Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

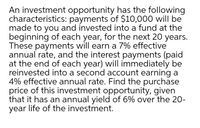

Transcribed Image Text:An investment opportunity has the following

characteristics: payments of $10,000 will be

made to you and invested into a fund at the

beginning of each year, for the next 20 years.

These payments will earn a 7% effective

annual rate, and the interest payments (paid

at the end of each year) will immediately be

reinvested into a second account earning a

4% effective annual rate. Find the purchase

price of this investment opportunity, given

that it has an annual yield of 6% over the 20-

year life of the investment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Development costs of a new product are estimated to be $100,000 per year for five years. Annual profits from the sale of the product, estimated to be $75,000, will begin in the fourth year and each year they will increase by ($10,000 + $10,000*4) through year 15. Compute the present value using an interest rate of 10%. Draw a cashflow diagram.arrow_forwardYou are going to invest $1,500 today in a fund today. After 10 years, you want to have exactly $2,500 in the fund. If the interest rate is compounded annually, what interest rate is needed to achieve this?arrow_forwardYou are considering a 10 year investment plan in which your target is $150,000. There are two options available for you: Option 1: Putting exactly an equal amount of money into an investment fund at the end of each year for 10 years with the rate of return of 8%, annually compounding. Option 2: Putting your initial investment of $50,000 in an asset that will pay you 9% rate of return, compounding quarterly for the first 6 years. The rate of return, compounding annually for the last 4 years (the period from year 7 to the end of year 10) has not been defined yet. Required: Compute the effective annual interest rate (EAR) in the first 6 years in Option 2? Compute the annually compounding rate of return you should target for your asset in the following 4 years to get $150, 000 at the end of year ten in Option 2?arrow_forward

- You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $10 million. Investment A will generate $2 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.5 million at the end of the first year and its revenues will grow at 2% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 7%? c. In this case, when does picking the higher IRR give the correct answer as to which investment is the better opportunity?arrow_forwardFind the present value of an investment that will pay $9,000 at the end of Years 10, 11, and 12. Use a discount rate of 10 percent.arrow_forwardAn investment of 1000 is to be used to make payments of 100 at the end of every year for as long as possible. If the fund earns an annual effective rate of interest of 6%, find how many regular payments can be made. Also, find the amount of the smaller payment to be paid on the date of the last regular payment to be paid one year after the last regular paymentarrow_forward

- An investment offers $966 per year for 11 years, with the first payment occurring Zyears from now. If the required return is 9 percent, what is the value of the investment? (HINT: Remember that when you calculate the PV of the annuity, the claculator gives you the present value of the annuity 1 period before the annuity starts. So if the annuity starts in year 7, that calculator will to give you the persent value of annuity in year 6. Now you have to bring this number to period O by inputting: N=6 (1 period before the annuity starts, in your case it would be a different number depending when your annuity starts) R=9 FV=Present value of annuity you found in step 1. And you solve for PV)arrow_forwardTanya is considering an investment that will require an initial payment of 400,000 and additional payments of 100,000 and 50,000 at the end of years one and two, respectively. It is expected that revenue from this investment will be 150,000 per year for five years, beginning one year from the initial investment.Assuming an annual effective rate of 10%, calculate the net present value of this investment.arrow_forwardA new project will have an intial cost of $10,000. Cash flows from the project are expected to be $3,000, $3,500, and $4,000 over the next 3 years, respectively. Assuming a discount rate of 8%, what is the project's Payback Period?arrow_forward

- An investment promises to pay you $40, 000 per year starting five years from today and continuing until the end of year 12. How much would you pay for that investment today assuming a discount rate of 10% ?arrow_forwardYou build a retirement fund by continuously paying into the fund for 30 years, at a rate of 5,000 per year at an effective annual interest rate of 9%. After 30 years, you buy a 30-year annuity immediate with your fund at an effective annual interest rate of 8%. The annuity pays P after one year, and payments increase by 5% thereafter. Find Parrow_forwardThe present value of an investment is estimated at about $266, 300. The expected generated free cash flow from the project for next year is $5, 000 and is expected to grow 15% a year for the next four years following the first generated cash flow. After the fifth year (t = 5), the growth rate is expected to be 6% in perpetuity. Estimate the discount rate used in valuing this projectarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education