Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

(Please answer in Excel and show how you got the answer so I can better understand. Thank you.)

1. Given the financial statements (

Transcribed Image Text:Revenues

Subscription solutions

Merchant solutions

Shopify Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income

(Expressed in US $000's, except share and per share amounts, unaudited)

Cost of revenues

Subscription solutions

Merchant solutions

Gross profit

Operating expenses

Sales and marketing

Research and development

General and administrative

Transaction and loan losses

Total operating expenses

(Loss) income from operations

Other income, net

Income before income taxes

(Provision for) recovery of income

taxes

Net income

Other comprehensive (loss) income

Comprehensive income

Net income per share attributable to

shareholders:

Basic

Diluted

Shares used to compute net income per

share attributable to shareholders:

Basic

Diluted

Three months ended

September 30, September 30,

2021

2020

$

$

336,208

787,532

1,123,740

67,355

447,476

514,831

608,909

237,949

221,028

128,722

25,311

613,010

(4,101)

1,344,553

1,340,452

(192,020)

1,148,432

(9,193)

1,139,239

9.18

9.00

125,071,460

127,619,188

245,274

522,131

767,405

52,170

310,087

362,257

405,148

147,608

143,427

51,799

11,753

354,587

50,561

135,806

186,367

4,701

191,068

4,190

195,258

1.59

1.54

120,511,484

124,908,279

Nine months ended

September 30,

2021

$

991,126

2,240,706

3,231,832

188,764

1,254,583

1,443,347

1,788,485

626,082

580,471

273,790

53,903

1,534,246

254,239

3,375,072

3,629,311

(343,341)

3,285,970

(14,660)

3,271,310

26.44

25.84

124,297,069

127,263,746

September 30,

2020

$

629,317

1,322,430

1,951,747

134,282

780,333

914,615

1,037,132

447,320

393,050

179,948

39,202

1,059,520

(22,388)

152,999

130,611

65,026

195,637

(1,790)

193,847

1.65

1.59

118,692,898

123,399,606

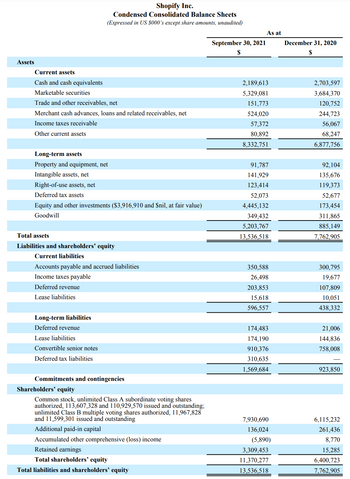

Transcribed Image Text:Assets

Current assets

Cash and cash equivalents

Marketable securities

Trade and other receivables, net

Merchant cash advances, loans and related receivables, net

Income taxes receivable

Other current assets

Long-term assets

Property and equipment, net

Intangible assets, net

Right-of-use assets, net

Deferred tax assets

Shopify Inc.

Condensed Consolidated Balance Sheets

(Expressed in US $000's except share amounts, unaudited)

Equity and other investments ($3,916,910 and $nil, at fair value)

Goodwill

Total assets

Liabilities and shareholders' equity

Current liabilities

Accounts payable and accrued liabilities

Income taxes payable

Deferred revenue

Lease liabilities

Long-term liabilities

Deferred revenue

Lease liabilities

Convertible senior notes

Deferred tax liabilities

Commitments and contingencies

Shareholders' equity

Common stock, unlimited Class A subordinate voting shares

authorized, 113,607,328 and 110,929,570 issued and outstanding;

unlimited Class B multiple voting shares authorized, 11,967,828

and 11,599,301 issued and outstanding

Additional paid-in capital

Accumulated other comprehensive (loss) income

Retained earnings

Total shareholders' equity

Total liabilities and shareholders' equity

September 30, 2021

$

As at

2,189,613

5,329,081

151,773

524,020

57,372

80,892

8,332,751

91,787

141,929

123,414

52,073

4,445,132

349,432

5,203,767

13,536,518

350,588

26,498

203,853

15,618

596,557

174,483

174,190

910,376

310,635

1,569,684

7,930,690

136,024

(5,890)

3,309,453

11,370,277

13,536,518

December 31, 2020

S

2,703,597

3,684,370

120,752

244,723

56,067

68,247

6,877,756

92,104

135,676

119,373

52,677

173,454

311,865

885,149

7,762,905

300,795

19,677

107,809

10,051

438,332

21,006

144,836

758,008

923,850

6,115,232

261,436

8,770

15,285

6,400,723

7,762,905

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (a) Why is the EPS (earnings per share) figure useful to the users of general purpose financial reports (GPFR)? Give reasons to support your answer.arrow_forwardThere are different tools for analyzing the financial statements of a company, such as horizontal analysis, vertical analysis, ratios for measuring financial health, and so forth. But before we begin using these tools, it is important to know the purpose of each tool. Please discuss one of these tools.arrow_forwardI need help to determine the following; 5. For P & B Manufacturing to assess its profitability I need help to calculate the net profit margin percentage AND the return on equity. Include calculations and round answers to 2 decimal places.arrow_forward

- I’m trying to do the debt to equity ratio. I understand that is total liabilities divided by stockholders equity. What would be my liability for the equation? Accounts receivable Inventory Net sales Cost of goods sold Total assets Total stockholders equity Net income arrow_forward“A company can be profit rich but cash poor” critically evaluate this statement focusing on the various financial ratios that can guide you in coming to such a conclusion.arrow_forwardDescribe the purpose of the five primary financial statements. Statement of Comprehensive Income Income Statement Balance Sheet Statement of Cash Flows Statement of Shareholder's Equity Give an example of a profitability, liquidity, and solvency ratio and explain the components and which financial statement would provide the informationarrow_forward

- How can I find out z-score from financial statement or balance sheet? Can you describe in detail how do i find out all the numbers i need for it? For example for gross profit ,argin I need gross profit to divide with sales. How can I do z-score? Thank youarrow_forwardThe financial statement that would be most useful in evaluating a company's financial flexibility is the a. balance sheet b. income statement c. statement of owner's equity d. statement of retained earningsarrow_forward2. Discuss how using debt ratios applies to your personal finances.3. What does the P/E ratio or EPS tell you about a companies’ overall financial condition? 4. What industry statistics can a business use for comparison?5. How can they use that information in their business? Please give a specific example.arrow_forward

- From curiosity, what graphs are made to indicate the financial performance of a company?arrow_forwardThe financial statement that shows the profitability of a business entity is known as: Group of answer choices Balance sheet and statement of retained earnings Balance sheet and income statement Income statement Statement of retained earningsarrow_forwardWhat single item on a financial statement of a business do you think has the most impact on growth? (Please Provide a through explaination.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education