Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

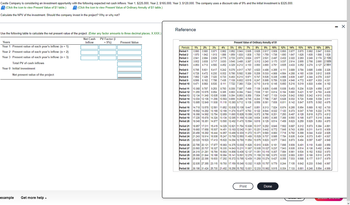

Question

Transcribed Image Text:Castle Company is considering an investment opportunity with the following expected net cash inflows: Year 1, $225,000; Year 2, $165,000; Year 3, $120,000. The company uses a discount rate of 9% and the initial investment is $325,000.

(Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.)

Calculate the NPV of the investment. Should the company invest in the project? Why or why not?

Use the following table to calculate the net present value of the project. (Enter any factor amounts to three decimal places, X.XXX.)

Net Cash

Inflow

PV Factor (i

= 9%)

Years

Year 1

Year 2

Year 3

Present value of each year's inflow: (n = 1)

Present value of each year's inflow: (n = 2)

Present value of each year's inflow: (n = 3)

Total PV of cash inflows

Year 0 Initial investment

Net present value of the project

example Get more help.

Present Value

Reference

Periods

Period 1

Period 2

Period 3

Period 4

Period 5

Period 6

Period 7

Period 8

Period 9

Period 10

Period 11

Period 12

Period 13

Period 14

Period 15

Period 16

Period 17

Period 18

Period 19

Period 20

Period 21

Period 22

Period 23

Period 24

Period 25

Period 26

Period 27

Period 28

Period 29

Period 30

Period 40

Period 50

Present Value of Ordinary Annuity of $1

1% 2% 3% 4%

0.990 0.980 0.971 0.962

1.970 1.942 1.913 1.886

2.941 2.884 2.829 2.775

3.902 3.808 3.717 3.630

4.853 4.713 4.580 4.452

5.795 5.601 5,417 5.242 5.076 4.917 4.767 4 623 4.486 4.355 4.111 3.889 3 784 3.685 3.498 3.326

6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 4.039 3.812 3.605

7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837

8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.946 4.772 4.607 4.303 4.031

9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 5.019 4.833 4.494 4.192

10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453

11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.421

12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.424 5.842 5.583

13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724

13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 6.811 6.142 5.847

5.234 5.029 4.656 4.327

5.197 4.793 4.439

5.342 4.910 4.533

5.468 5.008 4.611

5.575 5.092 4.675

5.669 5.162 4.730

5.749 5.222 4.775

14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.974 6.265 5.954

15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.120 6.373 6.047

16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 6.128 5.818 5.273 4.812

17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 6.198 5.877 5.316 4.844

18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.469 6.623 6.259 5.929 5.353 4.870

5% 6% 7%

0.952 0.943 0.935

1.859 1.833 1.808

2.723 2.673 2.624

3.546 3.465 3.387

4.329 4.212 4.100

8% 9% 10% 12% 14% 15%

16% 18%

20%

0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833

1.783 1.759 1.736 1.690 1.647 1.626 1.605 1.566 1.528

2.577 2.531 2.487 2.402 2.322 2.283 2.246 2.174 2.106

3.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589

3.993 3.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991

15.247 13.799 12.550 11.469 10.529 9.707 8.985 7.784 6.835 6.434 6.073 5.451 4.937

15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.464 6.097 5.467 4.948

18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 7.562 6.687 6.312 5.973 5.384 4.891

19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.201 9.442 8.772 7.645 6.743 6.359 6.011 5.410 4.909

20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883 7.718 6.792 6.399 6.044 5.432 4.925

21.243 18.914 16.936

22.023 19.523 17.413

22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 7.896 6.906 6.491 6.118 5.480 4.956

23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 7.943 6.935 6.514 6.136 5.492 4.964

24.316 21.281 18.764 16.663 14.898 13.406 12.137 11.051 10.116 9.307 7.984 6.961 6.534 6.152 5.502 4.970

25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.022 6.983 6.551 6.166 5.510 4.975

25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.566

6.177 5.517 4.979

32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.244 7.105 6.642 6.233 5.548 4.997

39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 8.304 7.133 6.661 6.246 5.554 4.999

Print

Done

sssssss.

