manufacturing to assess its profitability I need help to calculate the net profit margin percentage AND the return on equity. Include calculations and round answers to 2 decimal places.arrow_forward

- Chapter 24 discusses various methods of analyzing financial statements in terms of calculating ratios. Specifically, Return on Assets (ROA) is a very simple calculation: ROA= Net Income/Average Total Assets. Another method at arriving at this ratio is the DuPont Equation that was discussed in your textbook. In looking at the DuPont Equation, what benefits are derived by using this method rather than the most typical method that I have described above?arrow_forwardWhich of the following ratios is used to analyze a company's liquidity? a. Inventory turnover ratio b. Earnings per share c. Return on assets ratio d. Asset turnover ratioarrow_forwardQ3-1 What are the five groups of financial ratios? Give two or three examples of each kind. Q3-2 Explain the kind of information the following financial ratios provide about a firm? A. Quick ratio B. Cash ratio C. Total asset turnover D. Equity multiplier E. Time interest earned ratio F. Profit margin G. Return on assets H. Return on equity 1. Price / earnings ratioarrow_forward

- Using the information from 27A prepare the following ratios: gross profit margin profit margin return on assets earnings per share current ratio acid test ratio debt ratio Indicate what each is used for (ie: measuring efficiency, solvency etc)arrow_forward4. According to the basic DuPont equation, a firm's ROE is the product of what other two ratios? a. net profit margin and the equity multiplier b. ROA and the equity multiplier C. net profit margin and return on equity d. net profit margin and total asset turnoverarrow_forwardIndicate whether the following are a measure of (a) liquidity, (b) profitability, or (c) leverage. 1. Quick ratio 2. Times interest earned ratio 3. Current ratio 4. Ratio of net sales to assets 5. Return on total assets 6. Accounts receivable turnover 7. Return on stockholders' equity 8. Book value per share of common stock 9. Ratio of liabilities to stockholders' equity 10. Acid-test ratio 11. Earnings per share of common stock 12. Merchandise inventory turnover 13. Working capitalarrow_forward

- 1. Which of the following is referred to as the Accounting Equation? Assets Liabilities + Equity Equity Liabilities + Assets Liabilities Assets + Equity Assets = Liabilities - Equity = 2. Which of the following make up the Finance Equation? (select all that apply) Revenues = Price x Volume Costs = Fixed + Variable Profit Revenues-Costs Income Sales - COGSarrow_forwardIdentify two ratios to use to analyze a firm’s liquidity position, andwrite out their equations.arrow_forward5. Know the calculations for all of the following ratios (see ratio sheet that can be used on the exam) and know the category (listed in Question 4) they fall in: Formula Category/Use Ratio Working Capital Current Assets - Current Liabilities Net credit sales/Average Accounts Receivable Turnover accounts receivable Asset Turnover Net sales/Average total assets Net income/Average total stockholders' equity Total liabilities/Total stockholders equity Net income/Net sales Return on Equity (ROE) Debt to equity Return on Sales (ROS) (also known as Net Margin Current Assets/Current Liabilities Cost of goods sold/Average inventory Quick assets/Current Current Ratio Inventory Turnover Quick Ratio liabilities Dividend Yield Dividends per share/Market price per share Net earnings available for common stock/Number of outstanding common shares Net income/Average total Earnings per Share (EPS) Return on Investment (ROI) assets Price Earnings Ratio (P/E) Market price per share/Earnings per share…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education