Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

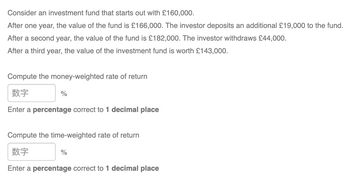

Transcribed Image Text:Consider an investment fund that starts out with £160,000.

After one year, the value of the fund is £166,000. The investor deposits an additional £19,000 to the fund.

After a second year, the value of the fund is £182,000. The investor withdraws £44,000.

After a third year, the value of the investment fund is worth £143,000.

Compute the money-weighted rate of return

数字

Enter a percentage correct to 1 decimal place

%

Compute the time-weighted rate of return

数字

Enter a percentage correct to 1 decimal place

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering an investment that is expected to pay 5 percent in year 1, 7 percent in years 2 and 3 and 9 percent in year 4. If you invest $2,000 today, what will this investment be worth at the end of the fourth year? A. $2,620.68B. $2,693.71C. $2,713.04D. $2,501.42arrow_forwardD3) Finance You invest in a mutual fund that charges a 3% front-end load, 1% operating costs, and a 1% 12b-1 fees. What are the total fees in year 1 on an initial investment of $20,000 with 10% annual growth in fund's asset value, or NAV? Note that "initial investment" means it is before the deduction of frontend load.arrow_forwardA company has two investment possibilities, with the following cash inflows: Investment Year 1 Year 2 Year 3 A $1,500 1,900 2,200 B $1,400 1,400 1,400 If the firm can earn 6 percent in other investments, what is the present value of investments A and B? Use Appendix B and Appendix D to answer the question. Round your answers to the nearest dollar.PV(Investment A): $ PV(Investment B): $ If each investment costs $4,000, is the present value of each investment greater than the cost of the investment?The present value of investment A is -Select-less than greater than Item 3 the cost.The present value of investment B is -Select-less than greater than Item 4 the cost.arrow_forward

- Bhaarrow_forwardUse the ERR method with ∈=8% per year to solve for a unique rate of return for the following cash-flow diagram. How many IRRs (the maximum) are suggested by Descartes’ rule of signs?arrow_forwardSuppose you makes a $1,000 initial investment today, a $4,000 additional investment at the end of year one, and another $500 investment at the end of year two. You had returns of 10% in year one, 2% in year two, and -5% in year three. What is the dollar-weighted average return on your investments? Select one: a. -2.59% b. 10.00% c. 0.51% d. -0.73% e. 3.00%arrow_forward

- An analyst has the following projected free cash flows for an investment: Year 1: $125,050; Year 2: $137,650; Year 3 to15: $150,000 a year; Year 16 to 20: $200,000 a year. The investment is expected to have a terminal value of $500,000 at the end of Year 20. If the analyst has estimated a present value of $3 millions for the investment, what is the discount rate that she/he has used in calculations. A. % 1.37 B. % 1.78 C. % 2.12 D. % 3.25arrow_forwardCalculate the duration for the following cash flows of an investment. Given the market interest rates are 10%. Year 1 2 3 4 7 8 Cash flow 140 150 160 170 180 190 200 250arrow_forwardUse the ERR method with = 10% per year to solve for a unique rate of return for the following cashflow diagram. How many IRRS (the maximum) are suggested by Descartes' rule of signs? The ERR is%. (Round to two decimal places.) A maximum of 0 $45 IRR value(s) is(are) suggested by the Descartes' rule of signs. $220 1 2 $350 Enf of Year $190 MARR = 10%/yrarrow_forward

- Consider an investment where the cash flows are: – $946.21 at time t = 0 (negative since this is your initial investment) $377 at time t = 1 in years $204 at time t = 2 in years $499 at time t = 3 in years (a) Use Excel's "Solver" to find the internal rate of return (IRR) of this investment. Take a screen shot showing Solver open with your entries for the function clearly visible. Paste the screen shot into an application (like Paint), and save it as a (.png) file. Upload your screenshot below. (b) What is the value of IRR found by Solver?arrow_forwardon this repurchase agreement. (a) You are investing GHS100,000 in an investment portfolio made up of a risky ass and a T/Bill. The expected return of the risky asset is 11% and its standard deviation is 20% The rate of return of the T/Bill is 3% (a) Compute what percentages of your funds must be invested in the risky asset and the risk-free asset so that the expected return of your investment portfolio is 8% (b) Compute what percentages of your funds must be invested in the risk-free asset and the risky asset to form a portfolio with a standard deviation of 8%.arrow_forwardYou are thinking about investing in a project that will provide you a cash flow of $78922 in 3 years and of $88519 in 4 years. If your required return on investments of this risk is 15.14%, how much are you willing to pay for this opportunity? Round to 2 decimal places. Include a dollar sign ($) or percent (%) as appropriate. Answer:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education