X

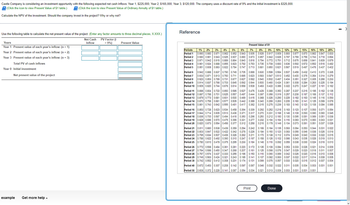

Transcribed Image Text:Castle Company is considering an investment opportunity with the following expected net cash inflows: Year 1, $225,000; Year 2, $165,000; Year 3, $120,000. The company uses a discount rate of 9% and the initial investment is $325,000.

F(Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.)

Calculate the NPV of the investment. Should the company invest in the project? Why or why not?

Use the following table to calculate the net present value of the project. (Enter any factor amounts to three decimal places, X.XXX.)

Net Cash

Inflow

PV Factor (i

= 9%)

Years

Year 1

Year 2

Year 3

Present value of each year's inflow: (n = 1)

Present value of each year's inflow: (n=2)

Present value of each year's inflow: (n = 3)

Total PV of cash inflows

Year 0 Initial investment

Net present value of the project

example

Get more help.

Present Value

Reference

Periods

Period 1

Period 2

Period 3

Period 4

Period 5

Period 6

Period 7

Period 8

Period 9

Period 10

Period 11

Period 12

Period 13

Period 14

Period 15

Period 16

Period 17

Period 18

Period 19

Period 20

Period 21

Period 22

Period 23

Period 24

Period 25

Present Value of $1

1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20%

0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833

0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.718 0.694

0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579

0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482

0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402

0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335

0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0,279

0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233

0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194

0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162

0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.195 0.162 0.135

0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112

0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093

0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078

0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065

0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054

0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.146 0.108 0.093 0.080 0.060 0.045

0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038

0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031

0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026

0.811 0.660 0.538 0.439 0.359 0.294 0.242 0.199 0.164 0.135 0.093 0.064 0.053 0.044 0.031 0.022

0.803 0.647 0.522 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018

0.795 0.634 0.507 0.406 0.326 0.262 0.211 0.170 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015

0.788 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.066 0.043 0.035 0.028 0.019 0.013

0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.059 0.038 0.030 0.024 0.016 0.010

0.772 0.598 0.464 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.053 0.033 0.026 0.021 0.014 0.009

0.764 0.586 0.450 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.047 0.029 0.023 0.018 0.011 0.007

0.757 0.574 0.437 0.333 0.255 0.196 0.150 0.116 0.090 0.069 0.042 0.026 0.020 0.016 0.010 0.006

0.749 0.563 0.424 0.321 0.243 0.185 0.141 0.107 0.082 0.063 0.037 0.022 0.017 0.014 0.008 0.005

0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.033 0.020 0.015 0.012 0.007 0.004

0.046 0.032 0.022 0.011 0.005 0.004 0.003 0.001 0.001

0.021 0.013 0.009 0.003 0.001 0.001 0.001

Period 26

Period 27

Period 28

Period 29

Period 30

Period 40 0.672 0.453 0.307 0.208 0.142 0.097 0.067

Period 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An investment has the following cash flows: August 21, 2008 February 12, 2009 October 17, 2010 April 15, 2011 May 28, 2012 July 19, 2013 November 22, 2014 August 21, 2015 C. $ -700 $ +300 $ +400 $ +600 $ +300 $ +400 $ +200 $ -1800 a. Calculate the Net Present Value of this investment. Assume the annual discount rate is 15%. b. Create a data table and graph illustrating the impact of the discount rate on the Net Present Value of this investment. Include a title and label the axes for the graph. Use Solver to determine the Internal Rate of Return(s) associated with this investment.arrow_forwardThe cash-flow diagram is provided a. If P = $1,000, A = $200, and % = 15% per year, then N= ? b. If P=$1,000, A= $200, and N=8 years, then i =? c. If A = $200, 1% = 15% per year, and N=4 years, then P=? d. If P= $1,000, /% = 15% per year, and N=4 years, then A= ? Consider the accompanying cash-flow diagram Click the icon to view the interest and annuity table for discrete compounding when /= 15% per year a. The number of years equals years (Round up to the nearest whole number). b. The interest rate equals % (Round to two decimal places) c. The present equivalent amount (P) equals S d. The annual payment amount (A) equals $ (Round to the nearest cent) (Round to the nearest cent)arrow_forwardGodoarrow_forward

