Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Can you help me with this question please? Gracias!

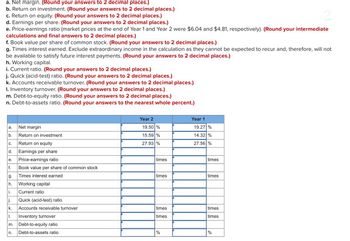

Transcribed Image Text:a. Net margin. (Round your answers to 2 decimal places.)

b. Return on investment. (Round your answers to 2 decimal places.)

c. Return on equity. (Round your answers to 2 decimal places.)

2

d. Earnings per share. (Round your answers to 2 decimal places.)

e. Price-earnings ratio (market prices at the end of Year 1 and Year 2 were $6.04 and $4.81, respectively). (Round your intermediate

calculations and final answers to 2 decimal places.)

f. Book value per share of common stock. (Round your answers to 2 decimal places.)

g. Times interest earned. Exclude extraordinary income in the calculation as they cannot be expected to recur and, therefore, will not

be available to satisfy future interest payments. (Round your answers to 2 decimal places.)

h. Working capital.

i. Current ratio. (Round your answers to 2 decimal places.)

j. Quick (acid-test) ratio. (Round your answers to 2 decimal places.)

k. Accounts receivable turnover. (Round your answers to 2 decimal places.)

I. Inventory turnover. (Round your answers to 2 decimal places.)

m. Debt-to-equity ratio. (Round your answers to 2 decimal places.)

n. Debt-to-assets ratio. (Round your answers to the nearest whole percent.)

a.

b.

C.

d.

e.

f.

g.

h.

li.

j.

k.

I.

m.

n.

Net margin

Return on investment

Return on equity

Earnings per share

Price-earnings ratio

Book value per share of common stock

Times interest earned

Working capital

Current ratio

Quick (acid-test) ratio

Accounts receivable turnover

Inventory turnover

Debt-to-equity ratio

Debt-to-assets ratio

Year 2

19.50 %

15.59 %

27.93 %

times

times

times

times

%

Year 1

19.27 %

14.32 %

27.56 %

times

times

times

times

%

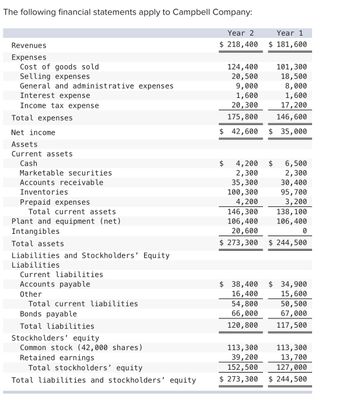

Transcribed Image Text:The following financial statements apply to Campbell Company:

Revenues

Expenses

Cost of goods sold

Selling expenses

General and administrative expenses

Interest expense

Income tax expense

Total expenses

Net income

Assets

Current assets

Cash

Marketable securities

Accounts receivable

Inventories

Prepaid expenses

Total current assets

Plant and equipment (net)

Intangibles

Total assets

Liabilities and Stockholders' Equity

Liabilities

Current liabilities

Accounts payable

Other

Total current liabilities

Bonds payable

Total liabilities

Stockholders' equity

Common stock (42,000 shares)

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

Year 2

$ 218,400

124,400

20,500

9,000

1,600

20,300

175,800

42,600

4,200

2,300

35,300

100,300

4,200

146,300

106,400

20,600

$ 273,300

$ 38,400

16,400

54,800

66,000

120,800

113,300

39,200

152,500

$ 273,300

Year 1

$ 181,600

101,300

18,500

8,000

1,600

17,200

146, 600

$ 35,000

$ 6,500

2,300

30,400

95,700

3,200

138, 100

106, 400

0

$ 244,500

$ 34,900

15,600

50,500

67,000

117,500

113,300

13,700

127,000

$ 244,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In the image you can look at the question . Is asking me to choose the correct answer below and fill in the answer box to complete your choice . How can I solve this type of question ?arrow_forwardCould you show me to solve this problem step by step. Pleasearrow_forwardIm having an issue with this problem. Thank you!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education