Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

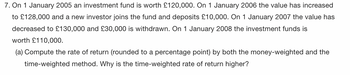

Transcribed Image Text:7. On 1 January 2005 an investment fund is worth £120,000. On 1 January 2006 the value has increased

to £128,000 and a new investor joins the fund and deposits £10,000. On 1 January 2007 the value has

decreased to £130,000 and £30,000 is withdrawn. On 1 January 2008 the investment funds is

worth £110,000.

(a) Compute the rate of return (rounded to a percentage point) by both the money-weighted and the

time-weighted method. Why is the time-weighted rate of return higher?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 2. An investor is setting up a fund which requires 10 years of contributions. The investor pays £150 per month for 10 years. All payments are made in arrears, i.e at the end of the period. The effective annual rate i = 6%. What is the value of the fund after 10 years? £ 数字 Enter an answer correct to 2 decimal places.arrow_forwardThe New Fund had average daily assets of $3.8 billion in the past year. New Fund's expense ratio was 1.3%, and its management fee was 0.8%. Required: a. What were the total fees paid to the fund's investment managers during the year? (Enter your answer in millions rounded to 2 decimal places.) Total fees paid million b. What were the other administrative expenses? (Enter your answer in millions rounded to 2 decimal places.) Other administrative expenses millionarrow_forwardsarrow_forward

- B. At time 0, K is deposited into Fund X, which accumulates at a force of interest of t + 3 t² + 6t+9 8₁ At time m, 2K is deposited into Fund Y, which accumulates at an interest of 10.25%, convertible quarterly. At time n, where n > m, the accumulated value of each fund is 3K. Calculate m.arrow_forwardAn investor pays the following separate amounts into a fund: £12,000 at t=7 years, £17,000 at t=13 years, £12,000 at t=28 years The fund pays an effective quarter-yearly rate of discount of 2.3% during the first 7 years and an effective half-yearly rate of interest of 4.9% for the remaining period until the end of year 28. Assuming that no withdrawals are to be made throughout the entire term of this investment, calculate the present value of the fundarrow_forwardA closed-end fund starts the year with a net asset value of $12. By year-end, NAV equals $12.10. At the beginning of the year, the fund is selling at a 2% premium to NAV. By the end of the year, the fund is selling at a 7% discount to NAV. The fund paid year-end distributions of income and capital gains of $1.50. Required: a. What is the rate of return to an investor in the fund during the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Rate of return % b. What would have been the rate of return to an investor who held the same securities as the fund manager during the year? (Round your answer to 2 decimal places.) Rate of return %arrow_forward

- An investor pays the following separate amounts into a fund: £5,000 at t=0 £8,800 at t=7 £13,000 at t=14 Assuming an effective rate of interest of 9% pa, calculate the amount in the fund at time 22arrow_forwardThe New Fund had average daily assets of $2.7 billion in the past year. New Fund's expense ratio was 1.6%, and its management fee was 1.4%. * Required: a. What were the total fees paid to the fund's investment managers during the year? (Enter your answer in millions rounded to 2 decimal places.) Total fees paid million b. What were the other administrative expenses? (Enter your answer in millions rounded to 2 decimal places.) Other administrative expenses millionarrow_forwardOn September 1, 2010, you decided to put $ 10000 in a money market fund. On March 1, 2015, you deposit another $ 12000 and on January 1, 2018, you added another $ 14000. This fund pays interest at the annual rate of 7.2%, compounded monthly. Find the future value of the fund on January 1, 2018, just before the third deposit. a. $ 34372.59 b. $ 35346.46 c. $ 31635.26 d. $ 35257.40 e. $ 34877.29arrow_forward

- The value in pounds of a fund at time t = 0 is V0 = 50, 000. After one year (at t = 1) it has increased to V1 = 51, 500 and at that time £1, 500 is withdrawn. After two years (at t = 2) the fund is worth V2 = 50, 800. (a) Compute the time-weighted rate of return. (b) If the fund is liquidated after two years what is the yield that has been achieved?arrow_forwardFor the following levered total cash flow returns, what is the levered NPV, and should you pursue the investment if your levered discount rate is 14%? Year Total Cash Flow (Pre-Tax) $ 31,795; yes 31,795; no x-31,795; yes -31,795; no 0 (400,000) $ 1 30,000 $ 2 30,900 $ 3 4 31,827 $ 32,782 $ 5 533,765arrow_forwardOn 5 November 2019 the FTSE 100 was £7,388.08. You invested £10,000 (net) in a FTSE 100 tracker fund (after charges) on that day. By close of business on 30 June 2020, the FTSE 100 was at £6,169.74. What would the value of your £10,000 would be on 30 June 2020? please show calculations, thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education