- Perez Company is considering an investment of $26,945 that provides net cash flows of $8,500 annually for four years.(a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)(b) The hurdle rate is 7%. Should the company invest in this project on the basis of internal rate of return?arrow_forwardCompute the profitability index for the following proposal, assuming the desired minimum rate of return is 12%. Use the present value factors with six decimal places at the end of your Chapter 25 notes; don’t use the tables in your textbook. Round all intermediate calculations to TWO decimal places; also round your final answer to TWO decimal places. (See your Chapter 25 notes, pages 9 & 14) Initial cash outlay................................. $16,000 Net cash inflow (after taxes): Year 1................................................. $10,000 Year 2.................................................. $9,000 Year 3.................................................. $6,000 Year 4......................................................... $0 Total net inflows.................................. $25,000arrow_forwardCompute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal place.)arrow_forward

- (Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: € 12 X End of Year 1 2 S 3 4 5 6 7 8 7 N example # 3 a. What is the present value of investment A at an annual discount rate of 25 percent? $(Round to the nearest cent.) E D A $12,000 12,000 12,000 12,000 12,000 30 F3 Get more help. C $ 4 Investment Alternatives DOD 888 F4 R F V de s % B 5 $12,000 12,000 12,000 12,000 F5 T G 6 B C $12,000 60,000 MacBook Air F6 Y H & 7 N 44 U J 8 PII Fa 1 M - a K MOSISO DD F9 O < مه 26 -0 L command F10 P . V : ; Clear all 4 FU { I option [ +11 = ? 1 " I Final check 419) F12 } 1 delete retuarrow_forwardYou are evaluating five different investments, all of which involve an upfront outlay of cash. Each investment will provide a single cash payment back to you in the future. Details of each investment appears here: Calculate the IRR of each investment. State your answer to the nearest basis point (i.e., the nearest 1/100th of 1%, such as 3.76%). The yield for investment A is The yield for investment B is The yield for investment C is The yield for investment D is The yield for investment E is %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) C Data table Investment A B с D E Initial Investment $1,600 $10,000 $600 $3,400 $5,200 Future Value Print $3,120 $15,775 $2,923 $4,526 $8,789 End of Year 10 11 16 Done 3 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 12 D Xarrow_forwardFor the cash flow shown below. Find the external rate of return (EROR) using the modified rate of return approach (MIRR), an investment rate of 15% per year, and a borrowing rate of 8% per year. Year 3 4 NCF,$ -9000 +4100 -2000 -7000 +12000 +700 +800 Select one: O a. 7.9% Ob.9.9% O c. 5.9% O d. 11.9%arrow_forward

- An investment has an installed cost of $527,630. The cash flows over the four-year life of the investment are projected to be $212,200, $243,800, $203,500 and $167,410, respectively. If the discount rate is 10%, at what discount rate is the NPV just equal to 0? (Input in percentage, keep 2 decimals. e.g. if you got 0.10231, input 10.23) Question 10 The Yurdone Corporation wants to set up a private cemetery business. According to the CFO, Barry M. Deep, business is "looking up". As a result, the cemetery project will provide a net cash inflow of $145,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 4% per year forever. The project requires an initial investment of $1,900,000. The company is somewhat unsure about the assumption of a growth rate of 4% in its cash flows. At what constant growth rate would the company just break even if it still required a return of 11% on investment? (Input in percentage, keep 2 decimals. e.g. if you got…arrow_forwardget the answer as per posiblityarrow_forwardAn analyst has the following projected free cash flows for an investment: Year 1: $125,050; Year 2: $137,650; Year 3 to15: $150,000 a year; Year 16 to 20: $200,000 a year. The investment is expected to have a terminal value of $500,000 at the end of Year 20. If the analyst has estimated a present value of $3 millions for the investment, what is the discount rate that she/he has used in calculations. A. % 1.37 B. % 1.78 C. % 2.12 D. % 3.25arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education