FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Analyse the effect of the actions below on the debt/equity ratio. Assume current debt/equity ratio is 0.5.

(v) Issuing new equity

(vi) Account receivable collected

(vii) Sell goods on book value, on cash basis

(viii) Pay off the company’s long term bank loan

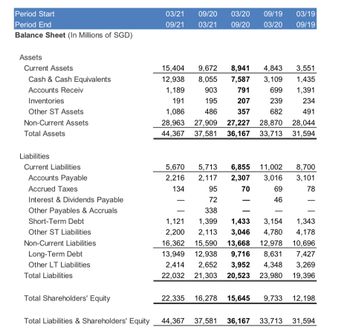

Transcribed Image Text:Period Start

Period End

Balance Sheet (In Millions of SGD)

Assets

Current Assets

Cash & Cash Equivalents

Accounts Receiv

Inventories

Other ST Assets

Non-Current Assets

Total Assets

Liabilities

Current Liabilities

Accounts Payable

Accrued Taxes

Interest & Dividends Payable

Other Payables & Accruals

Short-Term Debt

Other ST Liabilities

Non-Current Liabilities

Long-Term Debt

Other LT Liabilities

Total Liabilities

Total Shareholders' Equity

Total Liabilities & Shareholders' Equity

03/21

09/21

15,404 9,672 8,941 4,843

12,938

8,055

7,587

3,109

1,189

903

791

191

195

207

1,086

486

357

28,963

27,909

27,227 28,870 28,044

44,367 37,581 36,167 33,713 31,594

09/20 03/20 09/19 03/19

03/21

09/20

03/20 09/19

5,670

2,216 2,117

134

22,335

3,551

1,435

699 1,391

239

234

682

491

44,367

5,713 6,855 11,002

2,307 3,016

70

95

72

338

1,121

1,399

1,433

3,154

2,200 2,113

3,046 4,780

16,362

15,590 13,668 12,978 10,696

13,949 12,938

8,631

7,427

9,716

3,952 4,348 3,269

2,414 2,652

22,032 21,303 20,523 23,980 19,396

69

46

8,700

3,101

78

1,343

4,178

16,278 15,645 9,733 12,198

37,581 36,167 33,713 31,594

Expert Solution

arrow_forward

Step 1

Debt Equity Ratio is used to measure the company's total debt in relation to the equity i.e. amount invested by the owners and retained earnings over time. A debt-equity ratio of 1 to 1.5 is considered ideal depending on the type of industry.

A Debt-Equity ratio of 1.5 means that for every $1 of equity, the company has $1.5 of debt. This is considered to be ideal because more of equity can be costly and inefficient for the company and more of debt would mean financial trouble for the company.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Analyse the effect of each of the following transactions on the current ratio, quick ratio, debt-to-equity ratio and earnings per share. assume that the current ratio, quick ratio and debt-to-equity ratio are each greater than 1 and that earnings per share are positive. determine if the ratio increases decrease or are unchanged. consider each transaction independently of all the other transactions. Repaid short-term loans payable of $51 000. Purchased inventory of $48 000 on cash. Made repayments of $78 000 on the long-term loan. Declared, but did not pay, a $31 000 cash dividend on shares. Borrowed an additional $56 000 on the long-term loan. Sold short-term investments recorded in the balance sheet at $30 000 for $28 000. Issued 140 000 shares at the beginning of the financial period for cash of $168 000. Received $6000 owing in cash from a customer.arrow_forwardIf a company has a current ratio of 1.5:1, what effects will the borrowing of cash by long-term debt and collection of accounts receivable have on the ratio? Decrease and decrease ) Decrease and no effect Increase and increase Increase and no effectarrow_forwardA bank loan approved for the business that has been paid into the bank account will have the following impact on the accounting equation. Group of answer choices Increase equity and increase asset Decrease an asset and decrease a liability Decrease an asset and decrease stockholders’ equity Increase an asset and increase a liabilityarrow_forward

- Match each definition that follows with the term (a–h) it defines. Question 7 options: a company's ability to make interest payments and repay debt at maturity focuses on a company’s ability to generate net income useful for comparing one company to another or to industry averages use debt to increase the return on an investment measures the risk that interest payments will not be made if earnings decrease the percentage analysis of the relationship of each component in a financial statement to a total within the statement a percentage analysis of increases and decreases in related items on comparative financial statements an analysis of a company’s ability to pay its current liabilities 1. solvency 2. leverage 3. times interest earned 4. horizontal analysis 5. vertical analysis 6. common-sized financial statements 7. current position analysis 8.…arrow_forwardHow do firms use current liabilities, including accounts payable, accruals, lines of credit, commercial paper and short-term loans, to finance current assets?arrow_forwardWhich of the following ratios would a lender find most useful in monitoring a borrower's ability to make loan payments? () PE ratio Return on assets Total asset turnover Inventory turnover () Cash coverage ratio Previous Page Next Page Page 6arrow_forward

- If a company is worried about having enough cash to pay interest to their bondholders, rent to their landlords and wages to their employees. they are having:a. Solvency issuesb. Liquidity issuesc. Duration matching issuesarrow_forwardWhich of the following is not classified among the financing activities in a statement of cash flows? a Long-term borrowing. b Payment of dividends to stockholders. c Short-term borrowing. d Payment of interest to creditors.arrow_forwardUsing the data from Years n and n-1 below, answer the following questions. What are the company's assets, liabilities, and shareholder equity in Year n and n- I? What story does the balance sheet tell about changes in short term investments from Year n-1 to Year n? What story does the balance sheet tell about changes in notes payable from Year n-I to Year n? What is the company's net income in Year n and n-I? please provide answer and explain in detail for all answer all requirements with all working answer in textarrow_forward

- Indicate if the following transactions increase or decrease cash and classify the transactions as Operating, Investing or Financing Activities Enter I For increase and D for decrease. Enter O for Operating, I for Investing, and F for Financing. 1. Pay taxes D O 2. Collect cash from customers I O 3. Issue common stock F 4. Take out a loan from a bank 5. Purchase stock in another company I 6. Sell government debt security 7. Buy a patent 8. Retire a bonds payable 9. Pay dividends 10. Pay insurance 11. Pay interest on a loan 12. Pay principal on a loan 13. Pay salaries 14. Repurchase treasury stock 15. Sell a copyright to another firm 16. Pay suppliers for inventory 17. Dividend payments received from stock investment. 18. Interest payments received from investment in government debt securities.arrow_forwardPrepare the balance sheet and income statement by rearranging the above items. Note: Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive values. Cash Receivables Inventories BALANCE SHEET Assets Liabilities and Shareholders' Equity $ 15 Payables $ 35 35 Debt due for repayment 25 50 Total current assets $ 100 Total current liabilities $ 60 Property, plant, and equipment 520 Long-term debt Total liabilities 350 $ 410 Net fixed assets Total assets $ 520 Shareholders' equity 90 $ 620 Total liabilities and shareholders' equity $ 500arrow_forwardGuys could you please help me: I'm attaching AT&T's Balance Sheet and Income Statement for the analysis.I'd really appreciate help with the following: Perform a vertical financial analysis incorporatingi. Debt ratioii. Debt to equity ratioiii. Return on assetsiv. Return on equityv. Current ratiovi. Quick ratiovii. Inventory turnoverviii. Days in inventoryix. Accounts receivable turnoverx. Accounts receivable cycle in daysxi. Accounts payable turnoverxii. Accounts payable cycle in daysxiii. Earnings per share (EPS)xiv. Price to earnings ratio (P/E)xv. Cash conversion cycle (CCC), andxvi. Working capitalxvii. Explain Dupont identity, apply it to your selected company, interpret thecomponents in Dupont identity.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education